Nevro Corp. NVRO remains on the cusp of unparalleled growth, driven by its relentless focus on research and development (R&D). The luminous outlook stems from a stellar third-quarter performance in 2023 and the enduring success of its flagship Senza platform. Despite facing fierce competition and reliance on third-party payers, the company exhibits a promising trajectory.

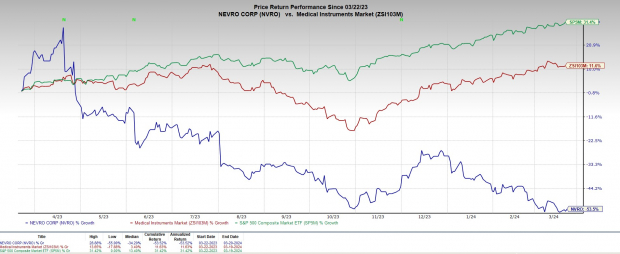

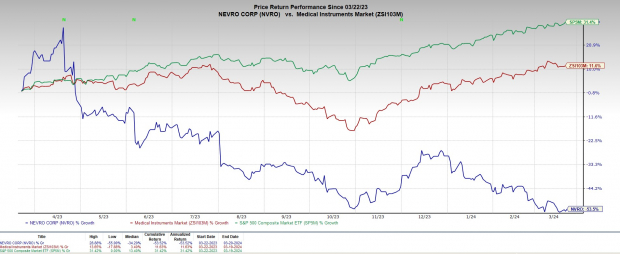

Over the past year, this Zacks Rank #3 (Hold) entity has experienced a setback, shedding 53.5% compared to the industry’s growth of 11.6% during the same period. By contrast, the S&P 500 soared 31.4% during this timeframe.

Market Capitalization and Growth Projection

Nevro boasts a market capitalization of $505.2 million, with anticipated growth of 16.6% in 2024. The company’s robust financial performance signals a steadfast journey towards sustained excellence, having surpassed the Zacks Consensus Estimate in three out of the last four quarters with an average surprise of 22.92%.

Image Source: Zacks Investment Research

A closer look reveals the innovation-driven ethos of Nevro.

Innovative Research and Development

R&D Edge: Nevro relentlessly pursues advancements in patient care through the evolution of HF10 therapy within the Senza platform. Continuous product enhancements, such as active anchors with superior performance, underline the company’s commitment to elevating patient experiences. The perpetual refinement of Senza promises an upward trajectory in performance.

Notably, the surge in HFX iQ adoption post its full market launch in the final quarter of 2023 underscores Nevro’s commitment to innovation, poised to resonate further in 2024.

Flagship Product Strength

Strength in Senza: Nevro’s Senza platform continues to showcase robust performance. Findings from the SENZA Randomized Controlled Trial and other pivotal studies advocate the efficacy of 10 kHz therapy in addressing diverse chronic pain conditions, offering a compelling treatment avenue for patients.

The recently published 24-month data from the SENZA NSRBP trial reinforces the pivotal role of high-frequency SCS in enhancing patient outcomes and reducing opioid dependence.

Favorable Financial Indicators

Nevro exceeded expectations with its fourth-quarter 2023 results, signaling a promising outlook. Noteworthy upticks in domestic and international revenues, coupled with a surge in U.S. permanent implant procedures, underscore a promising growth trajectory. The strategic acquisition of Vyrsa Technologies further fortifies Nevro’s market presence and heralds new opportunities.

Challenges and Considerations

Dependence on Third-Party Payers: Nevro’s market share hinges significantly on the reimbursement landscape, underscoring the critical role of third-party payors in enabling consumer access to its innovative products.

Intense Competition: In an evolving medical device landscape characterized by rapid technological advancements, Nevro faces stiff competition. The company’s success hinges on widespread adoption of its pioneering therapies amidst a competitive milieu.

Market Projections and Estimates

While short-term estimates for 2023 show a downward trend, Nevro is expected to witness a marginal revenue uptick in the first quarter of 2024, signaling a phase of recalibration and growth.

Exploring Investment Potential

In the realm of medical investments, Nevro stands poised as a choice investment, with a track record of resilience and innovation amidst a competitive landscape.

For investors seeking diversified exposure, key picks to consider include DaVita Inc., Cardinal Health, Inc., and Cencora, Inc., reflecting promising growth trajectories in the evolving medical ecosystem.

5 Stocks Set to Double

Unveiling the Next Big Stock Sensations

Top Picks for +100% Growth in 2024

Investors always yearn for the next big stock sensation. At times, it feels akin to capturing lightning in a bottle, a rare occurrence and a potent adrenaline rush for the financial world. Well, look no further – the Zacks experts have handpicked their #1 favorite stocks projected to gain +100% or more in 2024. The proof is in the pudding; previous recommendations have taken off like rockets, with impressive jumps of +143.0%, +175.9%, +498.3%, and as high as +673.0%.

Hidden Gems

What sets these recommendations apart is that most of these stocks remain stealthily under Wall Street’s radar. Like uncovering a buried treasure chest, this provides a thrilling opportunity to enter at the very foundation – a ground-level chance to ride the stocks as they ascend.

Seize Your Opportunity

Ready to dive into the action? Join in on the thrill by exploring these five potential home runs today. Don’t let the parade pass you by – click this link to discover the untapped potential awaiting you.

Want more insights from Zacks Investment Research? Obtain the latest recommendations by downloading the 7 Best Stocks for the Next 30 Days. The ever-evolving world of finance awaits, and the savvy investor is always ahead of the curve.

Catch up on the latest buzz surrounding DaVita Inc. (DVA), Cardinal Health, Inc. (CAH), Cencora, Inc. (COR), and Nevro Corp. (NVRO) with these free stock analysis reports.

Ever wondered why retaining Nevro Corp. (NVRO) stock is a strategic move for the time being? Uncover the insights in this compelling Zacks article.

Learn more on Zacks.com to stay informed about the dynamic world of stocks, investments, and financial analysis.

Zacks Investment Research continues to serve as a beacon in the ever-changing landscape of financial markets, guiding investors with expert analysis and insights.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.