Shiba Inu’s Uphill Struggle Amidst Decelerating Prices

Shiba Inu (SHIB) has been unable to break free from the $0.00003 to $0.000026 range, showcasing a battle for supremacy after a monumental 320% surge in the past month. Market data reveals the underlying causes of the current price stagnation, hinting at a potential recovery in the pipeline.

Shiba Inu Volume Plummet with Solana Meme Mania in Full Swing

Investors diverting their attention to the latest meme tokens circulating in the crypto space is believed to be the driving force behind Shiba Inu’s lackluster performance lately. The spotlight has shifted to tokens like Solana’s Dogwifhat (WIF) and the freshly minted unicorn SLERF, with the Avalanche blockchain joining the meme frenzy by enticing traders and liquidity providers with a $1 million incentive fund. In this ever-evolving landscape of flamboyant meme tokens, Shiba Inu has grappled to arouse ample interest to soar past the $0.000003 barrier.

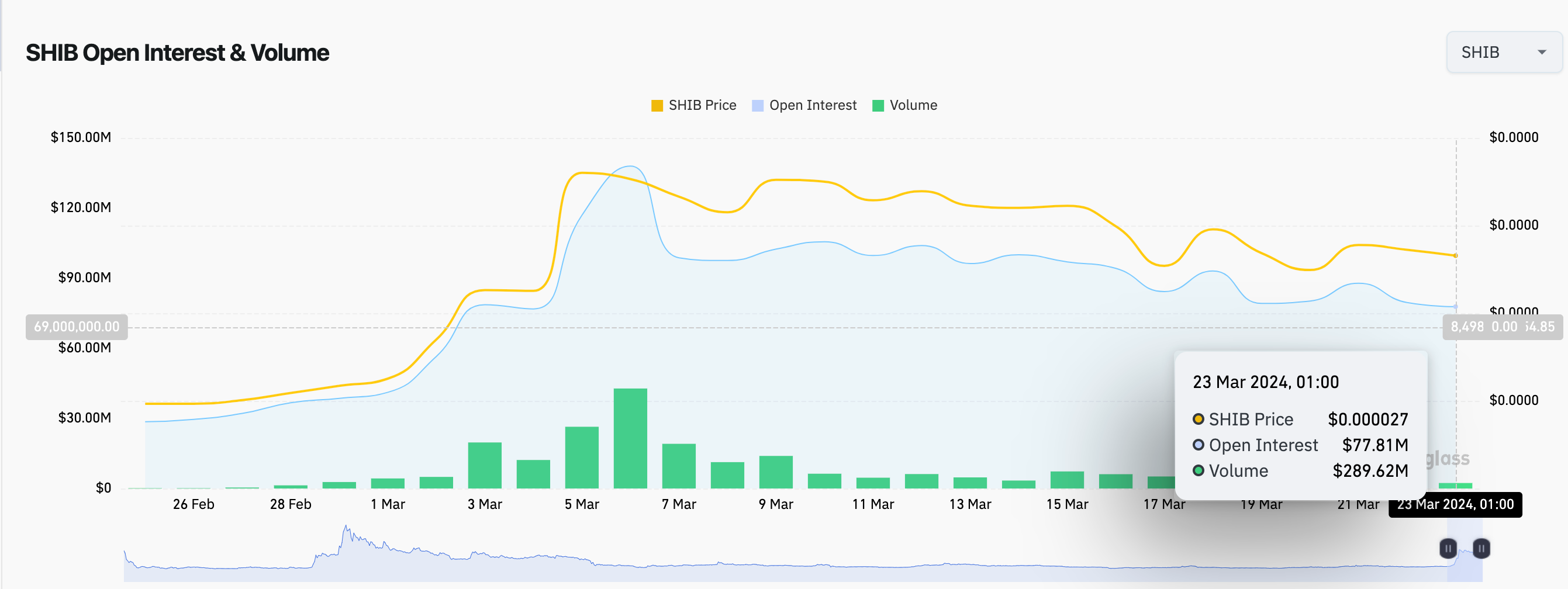

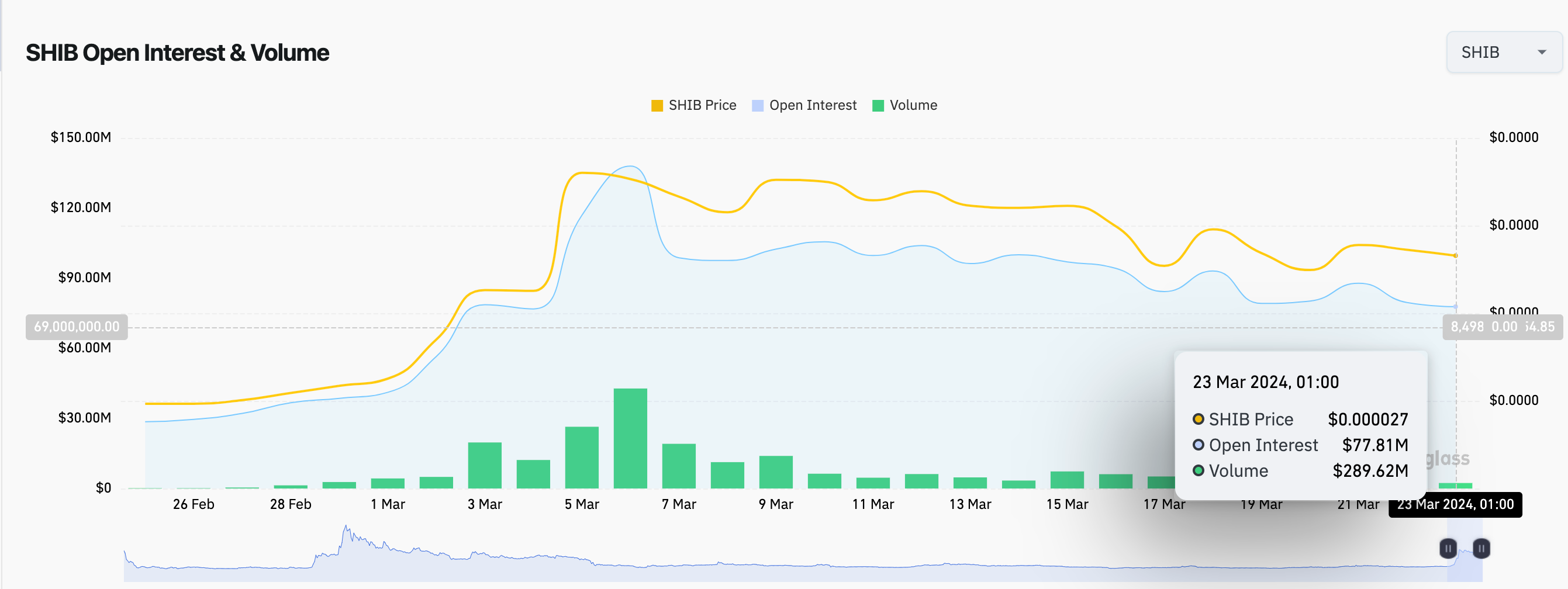

As depicted in the Coinglass chart, Shiba Inu’s open interest has dwindled from $117 million on March 5 to a meager $77 million by March 2023, indicating a significant $40 million exodus from the SHIB derivatives markets over the past fortnight. Moreover, the dwindling daily trading volume, plummeting from $5.2 billion to a mere $289 million, points to a struggle for Shiba Inu to allure new demand. Amidst the relentless rise of meme tokens in Solana and Avalanche networks, Shiba Inu’s appeal seems to have dimmed.

Bearish Forecast for Shiba Inu: Will the $0.00002 Level Be Revisited?

Trading presently at $0.000028, Shiba Inu faces an 11% dip from its weekly peak. The dwindling $40 million influx into the SHIB derivatives market, coupled with the staggering $4.9 billion depreciation in trading liquidity, poses the threat of a drastic 30% downturn toward the $0.000020 mark. The Bollinger band indicator further corroborates this bleak outlook, reflecting a market sentiment where traders are unwilling to pay as much for SHIB compared to previous days.

If the bears take the reins as anticipated, SHIB might descend to $0.000020. Conversely, the lower boundary of the Bollinger band hints at potential support around the $0.000024 level. Although an optimistic scenario of surging towards $0.00004 exists if the bulls overcome the resistance at $0.000030, the prevailing market climate painted by diminished trading volume and open interest makes this outcome seem unlikely.

This article was originally posted on FX Empire

More From FXEMPIRE:

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.