Warren Buffett’s Noteworthy Investment in Amazon: A Look Ahead

Warren Buffett, the famed investor, is celebrated for acquiring stocks at undervalued prices and reaping benefits as the market catches on to their potential. While he doesn’t always make the earliest investments, he typically enters the market at a point that allows for significant growth over time.

This strategy applies to one of the most recognized companies today. Buffett admitted in 2018 that he regretted not buying shares earlier, but his team included this stock in their portfolio the following year.

Looking for the best investment options? Our analysts have identified the 10 best stocks to consider right now. Learn More »

The stock in question has shown impressive gains and still holds substantial growth potential, particularly due to its leadership in fast-expanding sectors and its focus on artificial intelligence (AI). Let’s dive deeper into this Buffett investment that could see remarkable growth in the upcoming years.

Image source: The Motley Fool.

Buffett’s Investment Success Over the Years

To understand Buffett’s popularity among investors, it’s essential to look at his track record. He has consistently selected profitable investments, guiding Berkshire Hathaway to an annual compounded gain of nearly 20% over 58 years, significantly outpacing the S&P 500, which increased by only 10%. This remarkable consistency has earned Buffett the title of “Oracle of Omaha.”

Buffett emphasizes long-term investing, often holding onto stocks for many years to capitalize on a company’s gradual growth. A prime example is his investment in Coca-Cola, which he made in the late 1980s and continues to hold today. As such, Buffett is selective, favoring companies with promising prospects for the future.

Amazon: A Stock with Room for Growth

The company making waves this year is Amazon (NASDAQ: AMZN), which is a leader in both e-commerce and cloud computing. Despite initially passing on the stock, Buffett acknowledged his misstep in a 2018 CNBC interview, admitting he underestimated Amazon’s growth potential.

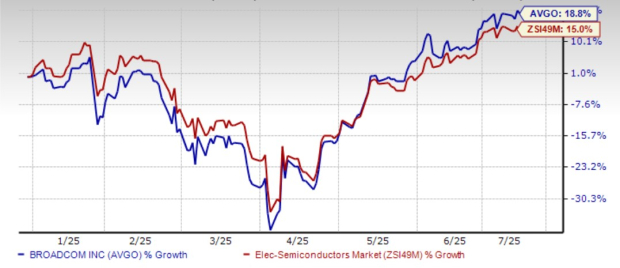

Buffett’s team acquired Amazon shares in early 2019, and since then, the stock has increased by about 150%. This highlights that latecomers to a company’s growth story can still see significant returns.

AI: Driving Growth at Amazon

Amazon continues to impress with its sustained earnings growth driven by its robust e-commerce and cloud services. A key component of this growth is the company’s investment in artificial intelligence (AI). This technology is enhancing operations across both sectors.

In e-commerce, AI tools are streamlining customer service and managing costs effectively. For instance, AI assists in determining the fastest delivery routes for packages. Additionally, Amazon has introduced Rufus, an AI-powered shopping assistant that enhances the shopping experience for customers.

On the cloud side, Amazon Web Services (AWS) offers a diverse range of AI products and services, contributing to an impressive $115 billion revenue run rate last year. As the AI market, currently valued at roughly $200 billion, is expected to exceed $1 trillion by the end of the decade, AWS is poised for further growth.

Currently, Amazon shares are priced at about 35 times forward earnings estimates. This valuation appears reasonable given the company’s growth narrative and future prospects. Many believe that as the AI boom unfolds, there is significant potential for the stock to skyrocket.

Thinking of Investing $1,000 in Amazon?

Before making an investment in Amazon, it’s wise to consider the insights from financial analysts:

The Motley Fool Stock Advisor team has pinpointed their top 10 stocks for investors right now, and surprisingly, Amazon did not make the list. Analysts believe these selected stocks could outperform in the years to come.

For reference, when Nvidia was recommended on April 15, 2005, a $1,000 investment then would be worth $823,858 today!*

Stock Advisor equips investors with tools for successful investing, featuring portfolio-building strategies, frequent analyst updates, and new stock recommendations each month. Since its inception in 2002, Stock Advisor has outperformed the S&P 500 by a substantial margin.

Learn more »

*Stock Advisor returns as of February 21, 2025

John Mackey, former CEO of Whole Foods Market, which is now an Amazon subsidiary, serves on The Motley Fool’s board of directors. Adria Cimino has invested in Amazon. The Motley Fool holds positions in and recommends both Amazon and Berkshire Hathaway. A full disclosure policy is available.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.