Adobe Shares Surge Amid AI Focus, But Challenges Persist

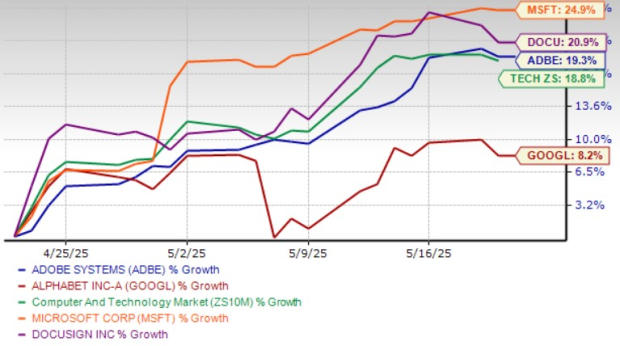

Adobe (ADBE) has seen its shares rise 19% over the past month, primarily driven by its increasing focus on Generative AI (Gen AI) and an expanding AI-powered portfolio. Additionally, a pause in tariffs has contributed to reducing macroeconomic uncertainty, benefiting the stock. Nonetheless, Adobe faces significant challenges in the near term due to fierce competition from firms like Microsoft (MSFT) and its partner OpenAI, as well as ongoing difficulties in monetizing its AI solutions.

When comparing Adobe’s AI business to giants like Microsoft and Alphabet (GOOGL), Adobe remains small. Microsoft is gaining traction with its Intelligent Cloud revenues, bolstered by Azure AI services and growth in its AI Copilot business. Conversely, Alphabet’s Google Cloud is experiencing accelerated growth thanks to its AI infrastructure, enterprise AI platform Vertex, and a robust adoption of Gen AI solutions.

The intense competition has weighed down Adobe’s stock, which has lagged behind Microsoft and document services provider DocuSign (DOCU) over the past month. Microsoft, DocuSign, and Alphabet recorded returns of 24.9%, 20.9%, and 8.2%, respectively, in the same period. This challenging outlook is likely to continue impacting Adobe’s stock performance.

ADBE Stock Performance Overview

Image Source: Zacks Investment Research

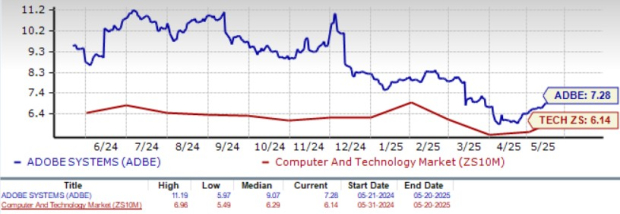

Adobe’s valuation appears overextended, indicated by a Value Score of D. Currently, ADBE stock is trading at a premium, with a forward 12-month price-to-sales ratio of 7.28X, compared to the broader Zacks Computer and Technology sector at 6.14X, Salesforce at 6.61X, DocuSign at 5.69X, and Alphabet at 5.90X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

What steps should investors take regarding Adobe shares now? Let’s examine the situation more closely.

Can Adobe’s Innovative Portfolio Enhance Future Prospects?

Adobe’s commitment to expanding its AI offerings includes introducing Adobe GenStudio and Firefly Services, designed to facilitate collaboration on marketing campaigns. The company has recently launched Firefly Video Model-powered Generative Extend in Premiere Pro, using AI to enhance video and audio clips. Enhanced versions of After Effects and new upgrades to Frame.io also demonstrate Adobe’s aim to innovate.

The company plans to monetize standalone Firefly subscriptions, incorporating these into various Creative Cloud offerings. By boosting its sales capacity, Adobe aims to provide comprehensive services across business, education, and government sectors. The addition of AI Assistant features in Acrobat, Reader, and Express suggests a positive trend for Adobe’s future growth as it integrates Gen AI innovations across its product lines.

Positive Guidance for Fiscal Year 2025

Adobe anticipates a new AI revenue stream to exceed $125 million by the end of the first quarter of fiscal 2025. This represents a low single-digit percentage of total revenues, which stood at $4.23 billion during the same period. The company expects this AI revenue to double by fiscal 2025’s close.

For fiscal 2025, Adobe predicts an 11% growth in Digital Media Annual Recurring Revenue. Expected revenues from the Digital Media segment are between $17.25 billion and $17.40 billion, while revenues from the Digital Experience segment are targeted between $5.8 billion and $5.9 billion. The Digital Experience subscription revenues are projected to range from $5.375 billion to $5.425 billion.

Adobe has reaffirmed its revenue guidance for the current fiscal year, estimating total revenues between $23.30 billion and $23.55 billion, compared to $21.51 billion in fiscal 2024. Non-GAAP earnings for fiscal 2025 are still projected to fall between $20.20 and $20.50, up from $18.42 per share in fiscal 2024.

Decline in Estimate Revisions for ADBE

As for fiscal 2025, the Zacks Consensus Estimate for earnings is currently $20.36 per share, reflecting a 5-cent reduction over the last two months. This figure represents a growth rate of 10.53% compared to fiscal 2024.

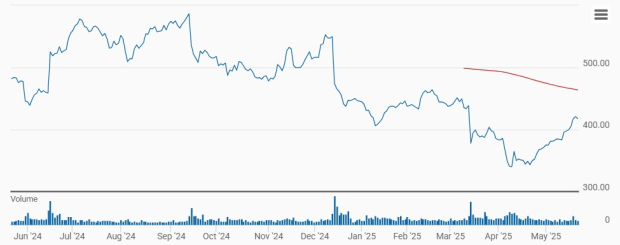

Adobe Inc. Price and Consensus

The Zacks Consensus Estimate for second-quarter fiscal 2025 earnings is now set at $4.96 per share, down a penny from the previous estimate, implying a 10.71% growth from the same quarter last year.

Additionally, ADBE has surpassed the Zacks Consensus Estimate in the last four quarters, with an average surprise of 2.53%.

Why You Might Want to Avoid ADBE Right Now

Given Adobe’s moderate near-term growth prospects and high valuation, the stock may not be appealing to investors.

Additionally, the stock is currently trading below its 200-day moving average, signaling a bearish trend.

ADBE Stock Trading Below 200-Day SMA

Image Source: Zacks Investment Research

ADBE currently holds a Zacks Rank of #4 (Sell), suggesting that investors should consider avoiding the stock for the time being.

Zacks Names Top Semiconductor Stock

This semiconductor stock, while much smaller than NVIDIA, has strong growth potential and a rapidly expanding customer base, addressing the increasing demand across AI, Machine Learning, and IoT sectors. Global semiconductor manufacturing is projected to grow from $452 billion in 2021 to $803 billion by 2028.

For the latest from Zacks Investment Research, you can explore their free report featuring the seven best stocks for the next 30 days.

Microsoft Corporation (MSFT): Free stock analysis report

Adobe Inc. (ADBE): Free stock analysis report

Alphabet Inc. (GOOGL): Free stock analysis report

DocuSign Inc. (DOCU): Free stock analysis report

All views expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.