Peering into the looking glass of ETFs can sometimes reveal enchanting surprises. One such marvel is the Invesco NASDAQ Next Gen 100 ETF (Symbol: QQQJ). Unfurling its layers, we uncover a shimmering implied analyst target price of $31.80 per unit, presenting a dazzling prospect for investors.

Gliding in the current landscape of $28.61 per unit, QQQJ glistens with an 11.16% potential upside, as analysts peek through the looking glass of the underlying holdings. Among these, Rivian Automotive Inc (Symbol: RIVN), BeiGene Ltd (Symbol: BGNE), and Alnylam Pharmaceuticals Inc (Symbol: ALNY) stand out as radiant stars. RIVN, though currently priced at $10.80 per share, flaunts a lustrous 78.74% upside to $19.30 per share – a pot of gold awaiting discovery. Similarly, BGNE gleams with a potential 67.83% ascendancy from its present price of $152.02 to the analysts’ target of $255.13 per share. ALNY shines too on this celestial map, with analysts foreseeing a stellar ascent to a target of $218.82 per share, a radiant 49.38% above its current stellar price of $146.48.

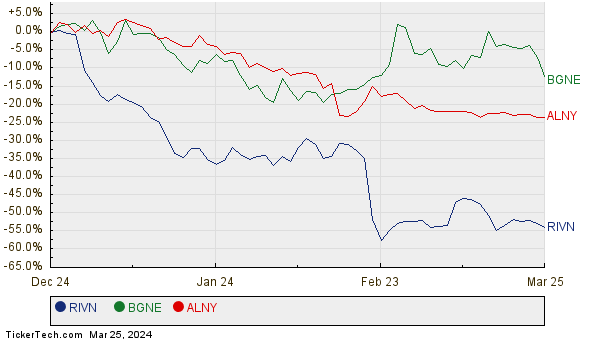

For those seeking a glimpse into the historical trajectory of these luminaries, a twelve-month price history chart comparing the constellations of RIVN, BGNE, and ALNY is provided herein.

Lingering over the horizon, a summary table of the current analyst target prices sparkles brightly, inviting investors to explore their potential treasures:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco NASDAQ Next Gen 100 ETF | QQQJ | $28.61 | $31.80 | 11.16% |

| Rivian Automotive Inc | RIVN | $10.80 | $19.30 | 78.74% |

| BeiGene Ltd | BGNE | $152.02 | $255.13 | 67.83% |

| Alnylam Pharmaceuticals Inc | ALNY | $146.48 | $218.82 | 49.38% |

Delving deeper into the riddles of analyst projections, questions arise – Are these targets merited, or do they dance on the edge of overzealous optimism? Do analysts steer their telescopes towards valid justifications, or do they lag behind the warp-speed advancements of the stars in the company cosmos? While high price targets may glisten like El Dorado, they also cast shadows of potential downgrades if rooted in antiquity. These are the cosmic conundrums that beckon further exploration and investigation by eager investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

SWBK Options Chain

Top Ten Hedge Funds Holding CODI

THOR YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.