AES Corp Recognized as Top Dividend Stock Among Dow Utilities

AES Corp (Symbol: AES) has earned the title of ”Top Dividend Stock of the Dow Utilities” according to a recent report by Dividend Channel. This report highlighted that, among the components of the Dow Jones Utility Average, AES shares exhibit favorable valuation and profitability metrics. Currently, AES shares trade at $11.135, boasting a price-to-book ratio of 2.2 and an annual dividend yield of 6.3%. In contrast, the average dividend-paying stock in the Dow Utilities yields 3.4% and carries a price-to-book ratio of 2.9. The report also referenced AES Corp’s robust quarterly dividend history and positive multi-year growth rates in key financial indicators.

The report stated, ”Dividend investors approaching investing from a value standpoint are generally most interested in researching the strongest and most profitable companies that are also trading at an attractive valuation. That’s what we aim to find using our proprietary DividendRank formula, which ranks the coverage universe based on our various criteria for both profitability and valuation to generate a list of the top most ‘interesting’ stocks, providing investors with ideas that merit further research.”

About the Dow Jones Utility Average

The Dow Jones Utility Average, commonly referred to as ”Dow Utilities”, was established in 1929 when all utility stocks were excluded from the Dow Jones Industrial Average. Today, it is one of the most closely monitored indices, representing the premier utility companies in the United States. For more information on the most popular ETF that tracks the Dow Utilities and its components, click here at ETFChannel.com.

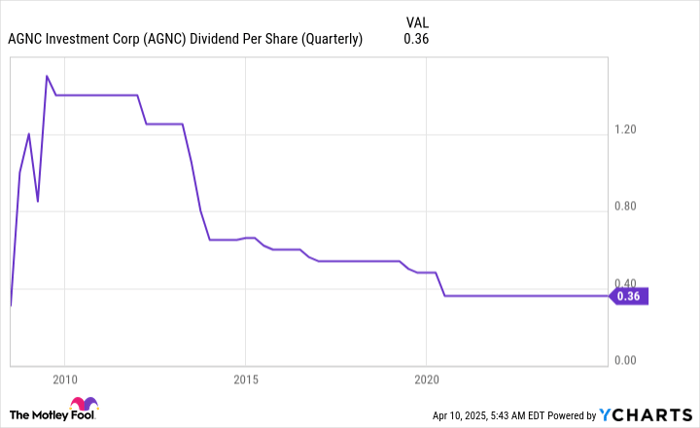

AES Corp’s Dividend Details

Currently, AES Corp pays an annualized dividend of $0.7038 per share, distributed quarterly. The next dividend has an ex-date set for May 1, 2025. The report emphasized the significance of AES’s long-term dividend history in evaluating the sustainability of its most recent dividend.

![]() 10 Top Ranked Dow Utilities Components »

10 Top Ranked Dow Utilities Components »

also see:

- Materials Stocks Hedge Funds Are Buying

- WETF market cap history

- Institutional Holders of QLGC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.