Delve into the world of income stocks with two gems that shine bright for investors in the current financial landscape as of April 3:

Zurich Insurance Group AG ZURVY: This stalwart in the insurance arena has seen a 3.4% surge in the Zacks Consensus Estimate for its annual earnings within the last 60 days.

Insight into Zurich Insurance Group Ltd.’s Performance

Explore the price and consensus journey of Zurich Insurance Group Ltd. | Zurich Insurance Group Ltd. Quote

This prestigious company carries a dividend yield of 4.2%, soaring past the industry average of 1.8%.

Insight into Zurich Insurance Group Ltd.’s Dividend Yield

Peruse the dividend yield performance of Zurich Insurance Group Ltd. | Zurich Insurance Group Ltd. Quote

Bancolombia CIB: This reputable player in the banking sector has observed a 1.4% uptick in the Zacks Consensus Estimate for its annual earnings over the past 60 days.

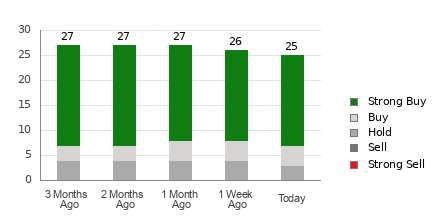

Analyzing BanColombia S.A.’s Financial Picture

Get insights into BanColombia S.A.’s price and consensus dynamics | BanColombia S.A. Quote

This distinguished firm boasts a remarkable dividend yield of 10.6%, overshadowing the industry average of 3.6%.

Understanding BanColombia S.A.’s Dividend Yield

Review the dividend yield scenario of BanColombia S.A. | BanColombia S.A. Quote

Explore the complete list of top-ranked stocks here.

Find more top income stocks using our premium screens.

Are you intrigued by semiconductor stocks?

Discover a stock that’s as tiny, yet potentially explosive, as a microchip in a computer. With the sector’s burgeoning growth, this company is poised for success amidst the AI, machine learning, and IoT revolution. Semiconductor manufacturing could swell from $452 billion in 2021 to a colossal $803 billion by 2028.

Download Zacks Investment Research’s latest recommendations for 7 Best Stocks for the Next 30 Days.

Access the Free Stock Analysis Report for Zurich Insurance Group Ltd. (ZURVY)

Explore the Free Stock Analysis Report for BanColombia S.A. (CIB)

For further insights, visit Zacks.com

Visit Zacks Investment Research

Remember, the author’s views are their own, and do not necessarily align with those of Nasdaq, Inc.