Tracking Consumer Giants’ Performance

Steering through the financial landscape requires a keen eye, especially in the weeks preceding the customary barrage of quarterly earnings releases. As the curtain lifts on the latest reporting season, recent murmurs from the halls of Oracle and Adobe have piqued interest, offering a sneak peek into the impending Tech sector revelations. Yet, the limelight now swivels towards the consumer arena, with behemoths like Nike NKE and Lululemon LULU taking center stage.

Gauging Market Sentiment

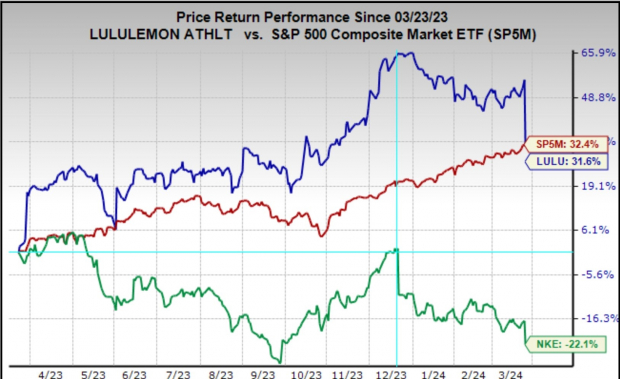

Analyze the charts they say; it tells a tale that numbers sometimes can’t articulate. The recent spate of pessimism stemming from Nike and Lululemon’s lackluster reports stems from tepid guidance from these retail giants. A glance at the one-year stock performance waltz between these companies and the S&P 500 index unveils Nike’s enduring tussle with internal tribulations. Enduring a second consecutive quarter of disappointing outlook, the company appears to be in a struggle.

Unveiling Contradictory Narratives

Lululemon, although heralded for its upward trajectory over the past years, encountered a directional shift in sentiment recently. As the charted journey of its shares trended ‘sideways-to-lower’, whispers of consumer caprice in its core market began to swell. The international embrace notwithstanding, concerns loom over the company’s primary market dynamics, suggesting turbulent times ahead.

Reading Between the Earnings Lines

Scrutinizing the crystal ball of consumer spending unveils interesting revelations. The shift towards experiential indulgences over material possessions hints at a probable slowdown in consumer disbursements. Are we witnessing a tectonic shift in consumer preferences or merely a transient fad?

Dissecting the Macro Beneath the Micro

As we brace to dissect the upcoming Q1 earnings reports, the echoes of the past emerge. Threading through the labyrinth of economic narratives, notions of an impending recession shadowed the corporate realm. Yet, the resilient US economy stood tall amidst the swirling uncertainties, paving a path towards a promising horizon.

Diving Into Q1 Predictions

Anticipations soar as we gear up for Q1 earnings to showcase a modest uptick from yesteryear, with expectations of a 2.4% surge in earnings hitched to a 3.4% increase in revenues. The whispers of growth reverberate across the financial corridors, optimistic but guarded.

The Tech Sector Comeback

Glimpses of optimism emanate from the tech trenches, where a resurgence seems imminent. With a projected 19.5% earnings leap for the Tech sector in 2024 Q1, accompanied by a 7.9% revenue upswing, the once-ailing sector seems poised to reclaim its dominant stance.

Exploring the Tech Sector’s Impact on Q1 Earnings: A Detailed Analysis

2024 Q1 Earnings Season Scorecard

The early blooming 2024 Q1 earnings season unveils a promising landscape shaped by the ever-vibrant Tech sector. Amidst the hullaballoo, results from 13 S&P 500 members have made their grand entrance, with five more eager to share their financial chronicles this week. These February-quarter revelations are the first brushstrokes in capturing the complete Q1 masterpiece, marking a spirited start to this fiscal year’s narrative.

Within this eclectic mix of 13 index members, the earnings symphony has surged by +43.3% compared to a year ago, harmonized by a +4% uptick in revenues. The performance ensemble dazzles with 76.9% surpassing EPS expectations and 46.2% hitting the right note with revenue projections.

Yet, let’s not dance merrily just yet. The numbers deserve a vintage backdrop – a juxtaposition with historical earnings and revenue movements must guide our rhythm to comprehend this upbeat tempo.

Putting the Q1 EPS and Revenue Beats in Context

In a whirlwind of comparison, historical reference breathes life into the current spectacle. The delicate dance between Q1 EPS and revenue beat percentages spins a tale of growth, resilience, and maybe just a hint of unpredictability.

An Investment Odyssey: Unveiling the Hidden Gems

Amidst this financial fiesta, a symphony of stocks awaits the discerning investor. From the treasure trove of thousands, five sagacious minds have dared to dream – each selecting a star to ascend towards a nebulous sky of +100% returns in mere months.

Among these celestial contenders, Director of Research Sheraz Mian beckons forth the chosen one, draped in accolades of a “watershed medical breakthrough.” With a tapestry of projects spanning the realms of liver, lungs, and blood, this investment whispers promises of hope and prosperity.

Could this be the serendipitous discovery to rival the legends of Boston Beer Company, shooting up by +143.0% in a mere swipe of 9 months? Or will it outshine the luminance of NVIDIA, whose glow rose by +175.9% within a single solar orbit?

Embark on this odyssey, witness this financial fable unfold. The echoes of market highs and lows beckon – will you seize this opportunity to dance with the stars?

For in the realm of investments, as in life, fortunes favor the bold.

Disclaimer: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.