Amid the dominance of big tech in the stock market, investors seeking greater diversity and potential returns are exploring avenues beyond tech giants. The Invesco S&P MidCap Quality ETF (NYSEARCA:XMHQ) presents an enticing opportunity by offering exposure to high-quality mid-cap stocks that have been quietly outperforming the market.

Unveiling the Investment Methodology

Guided by Invesco’s strategy, XMHQ tracks the S&P MidCap 400 Quality Index, comprising 80 securities from the S&P Midcap 400® Index with superior quality scores derived from factors like return on equity and financial leverage.

Performance that Defies Market Norms

Over the last three and five years, XMHQ has delivered annualized returns of 13.5% and 17.3%, respectively, surpassing broader market benchmarks like the Vanguard S&P 500 ETF (NYSEARCA:VOO). The fund’s steady returns over the past decade underline its reliability.

Holdings That Shine Bright

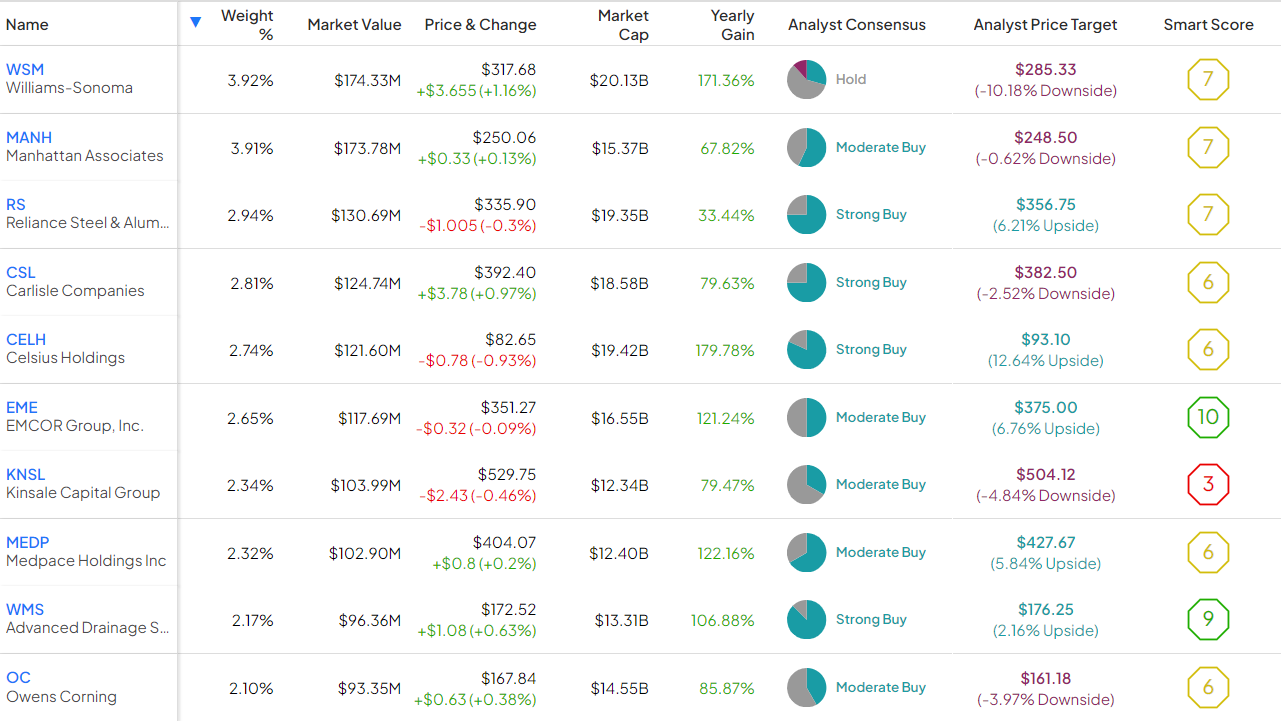

With 77 stocks and minimal concentration in its top 10 holdings, XMHQ offers diversification. Noteworthy stocks like Williams-Sonoma (NYSE:WSM) and Celsius Holdings (NASDAQ:CELH) within its portfolio have delivered exceptional gains, showcasing the potential beyond tech giants.

Looking beyond the standard tech-heavy ETFs, XMHQ presents an opportunity to tap into a blend of high-quality mid-cap stocks that have room for substantial growth. This ETF serves as a gateway to investments like Williams-Sonoma and Celsius Holdings that could offer investors a unique avenue for potential returns.

Diverse by design, XMHQ allocates only 9.4% to information technology, with significant weightage on sectors like industrials, consumer discretionary, and financials. This allocation reflects a balanced approach towards market exposure.

Insights from Analysts and Cost Efficiency

Analysts’ consensus on XMHQ leans towards a Moderate Buy rating, suggesting modest upside potential. With an expense ratio of 0.25%, XMHQ’s cost efficiency is a compelling factor for investors looking for quality exposure at a reasonable cost.

Diversification Beyond the Obvious

XMHQ uncovers a pathway to market-beating gains beyond the conventional tech-heavy investments. The ETF’s history of impressive returns and diverse high-quality holdings make it an appealing option for investors seeking to broaden their portfolios.

In conclusion, XMHQ stands out as a beacon of opportunity in the market, offering a unique blend of high-performing mid-cap stocks that bring a fresh perspective beyond traditional ETF offerings. Riding on its stellar track record and quality holdings, XMHQ paves the way for investors to explore hidden gems and unlock untapped potential in the market.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.