Nvidia Corp NVDA has recently hit a bump in the road, causing a stir in the investment community. After months of steady growth, the tech giant’s stock has taken a hit, losing about 2% in value over the past five trading days.

While Nvidia remains a top pick for many analysts, with the majority rating it as a “Buy,” there are signs showing a potential slowdown. Quarter-to-quarter revenue growth has dwindled from 22% to 15% in recent reports, signaling a possible cooling-off period for the company.

Despite this, Nvidia’s collaboration with Alibaba Group Holding’s BABA cloud-computing services unit to enhance autonomous driving experiences in China’s smart vehicle sector showcases the company’s ongoing commitment to innovation in the lucrative automotive AI market.

However, the options market seems to have anticipated this slowdown, with implied volatility (IV) currently lower than historical volatility. This could present an interesting opportunity for traders looking to capitalize on discounted options premiums.

With a potential decrease in stock movement, investors are eyeing exchange-traded funds, such as those offered by Direxion, a renowned provider of leveraged ETFs that utilize various instruments to amplify returns.

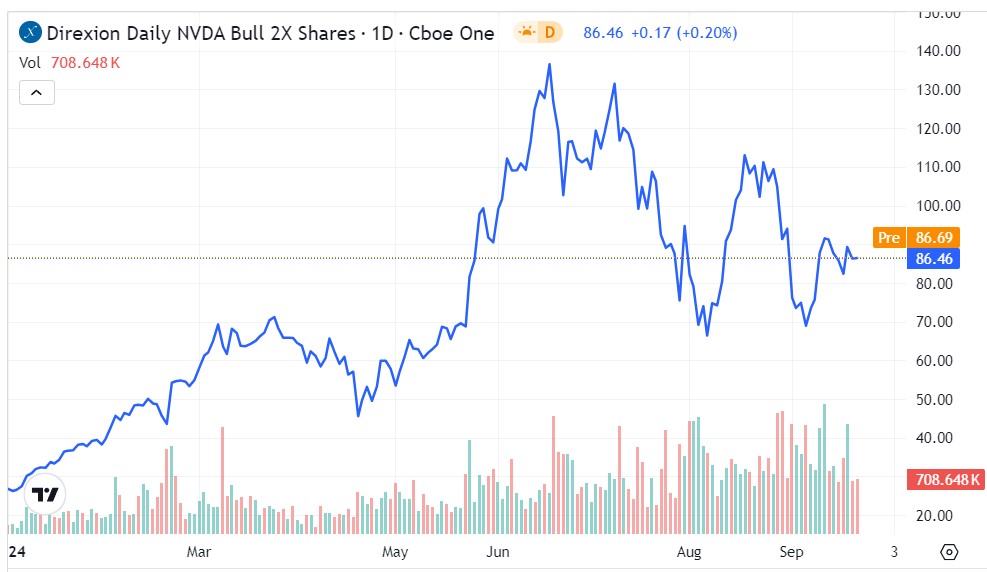

One such ETF is the Direxion Daily NVDA Bull 2X Shares NVDU, designed to deliver 200% of the daily performance of Nvidia shares. On the flip side, the Direxion Daily NVDA Bear 1X Shares NVDD aims for 100% of the inverse performance of NVDA.

Investors intrigued by these ETFs should be mindful of the short-term nature of these products, as they are not intended for prolonged exposure due to the volatility drag that can erode returns.

Exploring NVDU ETF: The NVDU ETF has delivered impressive returns, surging over 220% since the beginning of the year. Despite recent slower momentum, gaining 21.5% in the last six months, it maintains a strong position among moving averages, possibly indicating a bullish trend in the market.

The NVDD ETF Landscape: In stark contrast, the NVDD fund has faced challenges, losing 66% since January. However, recent small gains of over 6% in the past month have hinted at a potential shift, albeit with resistance at certain moving averages.

Image Source: Jordan Harrison from Pexels.

Market News and Data brought to you by Benzinga APIs