Seizing the AI Momentum

Amid the seismic shift towards artificial intelligence (AI) technologies, Nvidia has emerged as a dominant player, capturing a lion’s share of the AI GPU market. The company’s strategic focus on graphics processing units (GPUs) has positioned it as a go-to supplier for AI developers worldwide, accentuating its meteoric rise in recent times.

As AI services witness an unprecedented surge in demand across various sectors ranging from consumer tech to e-commerce and autonomous vehicles, Nvidia’s early mover advantage has translated into remarkable financial success. In the fourth quarter of fiscal 2024, its revenue witnessed a staggering 265% year-over-year increase, surpassing $22 billion. This exponential growth was primarily propelled by a remarkable 409% surge in data center revenue – a testament to the soaring sales of AI GPUs.

Moreover, the exponential rise in Nvidia’s free cash flow, which scaled a remarkable 430% in the past year, underscores the company’s financial robustness. In contrast, competitors like Advanced Micro Devices and Intel lag significantly behind in this aspect, further solidifying Nvidia’s market supremacy in AI.

Prime Opportunity: The Right Time to Invest

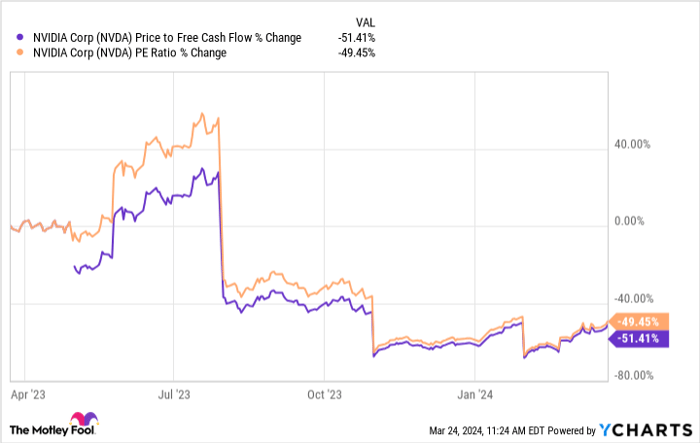

While Nvidia’s market capitalization has soared above $2 trillion, making it the third most valuable company globally, its stock has managed to retain exceptional value over the last 12 months. The price-to-free-cash-flow and price-to-earnings ratios have plummeted, positioning Nvidia’s stock at one of the most attractive valuations in recent times.

With its potent foothold in the burgeoning AI sector and ample cash reserves, Nvidia not only exudes stability but also promises long-term growth potential. The company’s resilience in fostering technological advancements and sustaining a competitive edge makes it a compelling choice for investors looking to optimize their portfolio strategy.

Considering Nvidia’s dominance in the AI domain and robust financial performance, investing in NVDA stock presents a unique opportunity to ride the wave of innovation and prosperity in the dynamic tech landscape.

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.