The Heart of The Matter: Rising 40.7% in six months, Agnico Eagle Mines Limited (AEM) outperforms the Mining – Gold industry, fueled by soaring gold prices and stellar earnings.

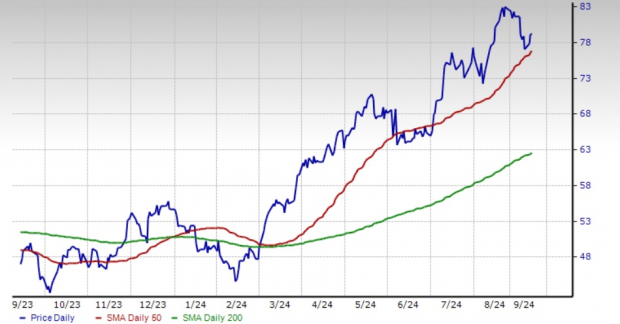

The Zacks Investment Research has been abuzz with the continuous bullish trajectory of Agnico Eagle, trading consistently above the 200-day SMA since March 4, 2024, and surpassing the 50-day SMA on July 3, 2024. With the ‘golden crossover’ on Jan. 1, 2024, it has seemly set foot on a bullish path.

Gold Rush Effect on AEM Stock

AEM’s shares linger at a modest 5% discount from its 52-week zenith of $83.50 touched on Aug. 26, 2024. Exploring AEM’s fundamentals may help strategize the best stance regarding the stock.

Agnico Eagle’s Growth Trajectory Marked by Key Projects

Agnico Eagle has been strategically pushing development on pivotal projects to fuel production and cash inflows. Noteworthy projects in the pipeline include Odyssey, Detour Lake, Upper Beaver, Hope Bay, and San Nicolas. The company also has its eyes set on the Kittila mine’s expansion and exploration.

A significant cash flow generator, the Hope Bay Project boasts proven and probable mineral reserves of 3.4 million ounces, promising enticing returns in the foreseeable future. The completion of the Meliadine phase 2 mill expansion project sets the stage for a capacity increase to 6,000 tons per day by end-2024.

The merger with Kirkland Lake Gold has positioned Agnico Eagle atop the gold industry as the supreme senior gold producer, promising sustainable growth through an impressive amount of development and exploration projects.

Financial Fortitude: AEM’s Strong Suit

AEM’s financial health sparkles bright as it shows robust liquidity and hefty cash flows, empowering it to fuel growth initiatives, trim debts, and enhance shareholder value. Flexing its financial muscles, Agnico Eagle upped its revolving credit facility to $2 billion in the first quarter of 2024.

A significant hike in the operating cash flow to $961.3 million in the second quarter paints a rosy picture. Backed by the gold price surge, AEM churned out a solid $557.2 million free cash flow in the same quarter.

Challenges Ahead: Rising Costs Weight on AEM

As the shadows lengthen, Agnico Eagle grapples with escalating production costs. Total cash costs per ounce of gold rose about 4% in the second quarter of 2024, signaling imminent challenges ahead.

Optimistic Outlook: Earnings Estimates & Valuation

The Zacks Investment Research points to a favorable outlook for Agnico Eagle, with a surge in earnings estimates for 2024. The consensus estimate of $3.65 for 2024 indicates substantial year-over-year growth of 63.7%, with a skyrocketing 104.6% anticipated in the third quarter.

A reasonable valuation pegs AEM at a forward 12-month earnings multiple of 21.58X, showcasing a 41.5% premium against the peer group average of 15.25X, but substantiated by a robust earnings trajectory.

Stock Performance Comparison: AEM Shines Bright

Glory basks upon Agnico Eagle as its shares outshine peers — Barrick Gold Corporation (GOLD), Newmont Corporation (NEM), and Kinross Gold Corporation (KGC), with whopping YTD gains of 44.2%, trumping the industry’s 27% and S&P 500’s 15% climb.

Conclusion

In conclusion, Agnico Eagle Mines Limited appears to be riding the gold price rally to its advantage. With a solid reputation and strategic projects in the pipeline, while grappling with rising costs, the overall outlook seems promising. Investors are keenly observing AEM to see if it holds the golden ticket for sustained growth amidst the surge in gold prices.

Potential investors are advised to delve deep into the current market dynamics and Agnico Eagle’s financial reports before making any critical decisions regarding buying, selling, or holding AEM stock.

The Glittering Prospects of AEM Stock Amidst the Gold Rush

Golden Investment Opportunity: Hold Your Horses with AEM Stock

In the ever-shifting terrain of the stock market, bold explorers seeking to strike gold find themselves drawn to Agnico Eagle Mines Limited (AEM). With a treasure trove of growth projects waiting to be unearthed, solid financial health laying the foundation, and bullish technicals pointing towards a glittering future, AEM is the golden nugget in the mining space.

While navigating the turbulent waters of the market, it is essential to note that this Zacks Rank #3 (Hold) stock comes with a cautionary tale – high production costs lurk in the shadows. Yet, the siren call of a healthy growth trajectory, an alluring dividend yield, and a favorable gold pricing environment render AEM a gem worth pursuing. Therefore, for seasoned investors already holding AEM in their treasure chest, the wise move is to batten down the hatches and weather the storm, holding onto this valuable asset.

Unleashing the Infrastructure Stock Boom Across America

As American infrastructure stands on the cusp of a renaissance, a surge of monumental proportions eagerly awaits. A bipartisan effort to mend the fractures in the nation’s infrastructure is not only urgent but inevitable. The clarion call for trillions in spending heralds a wealth of opportunities for astute investors seeking to sow the seeds of prosperity.

The real question beckons – will you stake your claim on the right stocks at the dawn of their ascendancy, when their growth potential gleams brightest? Prepare to embark on a strategic journey with Zacks. They have unveiled a Special Report, a treasure map to guide you through uncharted waters. Delve into the prospects of 5 specialized companies poised to reap the rewards of reconstructing roads, bridges, buildings, and spearheading energy transformation on a colossal scale.

Unlock FREE Access: Seize Profits from the Trillions Allocated for Infrastructure Expansion >>

Discover Newmont Corporation (NEM) : Free Stock Analysis Report

Exploring Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Digging into Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Unearthing Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

For further insights, delve into this article on Zacks.com.

Navigate to Zacks Investment Research

Although the journey and discoveries shared here reflect the author’s views, they do not necessarily mirror those of Nasdaq, Inc.