In the world of investing, seeking the elusive growth stocks akin to finding gems in a vast sea of investments. Two stocks that have recently captured the attention and optimism of Wall Street analysts are Skye Bioscience (SKYE) and Intuit (INTU). Both companies, with distinct industry focuses, have shown promising trajectories that hint at significant potential ahead.

BioPharma Potential: Skye Bioscience

Founded in 2014, Skye Bioscience (SKYE) delves into the realm of cannabinoids, exploring the therapeutic avenues presented by these derivatives of the cannabis plant. While the industry has historical connotations anchored in recreational use, Skye Bioscience distinguishes itself by concentrating on non-psychoactive cannabinoids like cannabidiol (CBD). These compounds exhibit promise in treating various maladies such as glaucoma, fibrotic, inflammatory, and metabolic diseases.

Backed by rigorous clinical studies, CBD has demonstrated its therapeutic potential in managing pain, inflammation, and neurological disorders. This scientific validation paves the way for Skye Bioscience’s pursuit of novel treatments.

While Skye Bioscience is yet to commercialize any products, its robust pipeline, buttressed by endeavors like the Phase 2a clinical trial for SBI-100 Ophthalmic Emulsion, showcases its commitment to innovation in the medical field. With the recent FDA approval for a Phase 2 trial involving nimacimab, the company’s exploration of treatments for obesity and chronic kidney disease stands on a firm foundation.

Fueled by a private placement equity financing initiative and the broader trend of shifting attitudes towards medical cannabis, Skye Bioscience’s journey is marked by optimism for its future endeavors. However, the volatile nature of the biotech and cannabis industries underscores the need for prudent investment strategies.

Financial Innovation: Intuit’s Ascent

In a landscape reshaped by the COVID-19 pandemic, Intuit (INTU) emerges as a beacon of financial innovation. The company’s suite of products, including QuickBooks, TurboTax, Credit Karma, and Mint, cater to diverse financial needs, simplifying management for individuals, small businesses, and accounting professionals.

Harnessing the power of artificial intelligence (AI) to enhance operational efficiency, Intuit’s commitment to technological advancement has translated into robust financial performance. Despite the stock’s underperformance relative to the market, the company’s revenue growth and increased earnings per share paint a promising picture.

As the financial landscape continues to evolve, Intuit’s strategic positioning and commitment to technological evolution bode well for its future growth. While market fluctuations may temper immediate gains, the company’s solid foundation sets the stage for long-term success.

Intuit Continues to Shine in the Financial Arena

Striking Numbers in Intuit’s Quarter Report

As Intuit released its earnings for the quarter, the stock market witnessed a staggering growth in earnings per share from previous years- a notable rise by leaps and bounds to $2.63.

Celebrating Innovations in Earnings Call

During the recent earnings call, CEO Sasan Goodarzi didn’t hold back in extolling Intuit’s technological prowess, mentioning the mind-boggling 500,000 customer and financial attributes per small business and 60,000 financial and tax attributes per consumer, providing the fuel for the company’s AI initiatives.

Dividends, Returns, and Share Repurchases

Intuit’s charm doesn’t stop at earnings alone – the company’s propensity for dividends shines through. Displaying a commitment to rewarding shareholders, Intuit bumped up its quarterly dividend payout by an impressive 15% year-over-year to $0.90 per share and further added value by repurchasing shares worth a whopping $536 million in the second quarter.

Glimpse into Intuit’s Financial Health

The company’s dividend yield may not dazzle as it stands at 0.55%, below the sector average. However, with a forward dividend payout ratio of 18.9%, there’s ample room for dividend growth as Intuit gears up to elevate its earnings in the coming years.

Future Projections and Wall Street Rating

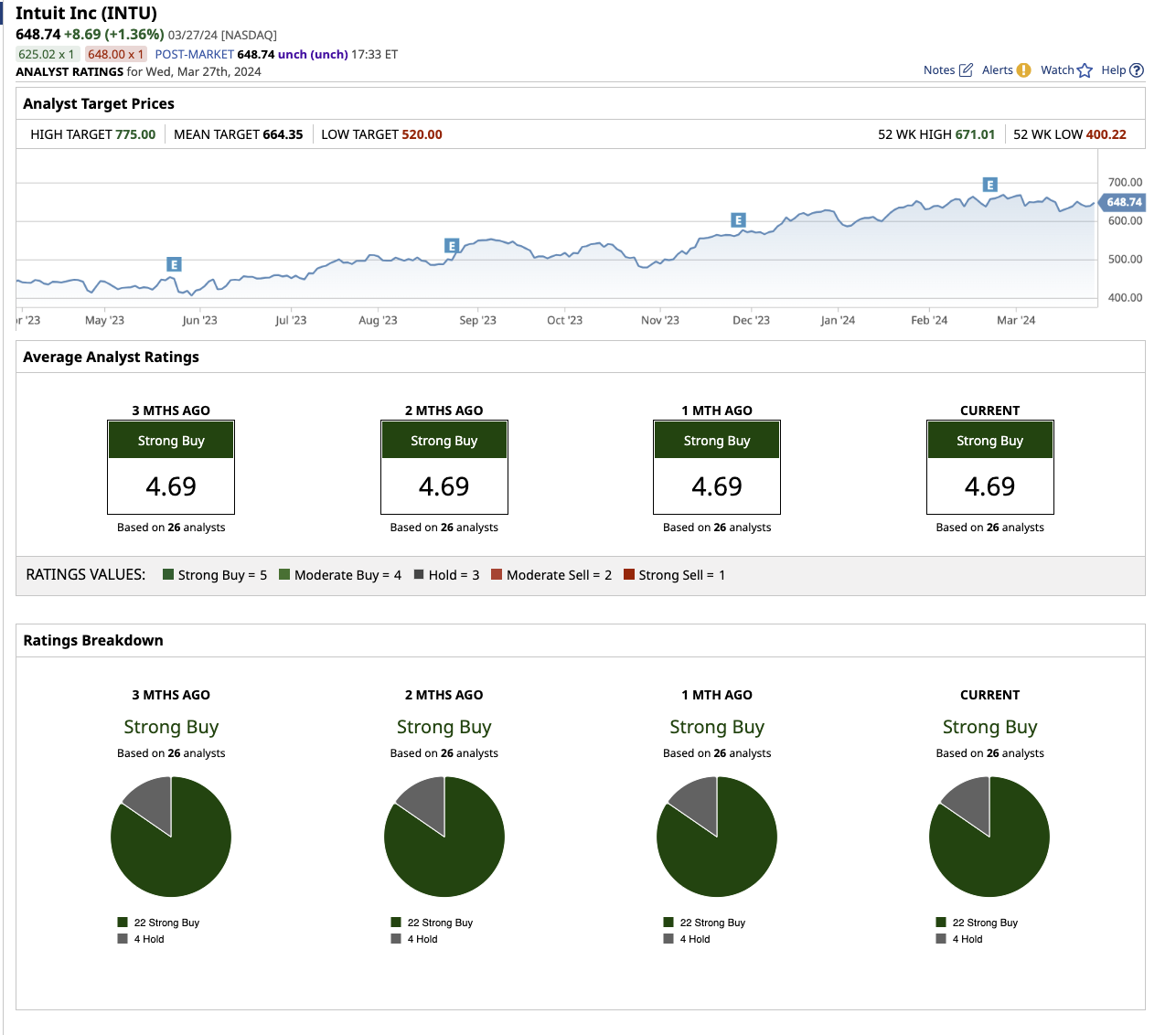

Management is optimistic about Intuit’s future, eyeing a full-year revenue growth in the range of 11% to 12% with projected earnings growth between 12% to 14% for fiscal 2024. Analysts are also bullish, predicting an uptick in revenue and earnings in the following years, with the stock still holding strong value even at a premium valuation.

Wall Street’s Endorsement

The sentiment on Wall Street speaks volumes – Intuit is branded as a “strong buy” with analysts lining up in favor. Of the 26 analysts monitoring INTU, a whopping 22 label it as a “strong buy,” while four opt for a “hold.”

Potential Upside and Closing Thoughts

With Intuit’s stock positioned for a modest climb to its mean target price, the high target price of $775 envisions a substantial 19.5% potential upside in the year ahead. The company’s strategic vision, consistent growth trajectory, and dedication to shareholder returns solidify Intuit’s stance as a compelling investment in the fierce fintech landscape.