Adobe and Apple are integrating artificial intelligence (AI) into their offerings, with Adobe enhancing its creative products and Apple incorporating Apple Intelligence into its operating systems for devices like iPhone and Mac. According to IDC, global spending on AI technologies is projected to exceed $749 billion by 2028, with 67% of the estimated $227 billion spending in 2025 coming from enterprises adopting AI capabilities.

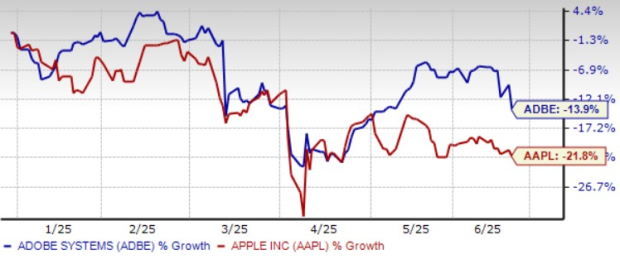

Year-to-date stock performance shows Adobe down 13.9% while Apple has seen a 21.8% decline. Adobe’s focus on AI products like Firefly has resulted in a promising trajectory, with earnings projected at $20.41 per share for fiscal 2025, a 10.8% increase year-over-year. In contrast, Apple’s fiscal 2025 earnings estimate has decreased to $7.11, indicating only 5.33% growth. Additionally, Adobe’s adjusted revenue guidance has been increased to between $23.5 billion and $23.6 billion, reflecting stronger demand for its AI offerings.

Adobe currently holds a Zacks Rank #2 (Buy), while Apple has a Zacks Rank #3 (Hold), suggesting that Adobe may represent a better investment opportunity under current conditions.