Xylem’s Soaring Success

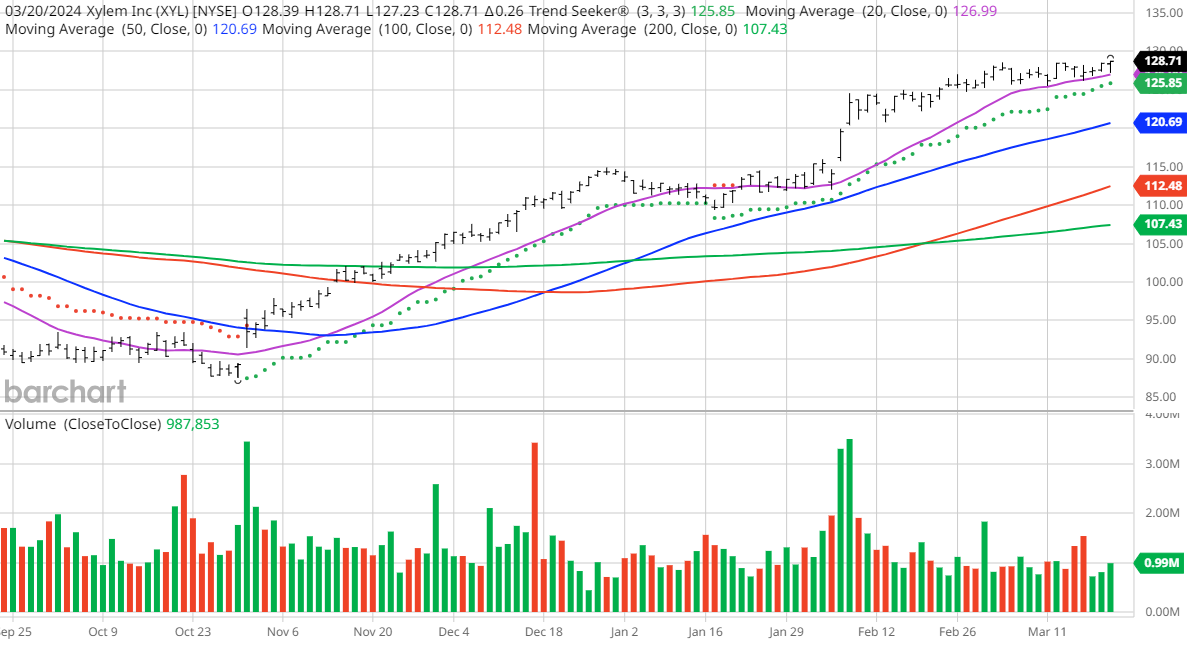

Xylem Inc., the industrial machinery juggernaut, is making waves in the financial seas with its stock price chart resembling a jet plane taking off. Powered by Barchart’s powerful screening capabilities, Xylem has emerged as a top contender, boasting impressive technical buy signals and Weighted Alpha levels. Since the Trend Seeker gave its buy signal on 1/22, the stock has soared by a hefty 13.52%. The price vs. daily moving averages graph paints a picture of steady price appreciation, a sight that would make any investor’s heart race with excitement.

The Driving Force Behind Xylem

In the competitive landscape of industrial engineering, Xylem stands tall with its portfolio of engineered products and solutions that span the globe. With segments dedicated to Water Infrastructure, Applied Water, Measurement & Control Solutions, and Integrated Solutions and Services, Xylem offers a comprehensive range of products and services under various well-known brands. The company’s strategic pivot in 2011, changing from ITT WCO, Inc. to Xylem Inc., heralded a transformative era for the organization that now sits at the helm of innovation and excellence in its industry.

An Insight into Xylem’s Performance Metrics

When navigating the choppy waters of the stock market, investors often seek a guiding light to lead them to potential treasures. Barchart’s technical indicators shine a favorable light on Xylem:

- 100% technical buy signals

- 36.62+ Weighted Alpha

- 31.81% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 3.71% in the last month

- Impressive Relative Strength Index at 66.82%

- Technical support level firmly at $127.72

- Recent trading price at $128.71, surpassing the 50-day moving average of $120.69

Xylem’s Fortitude in Fundamentals

Peering beyond the technical realm, fundamental factors provide a sturdy foundation for Xylem’s growth trajectory:

- Market Cap stands strong at $31.06 billion

- P/E ratio of 34.64 signals investor confidence

- Dividend yield at a respectable 1.05%

- Revenue projected to grow 15.40% this year and another 5.50% next year

- Earnings estimates indicate a 9.00% increase this year, followed by an additional 11.70% the next year, with a compound annual growth rate of 11.90% for the next 5 years

Navigating Investor Sentiment and Analyst Projections

Amidst the ebbs and flows of investor sentiment, Xylem has managed to garner favorable reviews from Wall Street analysts and individual investors alike:

- Wall Street analysts have issued accolades with 8 strong buy, 4 buy, 7 hold, and 1 underperform recommendation this month

- Price targets ranging between $100 and $150, with a consensus at $133

- Investor sentiment on Motley Fool indicates overwhelming confidence in Xylem beating the market

- Value Line rates the company as below average with a price target of $150, hinting at a 15% gain potential

- CFRAs MarketScope bestows a 5-star strong buy rating with a price target of $140

- The buzz around Xylem attracts attention with 16,280 investors monitoring the stock on Seeking Alpha

Brimming with potential and riding the wave of success, Xylem Inc. remains a beacon of hope for investors looking for a strong current to sail on in the unpredictable waters of the stock market.

Disclosure and Final Thoughts

The Barchart Chart of the Day serves as a lighthouse, guiding investors towards stocks experiencing exceptional price appreciation. While not a direct buy recommendation, these volatile stocks demand caution and a strategic approach. As investors navigate the markets, it’s crucial to maintain a diversified portfolio and adhere to stop-loss disciplines to weather the storm and emerge stronger in the long run.

On the date of publication, Jim Van Meerten did not have any positions in the securities mentioned. All content is for informational purposes only. For more details, refer to the Barchart Disclosure Policy.

The expressed views are solely those of the author and do not necessarily represent Nasdaq, Inc.’s opinions and viewpoints.