The Rational Behind the Decision

The recurrent inquiry about my focus on bullish stocks or those with future potential isn’t unusual. Yet, my rationale is clear: the quest for lucrative investments trumps the pursuit of stock divestment.

Why? Because with close to 58,500 listed companies globally, identifying high-yield stocks amidst these numbers is akin to panning for gold in a vast river – a challenging pursuit indeed.

Given my unwavering bullish outlook on oil since the pandemic’s zenith in 2020, my initial foray into the energy sector involved acquiring shares in Exxon Mobil (XOM) when it was priced at around $31.

An intriguing period it was, as the tech frenzy reached its zenith, overshadowing enticing value stocks such as Exxon.

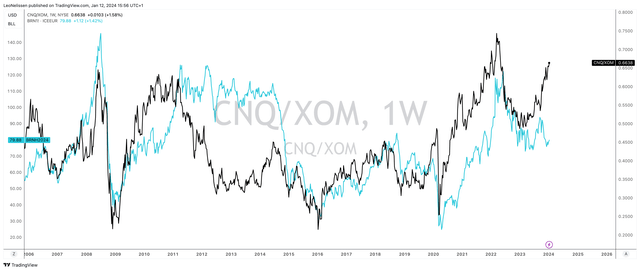

While I still hold a favorable view of Exxon in the long term (I reiterate, my goal isn’t to sow doubt about XOM), my recent move involved divesting from Exxon and redirecting my investment to Canadian Natural Resources (NYSE:CNQ), the second-largest exploration and production energy stock on the New York Stock Exchange, boasting a market cap of approximately $70 billion compared to Exxon’s $400 billion.

After months of podiatric discussions on oil and gas across various platforms, I felt compelled to address the persistent query regarding investment destinations.

Indeed, although Exxon remains a resilient and dependable oil investment, in my estimation, CNQ is the superior choice.

Therefore, I intend to delineate the reasons underpinning my shift from XOM to CNQ in this composition and elucidate why I have not wavered in this decision, despite Exxon’s standing as one of the most secure oil investments globally.

So, let’s delve deeper!

Sustaining the Bull Case

Prior to dissecting individual stocks, it’s vital to underscore a crucial aspect of my thesis: the aspect of demand.

Since 2020, my stance has been unequivocal – I firmly believe that notwithstanding environmental initiatives, oil and gas will remain pivotal components of our energy matrix for decades to come.

The same holds true for coal, especially with burgeoning energy needs in developing economies.

For instance, India’s projected spike in coal demand in the years ahead indicates a significant shortfall in meeting the requisites for the net-zero by 2050 initiative!

As I highlighted on Twitter recently, a developed nation like Germany consumes 6 times more electricity per capita than India, while the United States consumes 12 times more.

While multiple influences are at play, these developments fortify my conviction that any paradigm where global fossil fuel demand dwindles remains distant.

Javier Blas, an energy expert at Bloomberg, appears to concur, assessing oil demand beyond 2024.

According to his assessment, despite sanguine perspectives about the global economy breaking free from oil dependence, early indications of the energy transition are proving elusive.

The Energy Information Administration’s (“EIA”) prognosis suggests a 1.2 million barrels per day uptick in global oil demand for 2025, marginally lower than the anticipated 1.4 million in 2024.

Historically, global crude demand has consistently surged, averaging 1.05 million barrels per day from 1991 to 2023. Discounting the COVID-19 impact, the average oil demand growth over the last 30 years hovers around 1.18 million barrels per day.

Should the EIA’s prognostications materialize, global crude demand will clock an annual mean of 103.7 million barrels per day by 2025. Notably, China and India are poised to significantly drive this growth, while industrialized nations could witness a contraction in oil consumption.

From a personal vantage point, my bullish outlook transcends the EIA’s projections, as I perceive the agency as often overly pessimistic when it comes to oil demand growth.

An Affinity for Exxon, But the Quest for Enhanced Shareholder Value Persists

As alluded to earlier, my departure from Exxon does not stem from antipathy towards the company. It remains a well-administered entity with an AA- credit rating – one of the premium ratings globally across all sectors and industries.

Furthermore, by virtue of its magnitude, the company constitutes 22.7% of the Energy ETF (XLE), securing the top spot in terms of holdings.

Exploring the Future of Exxon and Canadian Natural

Exxon’s Performance in Context

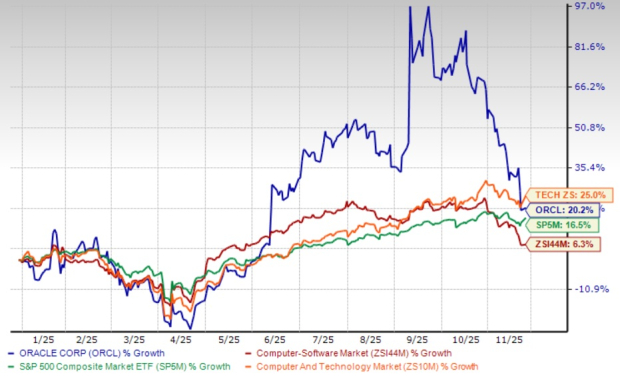

Over the past decade, Exxon Mobil Corporation (XOM) has outshone the XLE ETF with a 54% return, inclusive of dividends – a staggering 13 points higher. This performance, though admirable, pales in comparison to Canadian Natural Resources’ (CNQ) over 200% return during the same period.

Dividend Disparity

Despite producing approximately 3.7 million barrels of oil equivalent daily, Exxon’s dividend growth has remained lackluster with a five-year CAGR of just 2.6%, failing to beat inflation. In contrast, Canadian Natural’s current yield of 3.8% reflects its robust focus on shareholder returns.

Strategic Investments

Instead of prioritizing dividend growth, Exxon has fortified its balance sheet and invested in strategic acquisitions such as Denbury and Pioneer Natural Resources, streamlining its portfolio and expanding reserves in high-margin basins like the Permian. Moreover, it has significantly reduced structural costs by $9 billion since 2019.

Comparing Philosophies

Looking ahead, Exxon’s strategic focus on value-adding projects like chemicals, renewable-focused refinery assets, and the Guyana assets underscores its commitment to balanced growth and financial prudence. However, it remains to be seen if this approach can outshine the more aggressive strategies of its peers.

The Case for Canadian Natural

Headquartered in Calgary, Canada, Canadian Natural has set itself apart with a relentless focus on maximizing shareholder value through robust distributions, including dividends and buybacks. With a strong emphasis on reserves and production capabilities, CNQ has positioned itself as an industry leader in the energy sector.

Reserves and Distributions

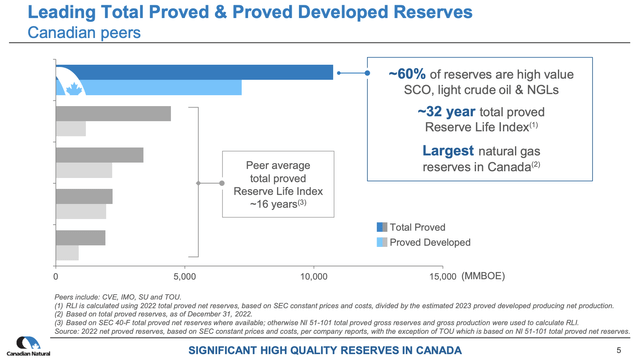

Canadian Natural boasts an extensive portfolio with over 5 billion barrels of oil equivalent in total proven reserves, offering a 32-year reserve life index. The company’s commitment to shareholder value is underlined by its substantial distributions and meticulous strategic planning, resonating with investors seeking robust returns.

CNQ’s Competitive Edge in the Energy Market

Canadian Natural Resources (CNQ) finds itself in an enviable position in the energy sector, propelled by substantial proven reserves exceeding 5 billion barrels of oil equivalent.

Stability in Production

One of CNQ’s standout attributes lies in its remarkably low decline rates, with nearly 58% of corporate production characterized by negligible declines. This results in an impressive overall corporate decline rate of approximately 11%, underscoring the stability of the company’s production.

This stability not only fortifies Canadian Natural’s production but also reduces the necessity for extensive maintenance capital to sustain output, setting it apart from its North American peers.

While many competitors operate in shale and offshore environments with higher decline rates, CNQ’s strategic positioning in low decline production offers a more predictable and sustainable free cash flow, providing a robust foundation for consistent shareholder returns.

Strategic Approach to Production and Shareholder Value

Looking ahead to 2024, CNQ’s strategic approach is evident in its production guidance, ranging from 1.33 million to 1.38 million barrels of oil equivalent per day, with a targeted exit rate of around 1.455 million barrels per day.

The company’s emphasis on a disciplined and flexible drilling program further sets it apart, with a plan that involves a balanced mix of longer and shorter cycle projects to maximize value for shareholders, reflecting a keen understanding of market dynamics.

Commitment to Shareholders

Demonstrating a strong commitment to returning cash to shareholders, Canadian Natural Resources has a track record of consistent dividend growth, reflecting 24 consecutive years of increases with a 21% compound annual growth rate over that period.

In 2024, the company raised dividends by 18%, with total dividends paid amounting to approximately C$4 billion, alongside share repurchases exceeding C$3 billion, further reinforcing CNQ’s dedication to increasing returns to shareholders.

Proactive Approach to Rewarding Investors

Notably, the recent 11% increase in the quarterly dividend to C$1 per share (4.6% yield) and the commitment to allocate 100% of free cash flow to shareholders upon reaching a net debt threshold highlight the company’s proactive stance in rewarding investors.

Once CNQ lowers net debt to C$10 billion, anticipated in 2024, it plans to distribute every penny of free cash flow to shareholders, showcasing a remarkable dedication to maximizing shareholder value.

A Preferred Choice Over Competitors

When considering investment options in the energy sector, CNQ’s prudent financial approach, robust production strengths, low breakeven prices, and unwavering commitment to substantial shareholder value make it an appealing choice over its competitors.

In contrast, while acknowledging Exxon Mobil’s conservative approach and diversified business as advantageous, CNQ’s prioritization of substantial shareholder distributions aligns with investors seeking aggressive returns.

Ultimately, CNQ’s proactive stance in rewarding investors elevates it as the preferred choice over Exxon Mobil, particularly for those betting on a prolonged bull case for oil.

In essence, CNQ’s robust financial position, coupled with its focus on shareholder value, solidifies its position as a stellar oil play offering potential for aggressive dividend growth, buybacks, and special dividends, making it an enticing investment opportunity in the industry.

So, while Exxon Mobil maintains its appeal, particularly in a bullish oil market, CNQ’s proactive approach to maximizing shareholder value makes it a compelling choice for investors seeking sustainable returns over the long term.