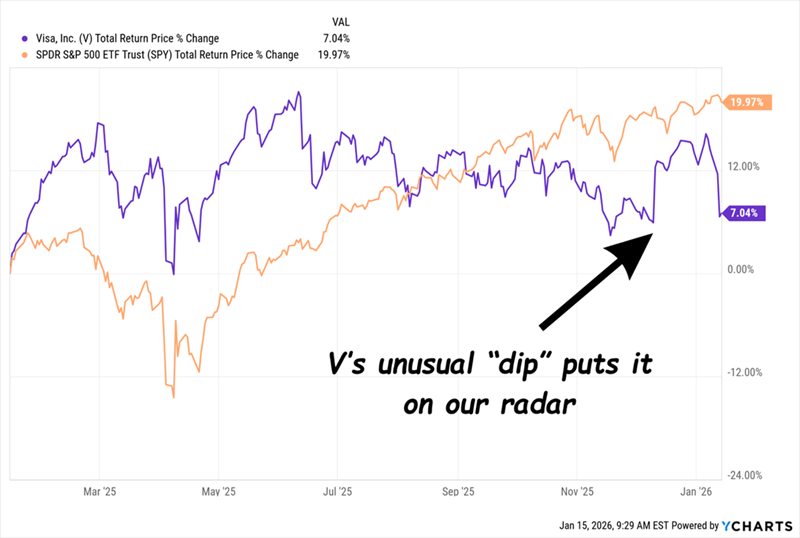

Visa Inc. (V) shares have seen a recent decline following President Trump’s proposal to limit credit-card interest rates to 10% for one year, which led to a swift sell-off by investors. Despite this, Visa remains a strong dividend payer, increasing its payout by double digits annually. The stock is currently underperforming, gaining just over 7% compared to the S&P 500’s 20% rally over the past year, providing a potential opportunity for investors to acquire shares at a bargain price.

Visa operates as a payment processor, not a lender, managing transactions across 220 countries. It processed 329 billion transactions in the year ending September 30. Financially, Visa boasts a strong balance sheet with $23.2 billion in cash against $25.9 billion in debt. The company has been active in share buybacks, repurchasing 9% of its float over the last five years, further supporting its dividend growth.

Additionally, Visa’s recent entry into the stablecoin market positions it to benefit from the increasing demand for digital currencies, with a monthly stablecoin settlement volume reaching a $3.5 billion annualized run rate as of November 30. This could further enhance Visa’s revenue streams amid fluctuating economic conditions.