When it comes to Cathie Wood and high dividend stocks, the analogy falls short of being a match made in heaven. Wood, along with her Ark Invest funds, has built a reputation around investing in groundbreaking growth companies rather than seeking out stocks with alluring dividend yields. However, Pfizer (NYSE: PFE) emerged as a peculiar outlier in her portfolio. Initiated in 2021, Wood held a position in the pharmaceutical giant through her Ark Genomic Innovation ETF. Yet, recent months have ushered in a pivotal shift as Wood bid adieu to this high-yield dividend stock. Should other investors mirror her actions and consider divesting from Pfizer as well?

Parting Ways with Pfizer

In a striking turn of events, by the close of 2023, Ark Genomic Innovation ETF boasted ownership of nearly 500,000 Pfizer shares. However, a mere 16 days later, Wood executed a substantial reduction in holdings, offloading more than 337,000 shares. The divestment trend gained momentum as the ETF shed almost 113,000 Pfizer shares within the first week of March, with subsequent sell-offs following suit. Today, Pfizer no longer occupies a spot among the ETF’s 40-plus holdings, signifying Wood’s definitive departure from the pharma giant’s stock after a tenure stretching over two years.

Unraveling Wood’s Disenchantment

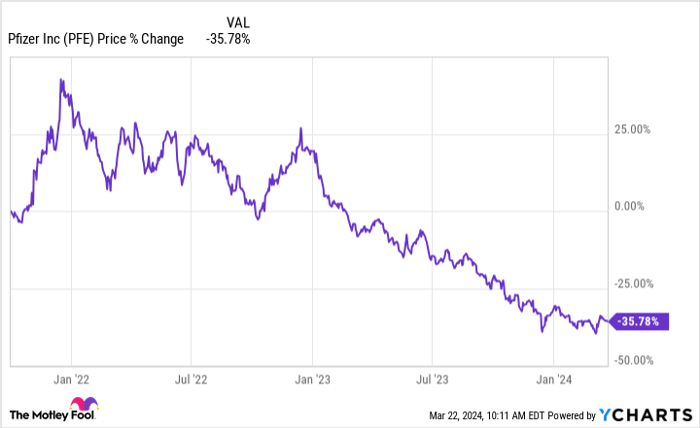

Delving into the rationale behind Wood’s pivot prompts the probing question: Why has Wood soured on Pfizer? Perhaps the answer lies in a cursory glance at the company’s stock performance since her initial investment in the third quarter of 2021.

Stocks seldom plummet to the extent witnessed by Pfizer without underlying causes steering the downward spiral. The company’s steep decline can be attributed to two prominent factors.

Firstly, sales slumps in Pfizer’s COVID-19 vaccine Comirnaty and oral antiviral therapy Paxlovid surfaced amidst the global shift into a post-pandemic era. The dwindling demand for these products, compounded by the U.S. transition to a private market footing vaccine costs, severely curtailed sales figures.

Secondly, Pfizer braces for a looming patent precipice in the upcoming years. Flagship drugs including Eliquis, Ibrance, Inlyta, Xeljanz, Xtandi, and Vyndaqel will witness crucial patent expirations between 2025 and 2027.

While Wood likely factored in Pfizer’s impending patent challenges at the time of her initial buy-in, the substantial plunge in COVID-19 related revenue may have caught her off guard. Additionally, her optimism regarding Pfizer’s potential dominance in the obesity market was dashed when the company veered to discontinue its weight-loss pill development initiatives, signaling a recalibration in strategic direction.

Is it Time to Bid Adieu to Pfizer?

As the query looms over whether investors should follow Wood’s lead and sever ties with Pfizer, divergent investment objectives emerge. While Pfizer might no longer align with certain portfolios, maintaining existing positions and even augmenting holdings might emerge as a prudent move for the majority of investors.

Presently, Pfizer’s dividend yield eclipses 6.1%, offering a tantalizing incentive for investors. Coupled with modest share price growth, this dividend yield could pave the way for compelling total returns. The stability of this dividend yield at current levels further bolsters its allure.

Forecasts envision a substantial uptick in Pfizer’s share price trajectory over the forthcoming years. Presently trading at a discount, Pfizer’s lineup of new products and expanded indications for existing offerings are poised to catalyze substantial revenue growth, offsetting the impending patent cliff. Strategic business alliances, including the recent integration of Seagen, are anticipated to inject an additional $25 billion annually in new revenue by 2030.

While Wood’s strategic exit from Pfizer may have been pivotal for Ark Invest, a stance that resonates differently with other investors, embracing this high-yield dividend stock at its current valuation might unveil long-term gains for the majority of stakeholders.

Is an investment of $1,000 in Pfizer at this juncture justified?

Prior to plunging into Pfizer stocks, a deliberation is in order:

The analyst ensemble at Motley Fool Stock Advisor has pinpointed what they perceive as the 10 premium stocks ripe for investors’ consideration at this juncture. Notably, Pfizer fails to secure a berth on this coveted list. The 10 highlighted stocks hold the potential to yield massive returns in the upcoming years.

Fortifying investors with a blueprint for success, Stock Advisor charts a navigable course, furnishing insights on portfolio construction, regular analyst updates, and two fresh stock recommendations each month. Noteworthy, Stock Advisor’s returns have thrice surpassed those of S&P 500 since 2002.

Glance at the 10 stocks

*Stock Advisor returns strategic as of March 21, 2024

Keith Speights holds positions in Pfizer. The Motley Fool harbors both positions in and endorsement for Pfizer. The Motley Fool adheres to a stipulated disclosure policy.

The insights and opinions articulated herein are emblematic of the author’s stance and do not necessarily mirror the perspectives espoused by Nasdaq, Inc.