“`html

The Trade Desk’s Stock Performance and Outlook

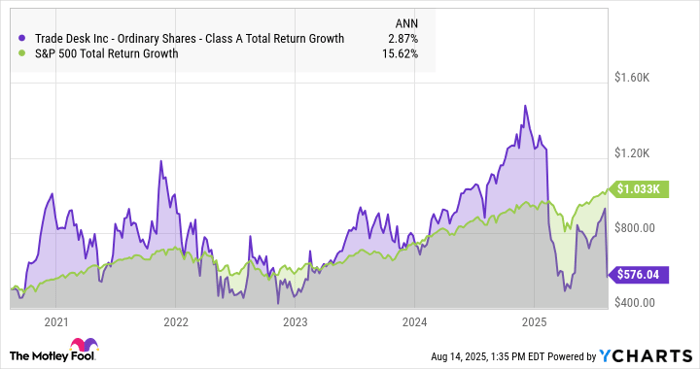

The Trade Desk (NASDAQ: TTD) has seen its stock plateau over the past five years, with an increase in value from $500 to $576. This modest growth contrasts sharply with the S&P 500 index, which has more than doubled during the same period with a compound annual growth rate of 15.6%, compared to The Trade Desk’s 2.9%.

Following recent earnings reports, The Trade Desk has maintained robust fundamentals, trading at 33 times free cash flow and 9 times sales. However, the company’s forward guidance indicates a projected sales growth of around 14% for Q3, suggesting a slowdown in momentum.

As of early December 2024, the company’s stock was down from previous valuations where it had traded at 134 times free cash flow and 30 times sales, reflecting a significant market correction while positioning the stock at more reasonable valuations compared to peers like Nvidia (NASDAQ: NVDA).

“`