Affirm Holdings, Inc. AFRM recently divulged insights from its latest survey delving into consumer behavior ahead of the 2024 holiday season. The study of 2,000 Americans showcased the sway of 0% annual percentage rate (APR) options on purchase decisions and budgeting confidence. This revelation paints a promising picture for Affirm, a purveyor of flexible and transparent payment solutions.

The survey uncloaked that 48% of respondents find the allure of 0% APR impactful. Among the advantages cited were economizing on interest expenses, facilitating larger purchases, and simplifying budget management, as detailed by 28%, 19%, and 17% of participants, respectively.

Furthermore, 42%, 28%, and 25% of consumers perceived 0% APR offers as appealing for acquiring furniture or appliances, electronics, and everyday essentials, in that order. This trend underscores a mounting inclination towards AFRM’s offerings, positioning the firm favorably for future endeavors. The survey also indicated that notwithstanding prevailing macroeconomic unease, 70% of Americans exhibit heightened money management confidence compared to the prior year.

At the recent Goldman Sachs Communacopia and Tech Conference, AFRM’s CEO Max Levchin underscored the company’s metamorphosis from a buy now, pay later entity to a broader payments enterprise. Levchin articulated Affirm’s ambition to stand as a contemporary counterpart to American Express Company AXP, espousing a “pro-consumer attitude.” Affirm’s strategy includes optimizing artificial intelligence to amplify workforce efficacy rather than downsizing roles.

Capitalizing on an expanded network encompassing more merchants, clientele, and enriched offerings, AFRM is poised to realize profitability for the first time in the fourth quarter of fiscal 2024. The company has also raised its fiscal 2025 GMV projection to exceed $33.5 billion, evincing substantial confidence in its trajectory.

Affirm’s Market Position and Price Momentum

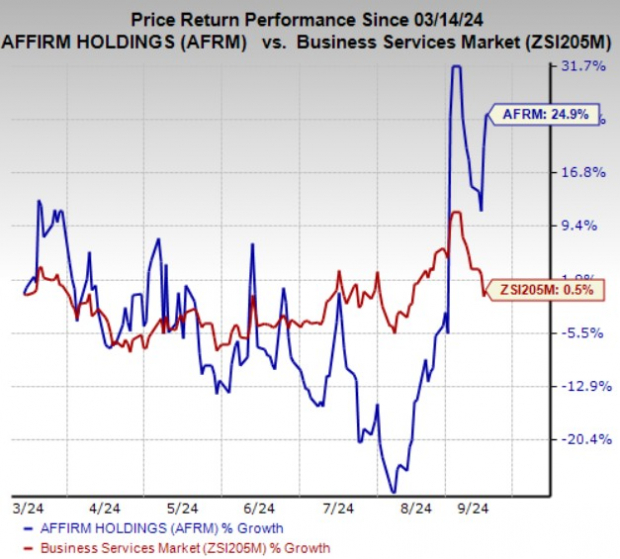

Affirm presently boasts a Zacks Rank #2 (Buy). Over the last six months, Affirm shares have surged by 24.9%, eclipsing the mere 0.5% industry growth.

Image Source: Zacks Investment Research

Alternative Investment Options to Consider

Investors eyeing alternatives can explore other top-ranked stocks in the broaderBusiness Services arena like Fidelity National Information Services, Inc. FIS and Paysign, Inc. PAYS. Both stocks currently hold a Zacks Rank #2.

The Zacks Consensus Estimate for Fidelity National’s earnings for the ongoing year forecasts a 50.5% jump year-over-year. FIS has surpassed earnings estimates in two of the last four quarters and fell short twice. Revenue estimates for the current year stand at $10.2 billion.

Forecasts for Paysign’s bottom line in the current year indicate a 75% surge versus the previous year. Revenue projections for PAYS in the current year indicate $58 million, signifying a 22.6% increase year-over-year.

To read this article on Zacks.com click here.

Market News and Data brought to you by Benzinga APIs