Palantir vs. SoundHound: Which AI Stock to Consider for 2025?

As we approach 2025, two artificial intelligence (AI) stocks are attracting significant attention: Palantir Technologies (NASDAQ: PLTR) and SoundHound AI (NASDAQ: SOUN). Both companies delivered exceptional results in 2024, with Palantir’s stock climbing nearly 400% and SoundHound AI’s surging about 900%.

This kind of performance is remarkable, prompting many investors to wonder whether now is the right time to buy either of these stocks.

Wondering where to invest $1,000? Our analysts have identified the 10 best stocks to consider now. Discover the 10 stocks »

Innovative Leadership in AI: Palantir and SoundHound

Both companies are making strides in the AI landscape, yet they serve different purposes and markets.

Palantir specializes in providing customized AI applications to its clients, ensuring that decisions are based on the latest data. Its platform allows for generative AI to be integrated into the core functions of businesses, rather than merely serving as an auxiliary tool. While Palantir primarily caters to government agencies, its commercial segment has rapidly embraced advanced AI solutions, suggesting a sustained benefit from the growing demand for AI in multiple sectors.

In contrast, SoundHound AI focuses on leveraging audio inputs for its AI models, creating a vast array of possibilities for applications. Collaborating with key players such as Nvidia, SoundHound AI aims to enhance the integration of its technology across various industries. Its software has found traction in sectors ranging from restaurant and automotive to financial services and healthcare.

Speed of Growth: SoundHound vs. Palantir

Examining the financial metrics reveals significant differences. Palantir, a larger and profitable entity, grows at a more measured pace due to its size. Conversely, SoundHound AI is smaller but demonstrates rapid growth.

For Q3, Palantir reported a 30% year-over-year revenue increase to $725 million, while SoundHound AI’s revenue surged 89% to $25 million. However, Palantir maintained a solid profit margin of 20%, while SoundHound AI faced a challenging negative margin of 87%.

These disparities might lead some investors to favor Palantir, but it’s essential to consider future growth potential. Analysts predict Palantir’s revenue will grow by 24% next year, while SoundHound AI is expected to see growth of 96%.

This stark contrast indicates SoundHound’s growth trajectory is just beginning, while Palantir’s might slow down a tad. It’s important to note that while SoundHound AI is not projected to achieve profitability until later, management anticipates adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) break-even by the end of 2025, which is a positive sign.

The Challenge of Valuation

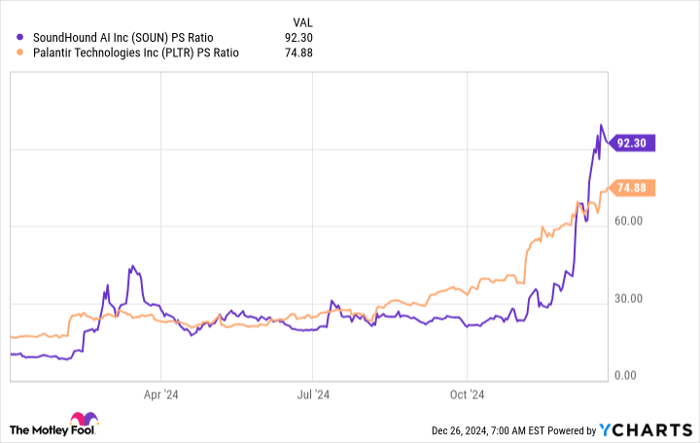

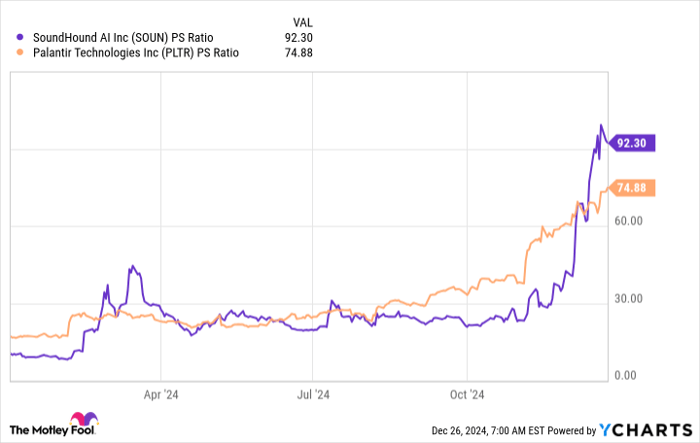

Both stocks have experienced significant appreciation in 2024, outpacing revenue or profit increases. The result is soaring valuation ratios.

SOUN PS Ratio data by YCharts

Currently, SoundHound AI trades at 92 times its sales, while Palantir’s ratio stands at 75. Both are among the highest valuations in the current market.

Typically, a ratio of 92 or 75 is deemed excessive, particularly when earnings are not a consideration. The validity of these valuations is debatable.

Palantir, being more mature, should target profit margins of around 30% and generally trades at approximately 40 times trailing earnings. Keeping its current growth trajectory in mind, it may take Palantir close to six years to reach that valuation without stock price growth, which sets a demanding standard.

Given these high expectations, there are legitimate concerns regarding Palantir’s ability to meet them.

Meanwhile, SoundHound AI’s rapid revenue doubling could lead to a price-to-sales ratio falling to around 11.5 by 2027 if it continues at its current growth rate. This reflects a more conventional valuation for software companies.

With expectations already factored heavily into both stock prices, the future appreciation seems more reliant on hype than actual business outcomes. However, if choosing between the two, I would lean towards SoundHound AI. Its rapid growth could mitigate high valuation multiples in a shareholder-friendly way.

Is Palantir Technologies the Right Investment for You?

Before making a decision, consider this:

The Motley Fool Stock Advisor team recently highlighted their choices for the 10 best stocks to invest in now, and Palantir Technologies was notably absent. The featured stocks have the potential for substantial future gains.

When Nvidia featured on this list back on April 15, 2005, a $1,000 investment would now be worth $857,565!*

Stock Advisor offers a straightforward path to investment success with portfolio-building guidance, analyst updates, and two fresh stock picks every month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than four times.

Explore the 10 stocks »

*Returns as of December 23, 2024

Keithen Drury holds shares in Nvidia. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.