“`html

Key Points

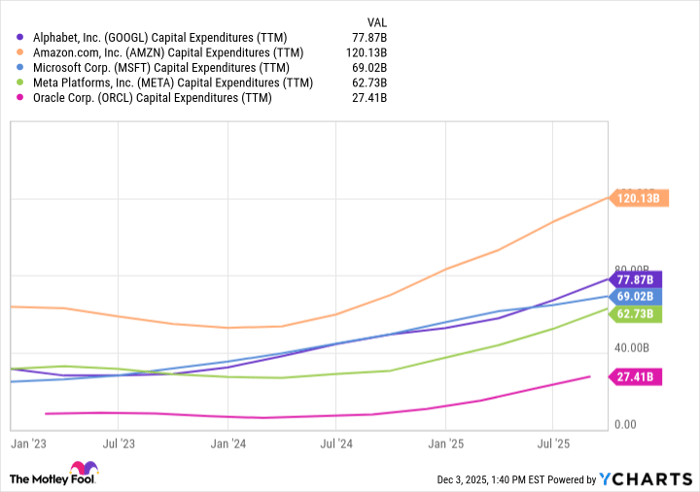

Taiwan Semiconductor Manufacturing (NYSE: TSM) holds a dominant position as the largest chip foundry, capturing approximately 68% of the market share by revenue. With rising investments in AI infrastructure, hyperscalers are projected to reach nearly $500 billion in capital expenditures (capex) in 2024, creating a multi-year opportunity in AI worth several trillion dollars.

Recent analyst predictions suggest that Taiwan Semi could experience significant growth as demand for GPUs remains strong. Multiple large-scale deals highlight the ongoing demand for chip procurement in AI development, indicating a potential breakout year for TSMC in 2026.

Despite geopolitical concerns, Taiwan Semiconductor has expanded operations in Arizona, Germany, and Japan, alleviating some investor worries. The current pace of deals suggests a robust future for TSMC, aligning it for potential prolonged share price increases similar to Nvidia’s trajectory.

“`