**Amazon Web Services (AWS) Reports Strong Q3 2025 Performance**

AWS generated $33 billion in revenue and $11.4 billion in operating income in Q3 2025, achieving a 34.6% operating margin. The segment’s trailing 12-month operating margin stands at 35.9%, stabilizing after previous compressions. Key growth indicators include a 20% year-over-year revenue increase and a remaining performance obligations backlog of $200 billion, ensuring revenue visibility over 3.8 years.

**Comparative Performance of Microsoft and Alphabet**

In Q1 fiscal 2026, Microsoft’s Intelligent Cloud segment reported a 43% operating margin, fueled by a 40% increase in Azure revenue. In contrast, Alphabet’s Google Cloud achieved a 23.7% operating margin in Q3 2025, up from 17.1% the previous year, driven by an 85% surge in operating income to $3.6 billion. Both companies are managing elevated data center buildup costs while demonstrating impressive revenue and margin growth.

**Financial Outlook for Amazon**

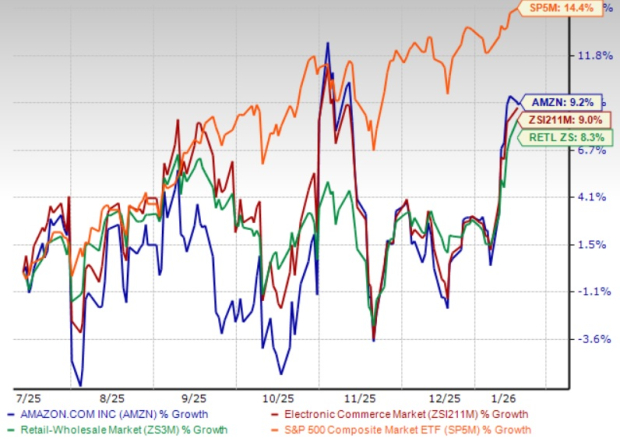

Amazon’s stock has increased by 9.2% over the past six months. The company’s forward 12-month price/earnings ratio is 31.16, surpassing the industry average of 25.64. The Zacks Consensus Estimate for Amazon’s 2026 earnings is $7.85 per share, a 9.46% rise from the previous year, indicating positive growth expectations.