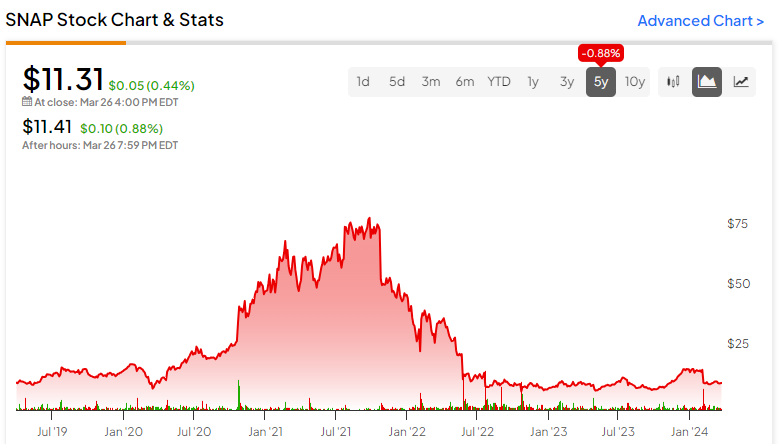

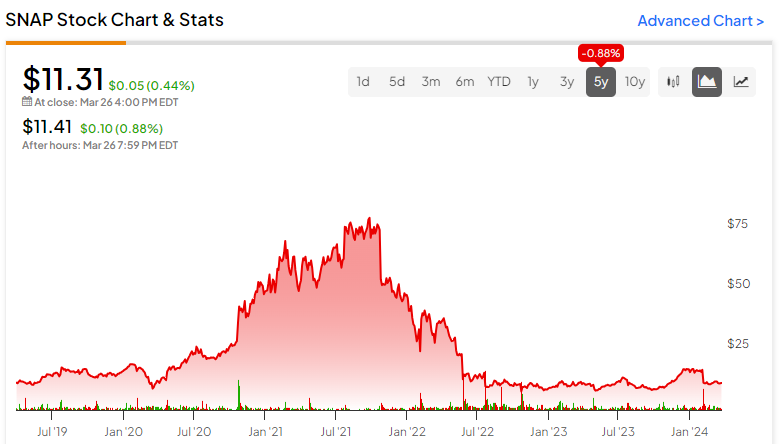

As we witness the plight of Snap (NYSE:SNAP), the writing on the wall is becoming increasingly clear. In my previous cautionary note at the $15.90 mark, I foresaw an unfounded stock spike hinting at trouble ahead. Today, with Snap teetering at $11.31, my apprehension has only seen further validation. With a backdrop of consecutive operational deficits and a glaring absence of robust free cash flow to justify its valuations, Snap appears to be inching closer to the precipice of penny stock status, a fate that seems increasingly inevitable for the social media entity.

The Growth Standstill amidst Peer Prosperity

At the core of my skepticism towards Snap lies its stagnant growth trajectory against the backdrop of its flourishing peers. Were Snap experiencing exponential growth, I might have been more forgiving of its dismal financial performance. Alas, with its revenue streams languishing, the company seems trapped in a quagmire.

Consider Snap’s meager $4.6 billion revenue in FY 2023, displaying a flatline compared to the previous year. This underwhelming showing unfolds while competing social media and content-sharing players witness notable revenue upticks.

Meta Platforms’ (NASDAQ:META) 16% revenue growth in the same period, alongside Alphabet’s (NASDAQ:GOOGL)(NASDAQ:GOOG) YouTube expanding by 16%, and even Pinterest boasting a 9% revenue surge, accentuates Snap’s feeble positioning in the field.

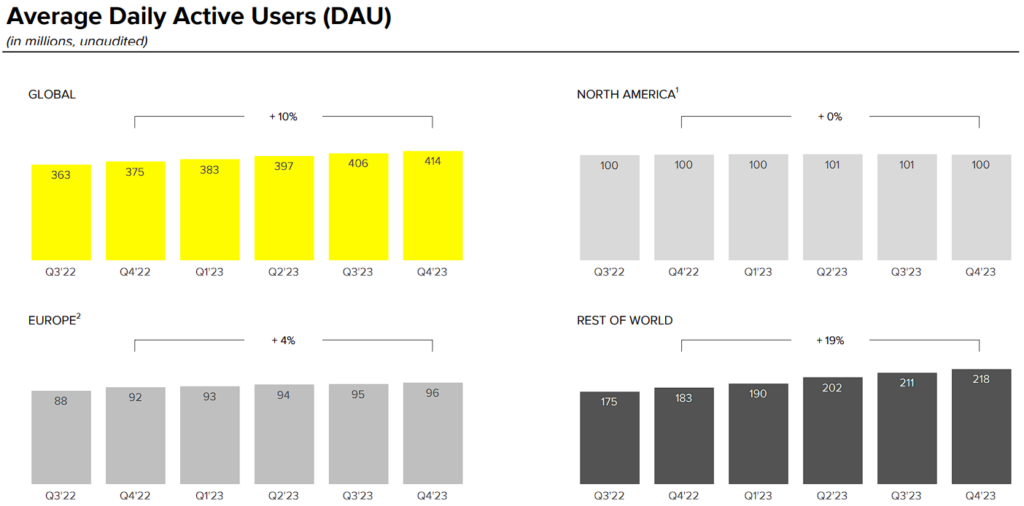

While Snap brandishes its global user growth, particularly a 10% lift in daily active users to 414 million in Q4, the narrative is rather superficial. The bulk of this growth emanates from the non-North American and non-European regions, where monetization potential remains a lingering question mark.

Despite the user base proliferation, especially the faltering North American user tally, Snap’s revenue per user (ARPU) plummeted by 5% in Q4. This decline offsets revenue gains from user growth, painting a rather grim financial picture.

With advertisers shying away from substantial investments in Snap’s platform due to conversion metric inadequacies, the decline in ARPU amidst a bustling advertising atmosphere sets the stage for even graver revenue perils once the global ad spending fervor wanes.

Unyielding Operating Losses & Misleading Free Cash Flow Signals

Scrutinizing Snap’s financial health reveals a distressing reality. As the company grapples with tepid revenue escalations, its persisting operating losses are likely to linger. Moreover, the seemingly optimistic free cash flow projections mask a more troubling truth, as Snap’s stock-based compensation (SBC) undermines shareholder interests.

Examining the numbers, FY 2023 witnessed a stark $1.4 billion operational loss, eclipsing Snap’s overall revenues by a considerable margin.

Despite Snap’s celebratory tone regarding positive free cash flow over the past three fiscal years, a deeper dive is warranted. FY 2023’s $35 million free cash flow figure is marred by an enormous $1.3 billion stock-based compensation expense adjustment, painting a less rosy financial portrait.

Hence, while the allure of positive free cash flow tantalizes investors, the dilutive impact of SBC, equivalent to about 7% of current market cap, far outweighs the incremental value creation, setting a trajectory of deteriorating equity per share and a declining stock price.

This downward spiral could escalate further if the ARPU descent continues, a scenario increasingly probable given Snap’s feeble performance in an otherwise favorable advertising ambiance.

SNAP Stock: Analysts’ Varying Verdicts

The Wall Street sentiment toward Snap remains in flux, with a Hold consensus stemming from nine Buys, 22 Holds, and two Sells over the recent quarter. Priced at $13.98 per share, the average price target suggests a modest 23.6% upside potential.

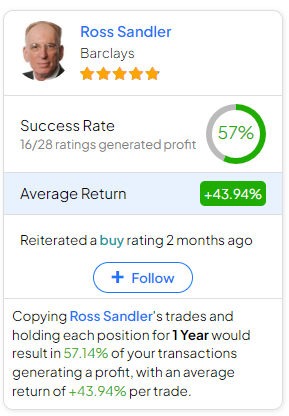

If contemplating which analyst to heed amidst the market chatter, Ross Sandler from Barclays emerges as the most accurate prognosticator over a one-year horizon, boasting an impressive 43.94% average return per recommendation and a 57% success rate.

The Road Ahead for SNAP

In contemplation, forecasting Snap’s trajectory toward penny stock waters may sound presumptuous. However, the momentum seems set in stone.

Despite management’s veneer of burgeoning user bases and positive cash flows, the hurdles ahead loom large. Stagnant revenue progress, accentuated by ARPU declines and prolonged operational setbacks, paint a grim narrative.

With competitors scaling heights and advertisers showing reluctance toward Snap’s platform, an aggravation in key metrics appears inevitable, especially during a potential ebb in global ad expenditures, hastening the erosion of shareholder value.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.