Sequoia Capital occupies a prestigious place in the illustrious history of venture capital, boasting early investment stakes in iconic companies such as Instacart, DoorDash, Apple, Airbnb, and many more. It comes as no surprise that billionaire investors keenly observe Sequoia’s investment choices for hints on the next big thing to hit the market.

From Humble Beginnings to a $50 Billion Valuation

Not a long while ago, David Velez, now a partner at Sequoia, unearthed a hidden treasure trove in Latin America. The region’s banking landscape, though dominated by a few powerful institutions, fell short in meeting customers’ needs.

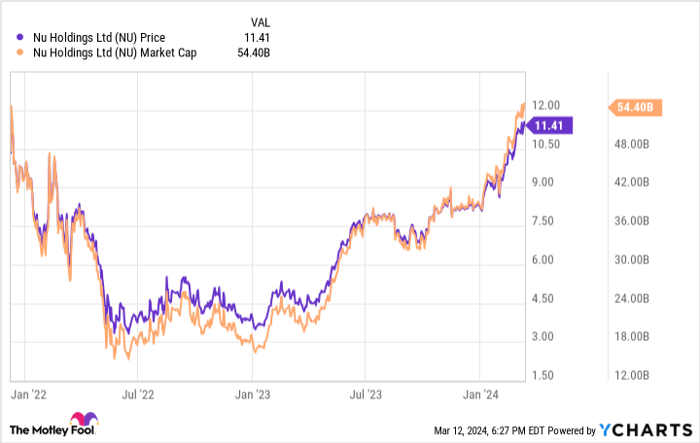

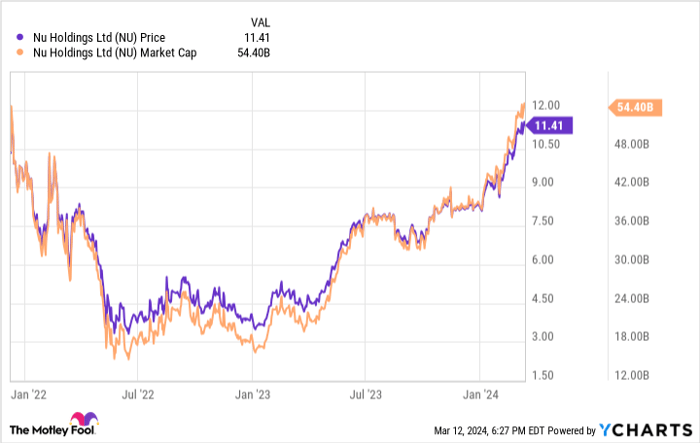

Velez’s insights led to the birth of Nu Holdings (NYSE: NU), with Sequoia spearheading its seed round. Over time, the company amassed a staggering $2 billion in funding rounds before going public in 2021. In a span of less than a decade, Nu skyrocketed from an idea to a publicly traded entity with a market valuation around $50 billion.

NU data by YCharts

Billionaire Backing in Full Force

Subsequent to its IPO, Nu attracted significant attention from influential players, including Warren Buffett’s Berkshire Hathaway funneling in $750 million without a single share sold. Tiger Capital, steered by billionaire investor Chase Coleman, seized an early-bird opportunity with a $240 million stake in the budding enterprise.

Founder David Velez himself ranks among the high-profile investors bolstering Nu’s future. Post-IPO, Velez’s net worth scaled past the $10 billion mark. Despite selling 3% of his shares recently, he remains a significant stakeholder in Nu’s trajectory.

The Winning Formula of Nu Holdings

Since its inception in Brazil in 2014, Nu effectively captured the hearts of over half the country’s adult population, thriving where established banks faltered. Whereas traditional banks grappled with cumbersome operations involving physical branches and extensive personnel, Nu adopted a lean, digital-first approach, slashing operational costs significantly.

Nu’s tech-savvy strategy not only paved the way for cost-effective operations but also opened doors for quick and widespread rollouts of new products, leaving competitors in the dust. The firm’s recent forays into Mexico and Colombia have seen its user base swell from 23.5 million to a staggering 95 million, culminating in a $360 million profit last quarter.

Although signs suggest Nu may have tapped into its prime customer segment, the prospects remain promising. With plans to expand across new markets like Guatemala, Peru, and several others, Nu anticipates a substantial addition of 100 million customers in the near future.

Furthermore, Nu’s service expansion potential remains largely untapped within its existing customer base, with each customer now averaging at least three products. As the company diversifies its product offerings, including insurance, personal loans, and crypto trading, the growth trajectory appears to be just warming up.

Trading at a slight premium post-IPO, Nu stocks present a lucrative long-term investment opportunity for investors eyeing sustainable growth.

Should you invest $1,000 in Nu right now?

Before diving into Nu stocks, consider this:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks for investors, excluding Nu. The selected stocks hold the potential to deliver substantial returns in the upcoming years.

Stock Advisor offers investors a roadmap to success, complete with expert insights, regular updates, and bi-monthly stock picks, consistently outperforming the S&P 500 since 2002*.

Discover the 10 stocks

Randi Zuckerberg, former spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg and a member of The Motley Fool’s board, holds no position in any mentioned stocks. The Motley Fool has stakes in and recommends several companies, including Nu. The Motley Fool has a strict disclosure policy.

The views expressed here are solely those of the author and may differ from Nasdaq, Inc.’s standpoint.