Acadia Healthcare Company, Inc. (ACHC), a leading behavioral healthcare provider headquartered in Franklin, TN, operates 262 facilities across 39 states and Puerto Rico, totaling approximately 12,000 beds. Recent scrutiny from the U.S. Department of Justice and the SEC has arisen from allegations published in a New York Times article that the company improperly retained patients to boost insurance payments. In response, Acadia has agreed to a $17 million settlement concerning Medicaid fraud in West Virginia.

The financial outlook for ACHC is concerning, with a projected 84.38% decline in earnings per share (EPS) for the current quarter compared to the previous year. Revised guidance for 2025 indicates adjusted EPS expectations have been lowered to between $2.35 and $2.45, along with reduced forecasts for adjusted EBITDA and operating cash flow. The company’s shares have plummeted 64.53% year-to-date, significantly underperforming major market indices.

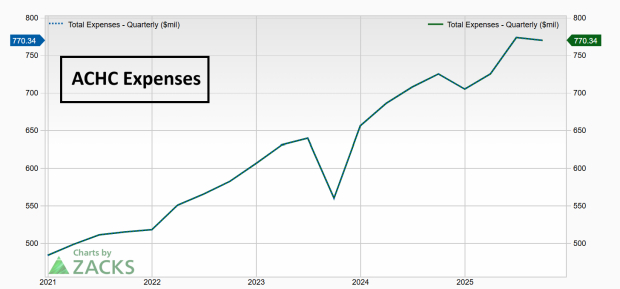

Overall, Acadia Healthcare is grappling with rising legal costs, increased operational expenses, and a negative growth trajectory, presenting a challenging financial landscape as it seeks to navigate ongoing scrutiny and maintain its market position.