Driving Forces Behind Expansion

The Cheesecake Factory Incorporated (CAKE) is like a seasoned chef serving up a delectable feast for investors. With a focus on strong comps growth, an engaging rewards program, and unique FRC-related concepts, the company is sizzling with potential. The expansion plan is akin to adding layers to a rich cheesecake, promising sweetness in the form of lucrative returns. Although concerns loom like impatient patrons, the savory aroma of success permeates through the air.

Factors Driving Growth

The Cheesecake Factory is mastering the recipe for success with impressive comps growth. While the recent quarter saw a slight dip compared to the prior year, the overall trajectory remains enticing. The company’s emphasis on its rewards program is like adding a cherry on top of an already delicious dessert. The FRC-related differentiated concepts are the secret ingredients that elevate the dining experience, setting the company apart from the competition.

On the expansion front, Cheesecake Factory is carving out new territories like a skilled pastry chef sculpting a masterpiece. The dedication to opening new restaurants, both domestically and internationally, showcases the company’s hunger for growth. The forthcoming year holds the promise of up to 22 new establishments, each poised to add to the company’s flavor and reach.

Expressing Concerns

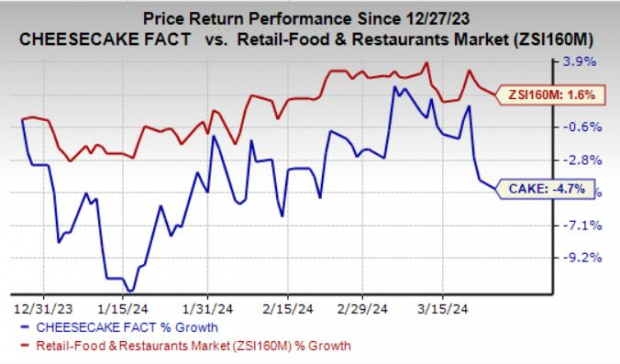

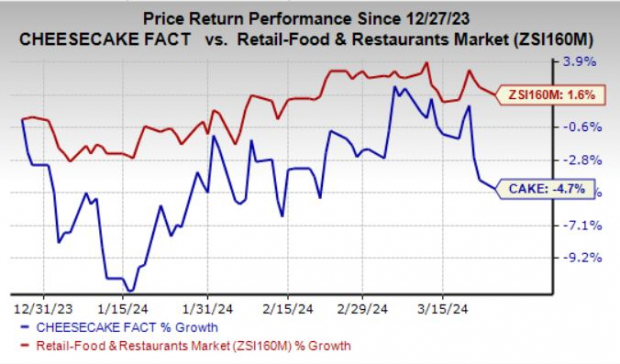

Image Source: Zacks Investment Research

The recent decline in Cheesecake Factory’s shares may leave a bitter aftertaste for some investors. The volatile macroeconomic environment has cast a shadow over the company’s performance, reminding stakeholders of the unpredictable nature of the market.

Supply chain challenges and inflationary pressures have added a pinch of uncertainty to the mix, causing concern among investors. The company’s cautious outlook reflects an awareness of the external factors that could impact its growth trajectory.

Zacks Rank & Bright Picks

Despite the challenges, Cheesecake Factory maintains a Zacks Rank #3 (Hold), indicating a steady course ahead. In a sea of uncertainty, some stocks shine brighter, offering a beacon of hope for investors.

Brinker International, Inc. (EAT) emerges as a Strong Buy, with a track record of impressive earnings surprises and robust stock performance. Texas Roadhouse, Inc. (TXRH) and Shake Shack Inc. (SHAK) also present enticing opportunities for investors, each with unique flavors that cater to different appetites.

These companies, like different dishes on a diverse menu, offer investors a chance to savor the potential growth and returns that the sector has to offer. In a world of financial flavors, each investor can find their preferred taste of success.

As you contemplate your investment decisions, remember that each stock offers a unique blend of risks and rewards, much like the diverse menu options at The Cheesecake Factory. Choose wisely, and savor the journey as you navigate the ever-evolving landscape of the financial markets.