Retail investors have set their sights on a rally to $90 for Trump Media (NASDAQ:DJT), sparking a frenzy of options trades that could push the stock’s volatility to new heights.

Unprecedented Surge and Short Sellers’ Dilemma

When the curtain fell on the debut of Trump Media and its new ticker on Tuesday, the market braced itself for a seismic event as the stock soared by 50%. This remarkable escalation left traditional media baffled—how could an ailing entity in the torrid industry suddenly command a staggering value of nearly $10 billion overnight?

While the market marveled at the stock’s meteoric rise, short sellers detected a vulnerable prey. Financial data from Fintel.io has revealed that nearly every available DJT share has been shorted, with borrowing fees reaching a dizzying height of over 210%, earning the company the unenviable title of the most costly U.S. entity to short sell.

However, both short sellers and bullish investors may be in for an electrifying surprise. In recent weeks, the trading volume of bullish call options in DJT has skyrocketed. Monday alone witnessed over 60,000 out-of-the-money options changing hands, positioning the stock for a potential surge to $100 or beyond, fueled by the dynamics of a gamma squeeze.

Will the short sellers be caught in a vortex? Trump Media’s fervent believers and speculative traders could propel the stock to unforeseen heights akin to a voyage to the moon.

Decoding the Gamma Squeeze Phenomenon

Gamma squeezes send shockwaves through stock prices as they witness a sudden and rapid ascent, compelling options market makers to scramble for shares in a bid to hedge their positions. This trend mirrors the dramatic surge that buoyed AMC Entertainment (NYSE:AMC) to dizzying heights in 2021 and mirrors Nvidia (NASDAQ:NVDA)’s current trajectory.

The primary focus of options market makers lies in revenue generation through commission fees rather than speculating on a stock’s trajectory. Consequently, for each call option they vend, these traders typically secure a corresponding number of shares to mitigate risks, a strategy known as “delta.” Ordinarily, this system functions seamlessly, with companies like Apple (NASDAQ:AAPL) transacting hundreds of thousands of option contracts daily without ruffling the stock’s underlying value.

However, out-of-the-money (OOM) options occasionally trigger a domino effect where rising stock prices amplify an OOM option’s “delta,” leading to an accelerated transformation in price dynamics, famously referred to as “gamma.” As stock prices surge, market makers are forced to purchase more stocks, propelling prices higher, setting off a cycle of intensified buying—a scenario culminating in a frenzied “gamma squeeze.”

Illustrative Case Study from DJT

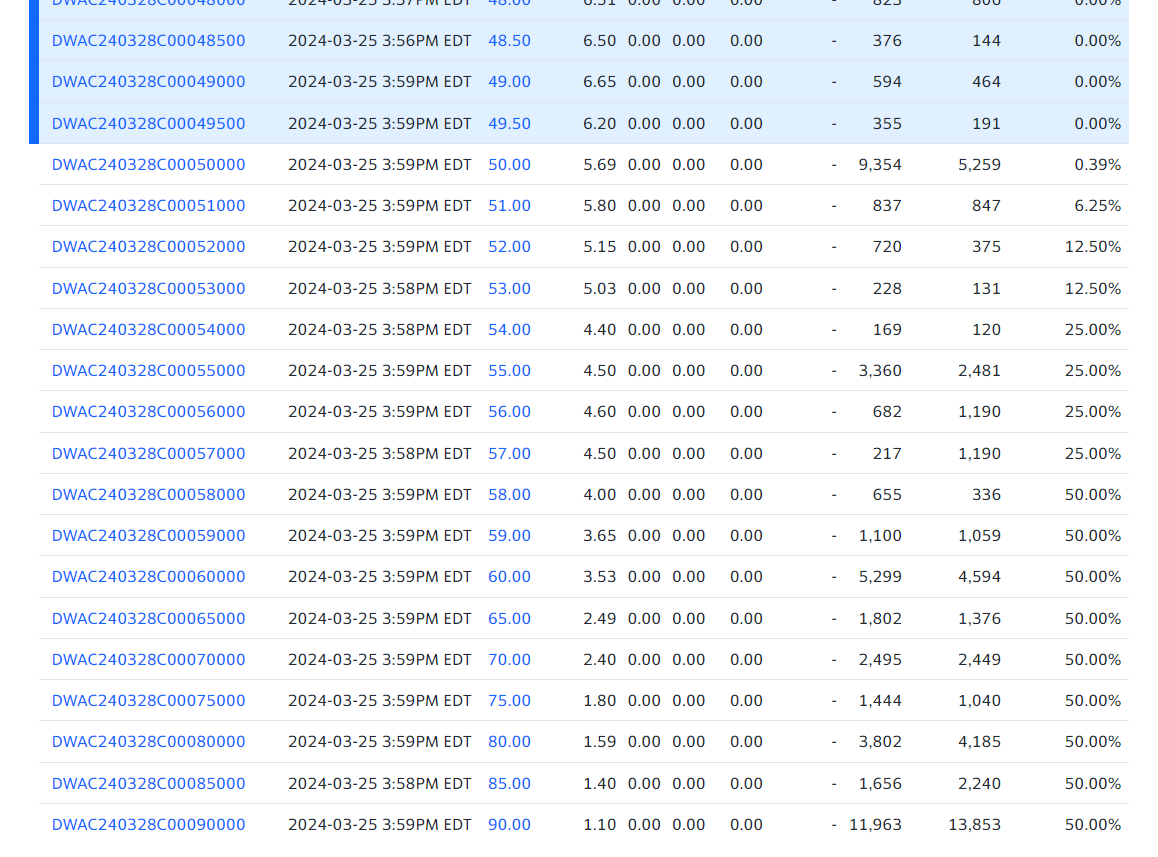

Consider this tangible illustration: On Monday, Trump Media’s $85 call options were valued at $1.40, whereas the $90 call options stood at $1.10. The margin between these two contracts was 30 cents, implying that for every $5 hike in DJT’s stock price (the variance between $90 and $85), market makers would earn 30 cents, or $30 per 100-share contract.

Faced with this scenario, market makers would secure 6 DJT shares for every 100-share contract sold, effectively neutralizing the risk of soaring stock prices. However, as DJT’s price escalates, so does the “delta,” causing the price spread between $50 and $55 options to expand to $1.19, requiring market makers to acquire 23.8 shares per contract—triggering a snowball effect.

The Enigmatic Trump Media Aura

Venturing deep into out-of-the-money territory seldom reaps rewards. Even Trump Media’s Digital World SPAC witnessed only two days of 100% gains, with none since 2021—an anomaly reflected in the restrained OOM options trading by entities like AMC Entertainment and GameStop (NYSE:GME). However, the fervor surrounding Trump Media has awakened the animal spirits of traders, with a surge in trading volume for these speculative bets providing a springboard for potential price hikes, akin to a tightly coiled spring ready to release.

Implications for Trump Media’s Valuation

The intrinsic value of Trump Media in the long run will hinge on a multiple of the profits it generates. Established entities like Facebook’s parent company, Meta Platforms, serve as a yardstick for evaluating Trump Media’s future worth, a testament to the ebb and flow of the financial tide that dictates the fortunes of companies embarking on turbulent market voyages.

The Trump Media Stock Rollercoaster: A Look Beyond the Numbers

Striking Valuation Comparisons: META vs. PINS

There’s an old saying in the stock market – value is what you pay, price is what you get. Currently, Trump Media is turning heads with its valuation, as shares trade at 33 times earnings, just shy of Pinterest’s 34x. Yet, the winds of speculation blow in an enticing narrative – most analysts foresaw no profits for Trump Media, painting a bleak picture of the long-term prospects. This perception renders shorting shares an expensive gamble, exacerbated by put sellers adopting short sales as a hedge.

Unveiling the Medium-Term Ride: SNAP and RDDT’s Lessons

In the raucous carnival of stocks, dispelling the myth that losing money equates to failure, companies like Snap and Reddit have proven that profitability isn’t the sole golden ticket to success. Instead, the market values the promise of future profits or a lucrative acquisition, often pegging stock prices to the volume of active users. If Truth Social expands its 5-million user base to 20 million this year, utilizing a conservative $10 per user valuation akin to Reddit and Discord, its worth escalates to $200 million, translating to $1.50 per share sans cash considerations. A mere leap to a 100-million user threshold elevates its value to a lofty $1 billion.

The Short-Term Thrill: Navigating the Wild Trump Media Ride

The allure of the short term beckons with a certain degree of unpredictability, especially in Trump Media’s bubbling cauldron. In this microcosm of volatility, fortunes can flip overnight, as illustrated by Dogecoin’s meteoric rise to $90 billion in 2021, spurred by Elon Musk’s digital endorsement. Indeed, Lucid Motors once soared to a valuation of $125 billion, fueled by aspirations to dethrone Tesla. It’s a realm where Donald Trump’s every keystroke holds the power to propel his social media venture to stratospheric heights.

What sets Trump Media apart is the scarcity in supply, with a minuscule fraction of its 135 million shares currently traded. Rough estimates postulate that a meager 30 million original DWAC shares and 8.3 million converted shares are up for grabs in the market. This dearth of available shares amplifies the impact of minor price shifts, exemplified by the need for almost half a million shares as a hedge against the imminent expiration of 40,000 options this week.

In essence, the limited availability of shares grants Trump Media indefinite upward mobility in the short run. Critics may scoff at the “illogical” valuation hovering above $60, but in the realm of meme stocks, conventional valuation metrics often fly out the window. As long as the price surges persist, the bullish horde will continue to flock in, ready to ride the wave of euphoria.

On this dizzying carousel of market dynamics, one thing rings true – in the stock market rollercoaster, what goes up must eventually come down. It’s a tale as old as time, yet always fresh with the scent of adrenaline and the lingering taste of uncertainty.