I have always had a soft spot for spicy food, particularly hot wings. Maybe it’s because I hail from Western New York, where the winters are harsh, and the heat from wings offers solace. This passion for fiery flavors led me to invest in Wingstop (NASDAQ: WING).

A Taste Too Bold to Swallow

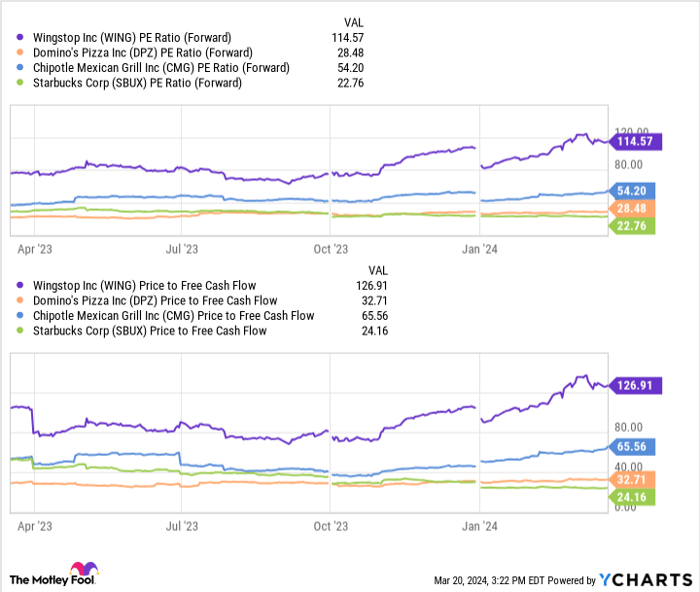

Wingstop’s meteoric rise in the market comes with a side of scorching valuation. The company is trading at an exorbitant multiple compared to its peers:

WING PE Ratio (Forward) data by YCharts

With a forward PE ratio and free cash flow more than 100 times, Wingstop blows past traditional restaurant stocks like Chipotle Mexican Grill (NYSE: CMG). Surprisingly, Wingstop’s valuation even outruns some of the tech giants, pushing the Nasdaq 100’s forward PE ratio to nearly 29 times.

While Wingstop’s rapid growth justifies a premium, its valuation remains difficult to digest. The company’s robust performance over the past year outshines its competitors in same-store sales and revenue growth. However, Chipotle’s swifter growth in adjusted earnings, alongside Starbucks and Domino’s consistent successes, casts a shadow over Wingstop’s valuation.

A Simmering Stew, Not a Boiling Broth

Hot stocks can eventually catch up with their lofty valuations, but Wingstop’s sizzle might need an eternity to simmer down. Despite forecasting modest growth rates, Wingstop doesn’t wield a unique recipe compared to industry peers.

Starbucks, Domino’s Pizza, and Chipotle all have their own magic mixes for growth. Starbucks plans to inject fresh vigor with its reinvention strategy, while Domino’s eyes global expansion. Chipotle matches Wingstop’s growth projections for 2024, leaving investors to wonder whether Wingstop’s spice can deliver enough flavor.

Too Hot to Stomach Any Longer

As a long-term investor, I seldom let valuation concerns dictate my moves. But Wingstop’s valuation has rocketed beyond reason, leaving little room for further gains. The market has priced the stock to perfection, with risks now outweighing rewards. A market hiccup or missed projections could send Wingstop’s stock spiraling downward.

Given the circumstances, I opted to cash out after a blazing run with Wingstop. If the stock cools down to a more rational level, I might reconsider my position.

Should you invest $1,000 in Wingstop right now?

Before diving into Wingstop, ponder this:

The Motley Fool Stock Advisor unveils the 10 top stocks set to reshape investors’ portfolios, excluding Wingstop. These selections have the potential for stellar returns in the years ahead.

Stock Advisor equips investors with a roadmap for success, offering portfolio building insights, analyst updates, and bi-monthly stock picks. Since 2002, the Stock Advisor service outperforms the S&P 500 twofold*.

Discover the top 10 stocks

*Stock Advisor returns as of March 21, 2024

Matt DiLallo holds positions in Chipotle Mexican Grill, Domino’s Pizza, and Starbucks. The Motley Fool also holds positions in and recommends Chipotle Mexican Grill, Domino’s Pizza, Starbucks, and Wingstop. The Motley Fool abides by a disclosure policy.

The opinions expressed here are solely those of the author and do not reflect the views of Nasdaq, Inc.