Investors Eye Coupang: A Growth Stock Worth Considering

Investors often benefit from waiting at least a year before engaging with new initial public offerings (IPOs). Many of these offerings are hyped up and might be overvalued, leading to unstable performances as they transition from private entities to public companies. As a result, many IPOs struggle immediately upon hitting the market.

A notable case in point is Coupang (NYSE: CPNG), South Korea’s leading e-commerce company. Priced around $50 per share during the IPO frenzy of 2021, Coupang’s stock depreciated to approximately $8 within 18 months and currently trades at roughly half its initial price. Nevertheless, over the past four years, Coupang has doubled its revenue, generated consistent cash flow, and established itself as the dominant e-commerce platform in South Korea.

As Coupang leverages its strong market position, analysts see it as a promising growth stock worth holding for the long term, potentially reaching new heights in the coming years.

Here’s a closer look at what differentiates Coupang’s future from other disappointing IPOs.

Image source: Getty Images.

Three Reasons to Consider Buying Coupang Stock

First, Coupang holds a commanding lead in South Korea’s e-commerce landscape, accounting for about 25% of the country’s online shopping market. This leadership allows Coupang to enhance customer service significantly, setting a high standard in the industry.

Coupang Aims to Impress Customers

South Korea’s high population density—a region where 81% of residents live in urban areas—gives Coupang an inherent advantage. This setup enables the company to provide services like dawn deliveries for orders made before midnight, same-day deliveries for select items, and next-day deliveries for most products, alongside a simple returns process.

Coupang’s logistics network is more efficient than those of many competitors found in China, Latin America, or the United States, allowing it to deliver superior service and satisfaction. According to the National Customer Satisfaction Index, Coupang achieved the highest customer satisfaction score among its peers in South Korea in 2024, a testament to its operational excellence.

Additionally, Coupang diversifies its offerings beyond traditional e-commerce with services like free grocery deliveries, restaurant deliveries, streaming media, online payments, and appliance installation. Its WOW membership, costing less than $6 monthly, consolidates these services into one convenient platform, creating a cohesive retail ecosystem in South Korea.

Growth Potential Remains Strong

Despite its established position in South Korea, Coupang’s growth trajectory is far from finished. The company took a significant step by acquiring luxury goods e-commerce platform Farfetch for $500 million in 2023. Before the acquisition, Farfetch was generating over $4 billion in annual sales but was unprofitable. Recently, it has achieved breakeven profitability under Coupang’s management and attracted 49 million monthly visitors from 190 countries by Q4 2024. Given South Korea’s high luxury spending per capita, this acquisition is expected to enhance Coupang’s growth prospects.

Furthermore, Coupang’s expansion into Taiwan shows promise. After experiencing a 23% sales growth quarter-over-quarter in Q4, Coupang launched its WOW membership program in the country and increased its product offering sixfold in the first quarter of this year. Management suggests that Taiwan’s growth may mirror the initial phase of Coupang’s success in South Korea, which had a population of 52 million compared to Taiwan’s 23 million.

Valuation Appears Reasonable

Coupang’s current trading ratio reflects a lofty 48 times free cash flow (FCF). This is largely due to the company allocating approximately half of its cash from operations (CFO) to capital expenditures (capex).

CPNG FCF = CFO – CapEx (TTM) data by YCharts

FCF represents CFO minus capex, meaning Coupang’s price-to-FCF (P/FCF) ratio appears inflated due to heavy capital investments aimed at supporting growth, such as expanding its logistical network in Taiwan. If Coupang were to freeze capital expenditures and focus solely on cash generation, its P/FCF ratio would likely align more closely with its price-to-CFO ratio of 24. This figure is a discount compared to the S&P 500’s average ratio of 32.

With Coupang showcasing 11% growth in sales and 9% in active customers during the first quarter—alongside improvements in gross and net profit margins—its valuation appears quite reasonable.

In summary, Coupang’s leading status in South Korea, coupled with its growth strategies in Taiwan and luxury sectors, makes it a compelling growth stock for consideration.

Should You Invest $1,000 in Coupang Now?

Before making any purchase of Coupang stock, here are some considerations:

Recent analysis by investment experts identifies ten top stocks that outperform the market. Coupang did not make this list, but those that did are believed to offer substantial returns in the near future.

For historical context, consider Netflix’s performance; if you had invested $1,000 when it was recommended in December 2004, it would now be worth about $620,719. Similarly, an investment in Nvidia following its recommendation in April 2005 would yield approximately $829,511.

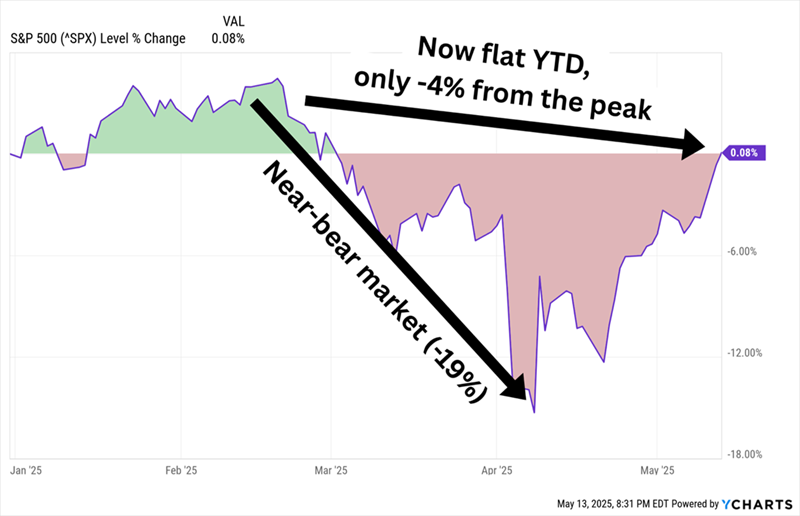

It’s important to note that the stock advisor has averaged a 959% return, significantly outpacing the S&P 500’s 170% return over the same period. Investors looking to mimic this success may want to explore the latest top 10 stock recommendations.

Josh Kohn-Lindquist holds positions in Coupang. The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.