Apple (NASDAQ: AAPL) maintains its position as a premier technology stock at Wedbush Securities despite concerns over its business in China. Analyst Dan Ives recently projected that Apple will become the first $4 trillion company by the close of 2024. This ambitious forecast implies a 40% upswing from its current market cap of $2.85 trillion.

Ives asserted in a note to clients, “With roughly 240 million iPhones in the window of an upgrade opportunity globally now at play for iPhone 15, and services reaccelerating into [fiscal year 2024], we view this as a golden opportunity to own Apple for the next year.”

Apple’s Bumpy Road in China and Quirky Financials

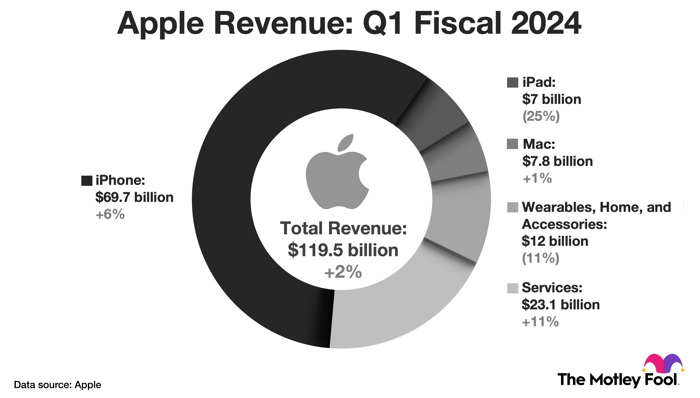

Apple delivered better-than-expected financial results for the first quarter of fiscal 2024, ending on Dec. 30, 2023. The company saw a 2% uptick in revenue to $119.5 billion, attributed to slight growth in iPhone sales and robust expansion in services revenue. Notably, advertising, video, and cloud services were positioned as significant contributors to this momentum.

The company’s profit margins on services, outshining hardware, have led to increased profitability over time as its services business expands. This trend persisted during the first quarter, with gross margin expanding by 290 basis points and GAAP earnings surging by 16% to $2.18 per diluted share. Stock buybacks have also played a role in the rapid bottom-line growth.

Despite these encouraging results, Apple’s shares dipped approximately 4% following the financial report due to declining sales in China and a lackluster revenue outlook. Concerns mounted as sales in China plummeted by 13%, fueling worries that the company is losing ground to local rivals like Huawei and Xiaomi. Furthermore, the absence of certain tailwinds caused Apple’s management to hint that revenue will likely drop by around 5% in the upcoming quarter.

Apple’s Role as a Dominant Force in Consumer Electronics

Apple has firmly established itself in various segments of the consumer electronics market. Its dominance in the smartphone domain serves as the bedrock of its operations. However, the tech behemoth also enjoys a leading position in the tablet and smartwatch sectors while standing as one of the largest personal computer vendors. This success is grounded in its brand authority and technological prowess.

Specifically, Apple combines premium hardware, including custom chips, with exclusive software and services to offer a captivating user experience. While the iPhone serves as the linchpin of this ecosystem, complementary products like Macs and AirPods contribute to its stickiness. This gives Apple considerable leverage in pricing. According to Insider Intelligence, the average iPhone costs twice as much as the average Android smartphone, indicating the company’s robust pricing power.

This pricing power enables Apple to make hefty investments in research and development. Notably, the company recently introduced its first mixed-reality device, the Apple Vision Pro, a product that some experts anticipate will eventually supplant the iPad.

Apple’s installed base exceeded 2.2 billion devices in the first quarter. While the company earns revenue from these consumers with the initial purchase, its focus is on continuous monetization through its services business. For instance, Apple generates revenue from the App Store, advertisements, iCloud storage, and financial products like Apple Pay, among other subscription offerings.

Apple boasts a dominant position in several of these sectors, leading the mobile application market in revenue with the Apple App Store, ranking as the fifth-fastest-growing digital advertising company in the U.S., and earning Apple Pay the title of the most popular in-store mobile wallet among U.S. consumers.

Apple’s Price Tag: Expensive or Worth the Splurge?

For Apple to create value for shareholders, it must continuously fortify its position in the smartphone arena and sustain the growth of its services business. Additionally, the company must remain at the forefront of emerging technologies such as virtual reality and augmented reality, which could potentially drive the next wave of consumer electronics innovation. Falling behind in these domains could leave Apple vulnerable to displacement, akin to how the iPhone supplanted Nokia and BlackBerry products.

While the likelihood of Apple reaching the $4 trillion mark in 2024 remains uncertain, potential investors should prepare to hold their positions for a minimum of three to five years. Personally, I have doubts about Apple’s ability to deliver returns that outpace the market during this timeframe. At present, its valuation of 29 times earnings seems steep when juxtaposed against Wall Street’s projected long-term annual earnings growth of 9.4%.

When taken together, these figures yield a PEG ratio of 3.1 for Apple. For context, Alphabet holds a PEG ratio of 1.5, Amazon stands at 2.3, and Microsoft registers 2.5. This implies that Apple is pricier than its prominent tech counterparts.

Considering an Investment in Apple?

Prior to making a move on Apple stock, it’s crucial to weigh the following: Motley Fool Stock Advisor analysts have identified what they believe are the top 10 stocks for investors to consider. Notably, Apple did not make the cut. The 10 stocks recommended possess the potential to yield considerable returns in the years ahead.

Stock Advisor provides investors with a straightforward roadmap for success, offering guidance on portfolio construction, regular updates from analysts, and two new stock picks every month. Since 2002, the Stock Advisor service has tripled the return of the S&P 500*.

Discover the 10 stocks

*Stock Advisor returns as of February 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Jefferies Financial Group, and Microsoft. The Motley Fool recommends BlackBerry and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.