Agnico Eagle Mines Limited (AEM) reported a first-quarter free cash flow of $594 million for 2023, a 50% increase from $396 million in the same period last year. The company’s free cash flow before working capital adjustments reached $759 million, nearly doubling from the previous year, supported by strong gold prices and disciplined capital spending.

During this quarter, AEM reduced its net debt by $212 million to just $5 million and returned $251 million to shareholders. This financial strength allows investments in growth projects including Canadian Malartic’s underground expansion and debt repayments. Comparatively, Newmont Corporation (NEM) achieved a record free cash flow of $1.2 billion, up from a negative $74 million year-over-year, while Barrick Mining Corporation (B) logged $375 million, a nearly 12-fold increase.

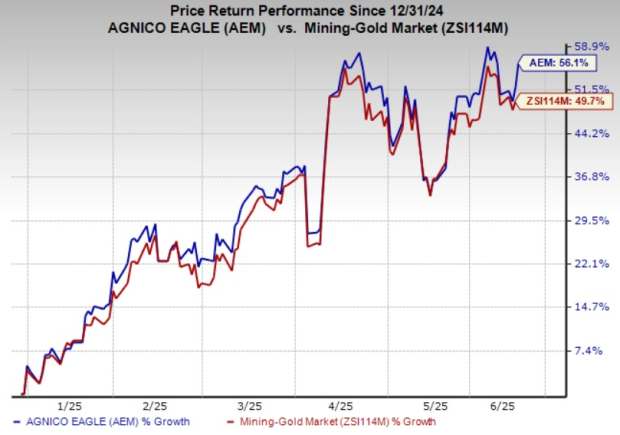

AEM’s shares have seen a year-to-date increase of 56.1%, outpacing the Zacks Mining – Gold industry’s rise of 49.7% amid a gold price rally. The company currently has a forward earnings multiple of 20.18, significantly above the industry average of 13.46.