Fed Cuts Rates Again: What Does a 4.75% Fed Funds Rate Mean for the Economy?

Fed Reduces Rates for the Second Time This Cycle

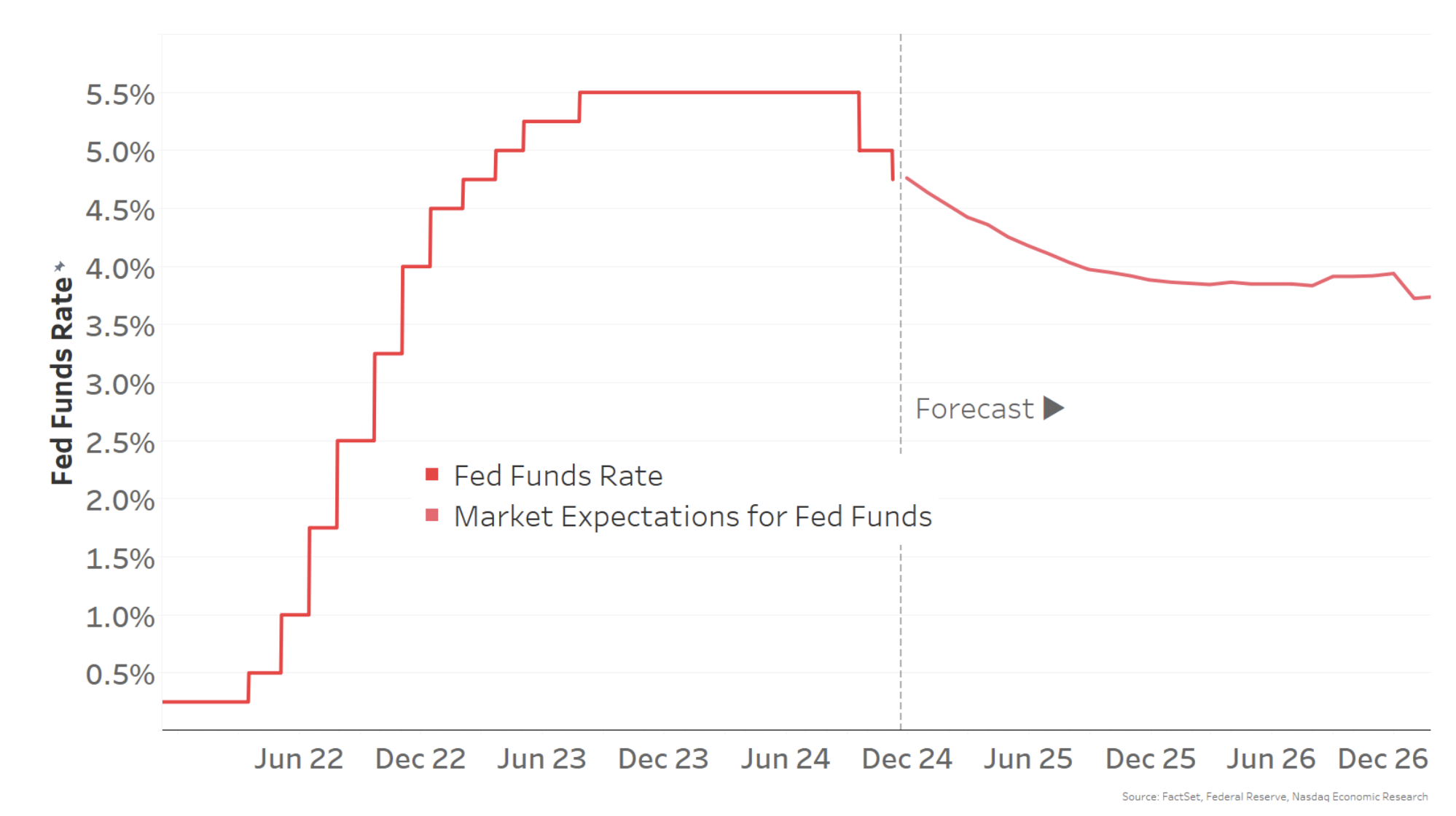

On November 7, the Federal Reserve cut rates again, lowering the Fed Funds rate by 25 basis points (bp) to 4.75%. This marks the second reduction in this rate cut cycle (as shown in the chart below, indicated by the darker red line).

Current Rate Far Exceeds Neutral Target

Chair Jerome Powell indicated the Fed aims to bring the Fed Funds rate closer to its “neutral rate,” which neither promotes nor hinders economic growth. However, this neutral rate is difficult to pinpoint as it fluctuates with GDP growth and inflation trends, compelling economists to model it while markets estimate its position.

During the Fed’s previous meeting in mid-September, estimates suggested rates would settle around 3% over the next couple of years. Recently, optimism about a stronger economy and supportive fiscal policies has led markets to predict rates settling around 3.85% by late next year (represented by the lighter red line).

No matter which estimate for the neutral rate is used, the current Fed Funds rate remains significantly above it. This indicates that monetary policy is still largely restrictive.

Past Rate Hikes Have Led to Recessions

Historically, maintaining restrictive rates can lead to economic downturns. For example, before the recessions of 1990-91, 2001, and 2007-09, the Fed raised the Fed Funds rate (shown as a red line) above the neutral rate (depicted as a brown line), causing the economy to slow and eventually enter recession (illustrated in grey-shaded areas).

In these instances, the Fed responded by cutting rates sharply, falling well below the neutral rate to facilitate economic recovery. Eventually, as the economy regained strength, the Fed raised rates again, repeating the cycle.

Currently, the Fed Funds rate sits 125 basis points above the New York Fed’s estimate of the neutral rate, marking the largest gap since the mid-1990s. However, that era also saw the Fed successfully manage a soft landing (noted by the green circle).

With the Fed Funds rate significantly exceeding the neutral estimate, there is a strong possibility—and necessity—for it to decrease over the next year. If not, the Fed risks a repeat of historical patterns that could result in another recession.

The information contained above is provided for informational and educational purposes only. It should not be construed as investment advice for any particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.