Abercrombie & Fitch Surpasses Earnings Expectations in Q4 FY 2024

Abercrombie & Fitch Co. (ANF) delivered impressive fourth-quarter fiscal 2024 results as its sales and earnings exceeded the Zacks Consensus Estimate while showing year-over-year improvements. This represented the eighth consecutive quarter of earnings surpassing projections for the company.

During the fiscal fourth quarter, Abercrombie reported earnings per share (EPS) of $3.57, growing 20.2% from $2.97 in the same period last year. The bottom line not only exceeded the Zacks Consensus Estimate of $3.48 but also reflected strong revenue growth and enhanced operating margins.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

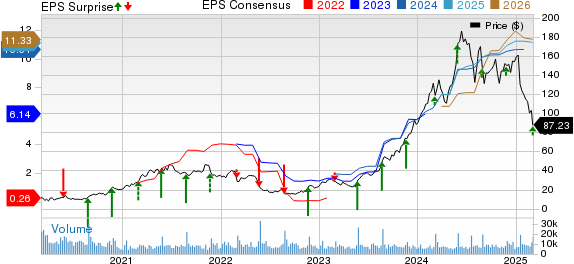

Financial Highlights: Price, Consensus, and EPS Surprise

Abercrombie & Fitch Company price-consensus-eps-surprise-chart | Abercrombie & Fitch Company Quote

Net sales reached $1.58 billion, marking a 9% increase year over year on a reported basis, and a 10% rise when accounting for constant currency. This figure surpassed the Zacks Consensus Estimate of $1.56 billion. Comparable sales (comps) for the quarter rose by 14%, supported by increased customer traffic across regions and brands.

Despite these robust results, Abercrombie’s shares fell by 9.2% following the earnings announcement. The stock, currently holding a Zacks Rank #3 (Hold), has seen a 30.7% decrease over the past three months, while the broader industry experienced a 13.7% decline.

Although year-over-year sales grew, they showed a slowdown compared to the 14% increase reported in the third quarter of fiscal 2024, leading to disappointment among investors. The company’s gross margin faced significant pressure from heightened freight costs, which are expected to persist. Additionally, a cautious EPS forecast for the first quarter of fiscal 2025 may have further dampened investor sentiment. The company anticipates a $5 million impact from existing U.S. tariffs on China, Canada, and Mexico within the current fiscal year, excluding potential new tariffs.

Regional and Brand Sales Contributing to Growth

Sales in the Americas grew 11% year over year, reaching $1.32 billion, while sales in EMEA increased 2% to $224.5 million. Conversely, sales in APAC declined 4% to $40.7 million. The Americas region marked its seventh consecutive quarter of double-digit sales growth, with comps increasing by 15% there, 12% in EMEA, and 17% in APAC.

The Abercrombie brand experienced a 2% sales uptick year over year, totaling $772.7 million, while Hollister’s sales surged by 16% to $812.2 million. The Abercrombie brand accounted for 48.8% of total company sales, whereas Hollister contributed 51.2%. Comps grew by 5% for Abercrombie and by 24% for Hollister during the quarter.

Our models predicted an 8.2% sales growth for Abercrombie and a 6.6% increase for Hollister, along with estimated sales growth of 7.2% in the Americas, 9.5% in EMEA, and 2.1% in APAC.

Quarterly Performance: Margins and Expenses

Abercrombie’s gross margin fell to 61.5% for the fiscal fourth quarter, contracting 140 basis points (bps) year over year. This drop stemmed from elevated freight costs, which outweighed the benefits of higher average unit retail prices due to reduced discounts.

Selling expenses totaled $526.4 million, a 5.5% year-over-year increase. However, as a percentage of sales, these expenses fell by 110 bps to 33.2%. General and administrative costs rose by 0.6% to $194.5 million but decreased as a percentage of sales by 100 bps to 12.3%.

Operating income improved to $256.1 million from $222.8 million in the previous year, reflecting a 14.9% increase. The operating margin rose to 16.2%, a 90 bps increase from 15.3% in the prior year, mostly supported by leveraged selling and administrative expenses, which offset the pressure from a weaker gross margin.

We had estimated a 60-bps increase in the adjusted operating expense rate to 16% for the fiscal fourth quarter.

Stable Financial Health for Abercrombie

At the close of the fiscal fourth quarter, Abercrombie held $772.7 million in cash and cash equivalents with no long-term borrowings and stockholders’ equity of $1.34 billion, excluding non-controlling interests.

The company’s liquidity stood at $1.2 billion, which included cash and equivalents. As of February 1, 2025, net cash provided by operating activities was $710.4 million.

In line with its capital management strategy, management announced a new share repurchase authorization of $1.3 billion, expecting to repurchase $100 million in shares during the first quarter and a total of $400 million for the fiscal year.

Outlook for Q4 and FY 2025

Management shared its projections for the first quarter and fiscal 2025. For Q1 FY 2025, net sales are expected to rise between 4-6% from the $1.02 billion reported for the same period last year. They anticipate an operating margin between 8-9%. EPS is estimated to range from $1.25 to $1.45, a decline from the prior year’s $2.14, with an effective tax rate around 25%.

As for fiscal 2025, sales are projected to grow by 3-5% from the $4.95 billion recorded in the last fiscal year. This increase is anticipated to come from regional and brand growth, though the company expects a 70-bps adverse impact from foreign currency. Abercrombie anticipates an operating margin ranging from 14-15%, with expectations of increased freight costs in the first half and lower freight costs in the second half compared to the previous year.

For fiscal 2025, the company expects a weighted average of approximately 51 million shares, reflecting share repurchases. Combined with the anticipated tax rate, Abercrombie forecasts EPS to be between $10.40 and $11.40, compared to $10.69 from fiscal 2024. They expect an effective tax rate of around 26%. Additionally, capital expenditure is projected at $200 million for the current fiscal year.

Plans for fiscal 2025 include the opening of 60 new stores, as well as 40 remodels and rightsizes, alongside 20 closures.

Notable Retail Picks

Highlighted below are three top-ranked stocks: Boot Barn (BOOT), Urban Outfitters

Boot Barn, Urban Outfitters, and Deckers Show Strong Growth Potential

Boot Barn, a lifestyle retail chain specializing in western and work-related footwear, apparel, and accessories, currently boasts a Zacks Rank #1 (Strong Buy). Their sales estimate for the current fiscal year predicts a growth of 14.9% compared to the previous year. Additionally, Boot Barn has a trailing four-quarter earnings surprise that averages 7.2%.

Urban Outfitters, known for its fashion lifestyle specialty retailing, also holds a Zacks Rank of 1. The company has achieved an impressive average earnings surprise of 28.4% across the last four quarters. The consensus estimate for Urban Outfitters’ sales growth in the current financial year stands at 5.9% from last year.

Deckers, a retailer of footwear and accessories, is ranked #2 (Buy) by Zacks. The company has performed admirably with an average earnings surprise of 36.8% over the trailing four quarters. For the current fiscal year, Deckers’ sales growth is estimated to be 15.6% from the prior year’s figures.

Special Offer: Access Zacks’ Stock Picks for Only $1

Yes, you read that right.

A few years ago, Zacks Investment Research surprised its members by offering them 30-day access to all stock picks for just $1—no obligations or hidden fees. This opportunity drew thousands of participants who wanted to explore Zacks’ portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and others, which collectively closed 256 positions with double- and triple-digit gains in 2024 alone.

For those looking for the latest investment recommendations from Zacks Investment Research, you can download a special report featuring “7 Best Stocks for the Next 30 Days” at no cost. Click here to get this free report.

Additionally, analysis reports on Abercrombie & Fitch Company (ANF), Deckers Outdoor Corporation (DECK), Urban Outfitters, Inc. (URBN), and Boot Barn Holdings, Inc. (BOOT) are available:

- Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

- Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

- Urban Outfitters, Inc. (URBN): Free Stock Analysis Report

- Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.