Metal and mineral markets are notoriously erratic and prone to abrupt downturns. The 2023 plunge in nickel, cobalt, and lithium prices, while extreme, is but one of many such episodes in the volatile history of these commodities. Industry veterans can recall the tumult of rare earth production, the fluctuations in platinum group metal markets, and even the rollercoaster ride of gold and silver trading over the years.

Despite geopolitical and market upheavals, major mining companies have grown nimbler at navigating choppy waters. However, the ranking of the top 50 miners in 2023 witnessed swift and drastic changes – a stark reminder of the outsized risks miners face beyond market fluctuations.

The Panama Debacle

In a dramatic turn of events, the Panama government ordered the shutdown of First Quantum Minerals’ Cobre Panama mine after the Supreme Court ruled the mining contract unconstitutional. This decision followed months of protests and political pressure, bolstered by the public support of prominent figures such as climate activist Greta Thunberg and Hollywood actor Leonardo Di Caprio, whose viral video called for the closure of the “mega mine”. The irony that Cobre Panama is integral to the green energy transition did not escape observers, but this did little to stem the tide of opposition.

FQM is now in the throes of arbitration proceedings as it winds down operations, with hopes of reopening the mine dwindling. Plunging nickel prices have also compelled the company to halt operations at its Raventhorpe mine in Australia. From a lofty 25th position in the ranking with a valuation exceeding $20 billion in March 2022, FQM plummeted out of the top tier entirely, concluding 2023 at number 58 with a market cap below $6 billion.

Cobre Panama, which contributed more than 40% of the company’s revenue, faced a devastating blow, nudging FQM further from the pinnacle of the mining industry. The company’s shares have experienced a slight resurgence in 2024 amid murmurs of a potential takeover, but still not sufficient to reenter the top 50.

Rising Up: Amman Mineral Internasional

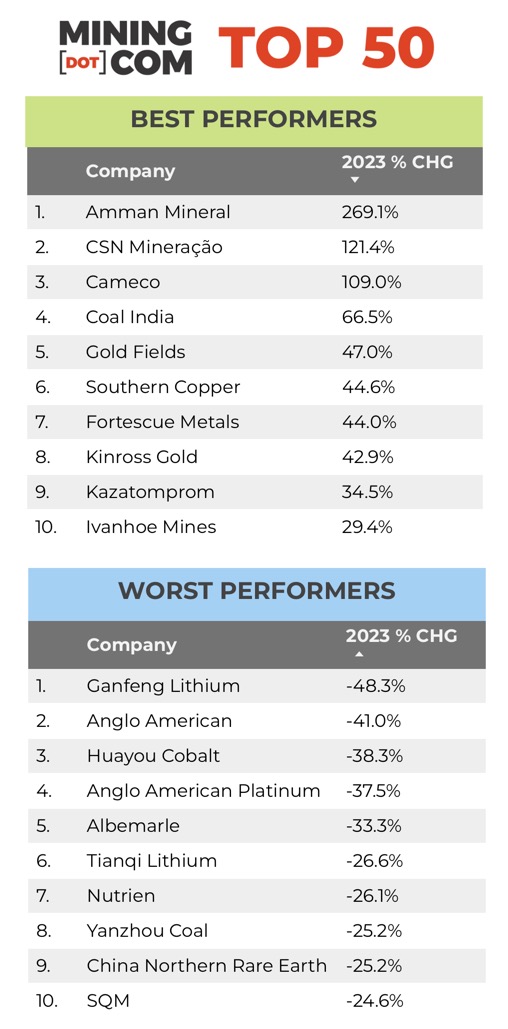

While FQM faced a tumultuous year in 2023, Amman Mineral Internasional experienced an ascent worthy of admiration. The Indonesian firm’s stock surged by a remarkable 269% since its debut in Jakarta, propelling its market capitalization to over $30 billion by the year’s end, securing the 12th spot in the ranking.

This remarkable valuation, achieved on an annual revenue of $2 billion, underscores the exceptional performance and robust margins at the company’s Batu Hijau copper and gold mine. Despite being the third largest mine globally in terms of copper equivalent output, Batu Hijau pales in comparison to Cobre Panama concerning copper production. Furthermore, the company is developing the Elang project adjacent to Batu Hijau, signaling its sustained growth trajectory.

Amman Minerals’ meteoric rise has engendered the creation of at least six new billionaires, and the company’s stock continues its upward momentum in 2024, already registering double-digit gains in January.

Precious Metals in the Balance

Despite gold reaching an all-time high price on December 1, 2023, gold mining stocks did not capitalize on the bullish market. Gold and royalty companies on the MINING.COM TOP 50 ranking added a collective $20.8 billion in market capitalization during 2023, a testament to the mercurial nature of the industry.

Gold miners have struggled in 2024, as evidenced by Newmont’s 17% decrease in value, Barrick shedding 13%, and Agnico Eagle shareholders experiencing a 9% decline. The number of precious metals companies in the top 50 has remained relatively stable over the years, with Kinross joining the ranks following Newmont’s absorption of Newcrest. Furthermore, Anglogold Ashanti has resurged back into the top tier after a struggle to reclaim its position in the ranking.

However, silver has failed to ride gold’s coattails, with no silver specialist featuring in the top 50 for several years. The exit of platinum and palladium majors like Sibanye Stillwater and Impala Platinum has made space for Royal Gold to re-enter the top 50, while Anglo American Platinum faces a challenging year as palladium and platinum prices continue to slide.

The Trials of Anglo American

London-listed Anglo American has weathered a challenging year, compounded by its exposure to platinum group metals and control of AngloPlat. Once valued at $70 billion in March 2021, the company now stands at $30 billion, with rumors of a potential acquisition by Glencore adding to its woes.

The company’s history, steeped in more than a hundred years on the South African gold and diamond fields, has been marked by tumultuous episodes. A resurgence in iron ore prices has provided some respite, preventing a deeper slump in the company’s share value and safeguarding the diversified majors reliant on iron ore.

The top 10 mining companies have managed to uphold their share of the total market cap, despite the seismic shifts within the industry, signaling their resilience in the face of adversity.

Boom or Bust: The Top 50 Mining Companies in 2023

Panning Out The Top 50

When it comes to the top 50 mining companies in the year 2023, the landscape has been a tantalizing mix of cutthroat competition, ups, downs, mergers, and potentially lucrative opportunities. These mining mammoths, who’ve weathered their fair share of storms, have proven that size isn’t everything, but it sure does count for something in the rough-and-tumble world of mining. As access to capital becomes a migraine rather than just a headache, there’s a consistent trend where the big players get bigger, and the smaller ones struggle to rise. But when it comes to the commodities that drive these companies, there’s a fascinating story to tell – one that showcases the resilience of the mining industry in the face of the ever-changing tides of fortune.

Lithium Lament

As we delve into the tumultuous year that was 2023, the fate of lithium miners in the top 50 comes to the forefront. The combined losses for these miners soared to almost $30 billion in market cap over the course of a year, an undeniable blow against the backdrop of lithium’s meteoric rise. The drama surrounding key players like Liontown, Albermarle, and Hancock Prospecting turned into a veritable soap opera, while Chile’s attempt to reclaim control of its lithium industry proved to be less impactful than initially feared. Despite the precipitous decline in lithium prices, none of the battery metal miners’ stock performances were dire enough to drop them out of the Top 50 – a testament to the industry’s perseverance in the face of adversity.

Shifting Sands in Mining Capitals

In a fascinating turn of events, the shift of power in mining capitals has been nothing short of seismic. Pilbara Minerals, the lone ranger still showing share price gains amidst the turmoil, muscled its way into the Top 50, shifting the balance of power among the mining capitals. The battlement of Western Australia’s capital to five mining companies, surpassing Vancouver, BC, as the top home base in the ranking, is a sign of changing times. With the exit of First Quantum, Vancouver now houses three mining companies in the Top 50, while the return of Kinross has propelled Toronto-headquartered miners back up to four, painting a dynamic and ever-changing portrait of the mining world.

Nuclear Resurgence

The uranium market tells a tale of resurgence, with prices more than doubling in 2023 and recently hitting triple digits for the first time in 16 years. This remarkable breakthrough for the nuclear fuel comes after a decade in the doldrums post the Fukushima disaster in Japan. Cameco, based in Saskatoon, shot up the rankings, marking a substantial leap of 22 places since the previous year. Additionally, Kazatomprom, the world’s top uranium producer, saw its shares’ value exceed $10 billion by the end of 2023, underscoring the nuclear option’s robust return to prominence in the mining arena.

*NOTES:

Source: MINING.COM, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange at December 28, 2023, to January 2, 2024, where applicable, currency cross-rates January 2, 2024.

Percentage change based on US$ market cap difference, not share price change in local currency.

As with any ranking, criteria for inclusion are contentious. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, and a number of entities in China and developing countries around the world.