Aerospace Defense Stocks Hit New 52-Week Highs Amid Spending Surge

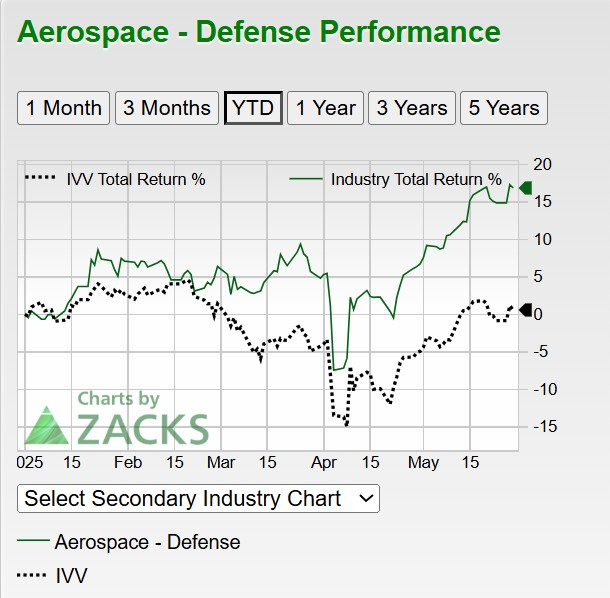

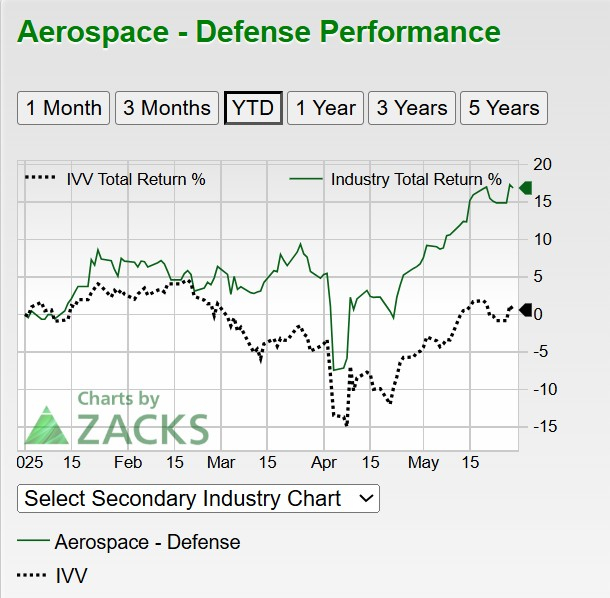

The Zacks Aerospace-Defense Industry

Several Aerospace Defense stocks on the Zacks Rank #1 (Strong Buy) list reached new 52-week highs this week. Increased global military spending is driving demand for defense technology and causing earnings estimates to rise.

Howmet Aerospace HWM and Safran SAFRY are notable performers within the top 16% of over 240 Zacks industries. Year-to-date, Howmet has gained +55%, while Safran is up +35%, both exceeding the industry’s +17% return.

Safran, based in France, has attracted investor interest due to a rise in aircraft orders amid geopolitical tensions in Europe. Pittsburgh’s Howmet has experienced consistent growth from its international operations in North America, Europe, Australia, China, and Japan.

Image Source: Zacks Investment Research

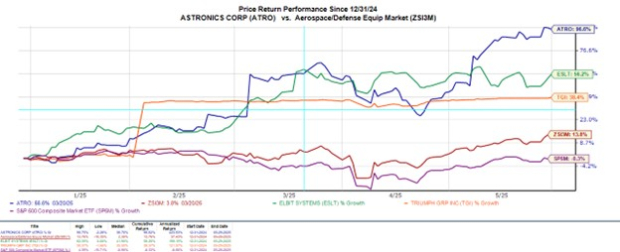

The Zacks Aerospace-Defense Equipment Industry

In the top 17% of Zacks industries, the Aerospace-Defense Equipment Industry boasts three stocks with a Zacks Rank #1 (Strong Buy): Astronics ATRO, Elbit Systems ESLT, and Triumph Group TGI.

Astronics has emerged as a leader, gaining nearly +100% this year by manufacturing specialized lighting and electronics for military and commercial aircraft. Meanwhile, Elbit is known for its Night Vision Goggles Head-Up Displays (NVG-HUD) for helicopters, and Triumph produces various aircraft components.

Image Source: Zacks Investment Research

The Aerospace-Defense Equipment industry predicts an EPS growth rate of 18.54% for 2025. Both Astronics and Elbit are expected to exceed this rate, while Triumph’s annual earnings are forecasted to grow by 14%.

Image Source: Zacks Investment Research

Bottom Line

Aerospace defense stocks might see further upside as EPS estimates for fiscal years 2025 and 2026 continue to rise. With anticipated growth into next year, the current market may still present a favorable buying opportunity.