Every crisis harbors investment opportunities. When the banking crisis erupted last year, my attention was swiftly drawn to the financial sector. Amid this flurry, one company stood out – The Charles Schwab Corporation (NYSE:SCHW), a formidable banking and brokerage behemoth. Despite intermittent weakness, its signs of growth were hard to ignore. Since my bullish article in September 2023, its shares have catapulted 20%, trouncing the S&P 500’s meager 6.5% ascent.

Now, as the dust settles, I sense that the low-hanging fruit has been plucked. The recent share surge and persistent financial pain nudge me to recommend exploring other opportunities. Granted, Schwab’s shares may ascend further – especially if the broader market blooms. Nevertheless, weighed against the assumed risk, there are more favorable prospects at present. Consequently, I am downgrading the stock to a ‘hold’.

Assessing the Firm’s Fortunes

Despite this change in posture, Charles Schwab remains a compelling prospect for long-term investors – just not a standout one. In many aspects, the company continues to deliver impressive results. In November, total client assets surged to $8.18 trillion, trailing only slightly behind the all-time high of $8.24 trillion reported in July. This surge, propelled by a $19.2 billion influx of net new assets and $508 billion from the stock market rally, counteracted three months of dwindling asset prices.

The brokerage arm also shows remarkable vigor. The company recorded 286,000 new brokerage accounts in November, reflecting strong momentum in a mature trading space. Throughout 2023, it amassed 3.47 million new brokerage accounts, averaging about 315,000 per month and marked an all-time high of 34.67 million active brokerage accounts in November.

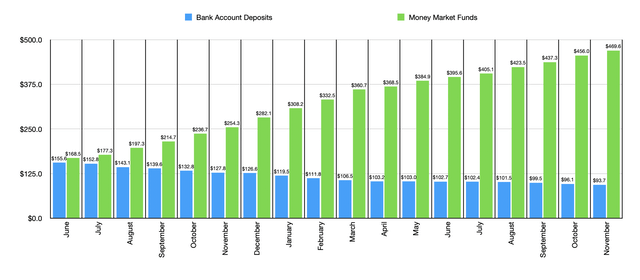

However, not everything is rosy. Average interest-earning assets have steadily declined, dwindling from $614.10 billion in June 2022 to $439.12 billion by November. Furthermore, the company’s bank account deposits, a historical source of cheap capital, face stiff competition in the current high-interest rate environment.

Charles Schwab’s Financial Rollercoaster

Charles Schwab’s financial journey in 2022 and 2023 has resembled a rollercoaster ride, with drastic fluctuations in various aspects of its fiscal standing. The institution has undergone significant changes in its assets, bank deposits, and net revenue, leaving investors on edge about where the company is headed next.

Bank Account Deposits

The saga begins with bank account deposit outflows, a weak spot for Charles Schwab. In June 2022, the company held $155.6 billion in bank account deposits, but this total dwindled each month, plummeting to $93.7 billion by November. The hope remains that a forthcoming drop in interest rates might reverse this trend. Despite the disappointment in this area, there is a silver lining – the firm has experienced a surge in money market funds. Within the same timeframe, money market funds ballooned from $168.5 billion to a staggering $469.6 billion.

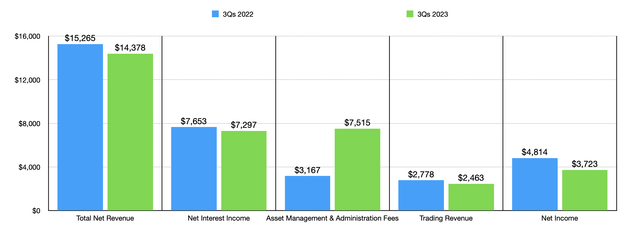

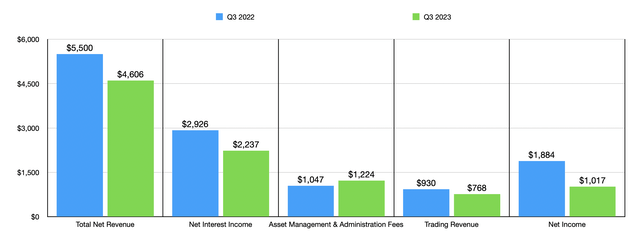

Financial Condition and Trading Revenue

The company’s financial condition has been tumultuous, compounded by declining trading revenue due to fee compression and reduced trading activity. Consequently, net revenue has slumped for the most recent quarter and the first nine months of 2023 compared to the corresponding period in the previous year. This downward trend has also had a cascading effect, dragging profits down as well. In the first nine months of 2022, the company posted a net profit of $3.72 billion, a sharp decrease from the $4.81 billion in the same period the year before. Nonetheless, it’s essential to note that in spite of the decline, Charles Schwab continues to generate billions in profits annually, portraying a mixed but not dire financial landscape.

Investment Conclusion

All things considered, the current state of affairs poses a conundrum for investors to carefully evaluate. Previously bullish on the company, recent events have led to a change in viewpoint. Despite the recent surge in stock price, the persistent weakness in bank account deposits, net revenue, and profits has prompted a downgrade to a ‘hold’ recommendation. While the long-term outlook may still hold promise, the present landscape indicates a turbulent ride ahead for Charles Schwab.