Nvidia vs. Micron Technology: Growth Prospects

As of December 17, 2023, Nvidia (NASDAQ: NVDA) continues to lead the AI chip market with a market capitalization of over $4.4 trillion, marking a significant increase in investment value—$100 invested five years ago is now worth $1,360. However, Micron Technology (NASDAQ: MU), a memory chip producer, is gaining attention due to a booming demand for memory chips driven by AI applications.

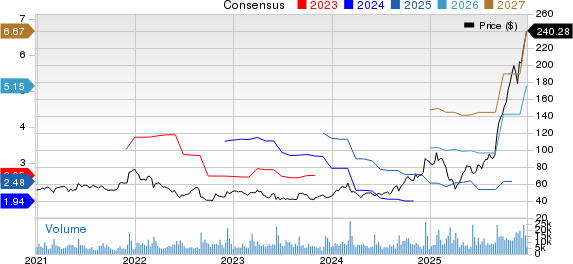

In its first fiscal quarter results for 2026, Micron reported a 57% year-on-year revenue increase to $13.6 billion, with adjusted earnings soaring 167% to $4.78 per share. The company anticipates a fiscal second-quarter revenue of $18.7 billion, a 2.3 times increase compared to last year. Additionally, Micron is projecting a 440% rise in adjusted earnings to $8.42 per share, vastly exceeding Wall Street estimates.

Market researcher IDC forecasts global AI infrastructure spending will reach $758 billion by 2029. Micron’s high-bandwidth memory (HBM) market is expected to grow at a 40% annual rate, positioning the company for sustained growth through 2030. With a price-to-earnings-to-growth (PEG) ratio of 0.53, Micron is currently perceived as undervalued compared to Nvidia, which has a PEG of 0.69, suggesting it could outperform its rival in the coming years.