2025 Market Highlights: Is a Major Investment Opportunity on the Horizon?

Editor’s Note: Geopolitical uncertainties, tariffs, mixed earnings reports, and stagnant prices have caused disruption this year. Yet, our partners at TradeSmith confidently predict a significant market movement ahead, specifically an ongoing epic melt-up that began in April of last year and is expected to build momentum over the next twelve months.

Today, TradeSmith CEO Keith Kaplan joins us to explain how this Mega Melt-Up could present one of the greatest investment opportunities of your life, and why current downward trends should not concern you.

Take it away, Keith…

The market has experienced significant fluctuations in 2025.

With developments like breakthroughs in Chinese AI, sweeping changes in trade policies, and the Federal Reserve’s rate cuts, inflation expectations have surged amid constant headline shifts.

As anticipated, stock prices have seen erratic behavior: climbing one week and causing losses the next.

As of now, the Nasdaq-100 has dipped 1.8% from the start of the year, which is particularly disappointing after a year-to-date increase of 5.7 just last week.

This turmoil leads to a common question: “Are we on the brink of a crash?”

A quick Google search might return numerous media articles insisting you should be worried.

However, I’m here to reassure you:

This isn’t the onset of a bear market.

In fact, it’s shaping up to be one of the biggest investment opportunities available.

We are currently in what my team has termed a Mega Melt-Up.

After studying price movements over recent years, we discovered that only two other market scenarios resemble this one: the 1990s and the 1920s—both periods saw rapid growth for individual companies.

If our findings are accurate, I have strong confidence they are, then the volatility we’ve observed this year isn’t a warning but an indication that we are in a rare Mega Melt-Up phase.

Three Bear Markets Leading to a 1,000% Gain

Indeed, the volatility observed at present actually bolsters the argument for a Mega Melt-Up.

Let’s take a moment to reflect on past market trends.

Similar to the events we’ve witnessed thus far in the 2020s, the 1990s were a time of rapid growth.

Between 1995 and 2000, the Nasdaq-100 increased by an astonishing 1,000%.

However, it was not a straightforward ascent. During those five years, there were more than twenty major pullbacks.

Some of these could be classified as “official” bear markets.

Each of these moments turned out to be lucrative buying opportunities.

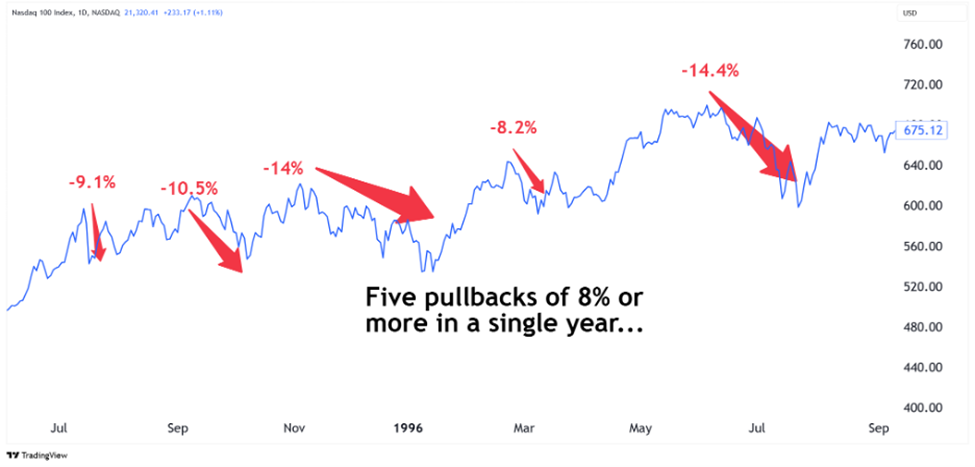

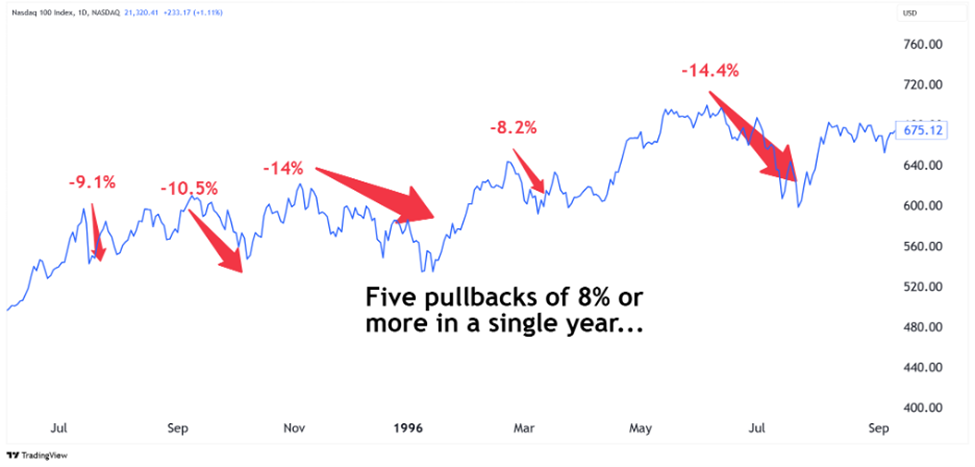

For instance, from 1995 to 1996, the Nasdaq-100 demonstrated increasing volatility. It experienced declines of 9.1%, 10.5%, 14%, 8.2%, and 14.4% within one year:

What else transpired during that time? The Nasdaq-100 gained nearly 40% in 1995, followed by a 22.7% rise in 1996.

Moving forward to 1997-1998, similar patterns persisted.

During late 1997, the Nasdaq-100 underwent a 20% retreat, marking a brief bear market. Additionally, in 1998, it faced two separate declines of -22.2% and -19.1% within six months:

Nevertheless, the index rebounded, closing with gains of 21.6% in 1997 and 39.6% in 1998.

Finally, examining 1999 reveals another pattern of significant pullbacks, which contributed to remarkable long-term success.

Analyzing the Upcoming Mega Melt-Up in Stock Markets

The stock market recently experienced substantial fluctuations, including a final rally of nearly 9% before stocks surged towards the end of the year:

What was the Nasdaq-100’s return in 1999? 101.95%, the highest ever recorded.

The main takeaway is straightforward: a Mega Melt-Up necessitates significant price swings along the way.

This observation aligns with our research findings, which indicate that both the Mega Melt-Up of the 1990s and that of the 1920s experienced considerable volatility.

Such fluctuations are a common trade-off for extraordinary market gains.

Looking at the present situation, the S&P 500 is currently 3% off its peak, while the Nasdaq-100 sits at 5% below its highs.

It’s entirely possible for these indices to decline further, yet this possibility does not alter my perspective on the upcoming Mega Melt-Up.

In fact, there are arguments supporting the notion that this Melt-Up may surpass the 1990s phenomenon.

Potential Factors for a Bigger Melt-Up than the 1990s

The 1990s saw three primary forces boosting stock values:

- The emergence of the internet (termed a General Purpose Technology) and new businesses designed to leverage this trend.

- The advent of online trading, enhancing accessibility to stocks.

- Accommodative monetary policy, where the Federal Reserve’s interest rate cuts stimulated a consumer credit boom.

These factors function as our Melt-Up Multipliers, essential for fostering a powerful Melt-Up.

The 1920s experienced similar influences, characterized by electrification as the major technological leap, margin lending that allowed increased stock ownership, and a flourishing consumer credit market.

Today’s scenario possesses these three critical Melt-Up Multipliers, reinforced by an additional factor:

- Artificial Intelligence: AI represents today’s internet moment, revolutionizing sectors from healthcare to finance.

- Zero-Commission Trading & Apps Like Robinhood: An unprecedented influx of retail investments is saturating the market.

- The Fed’s Rate Cuts: The Federal Reserve is lowering rates again, akin to actions taken in the mid-90s.

Additionally, there’s a “wild card” factor: President Donald Trump. His administration, regardless of individual opinions, has pursued policies viewed as favorable for markets. For instance, the last time he assumed office in 2017, the Nasdaq-100 gained 31.5%.

This convergence creates a conducive environment for a Mega Melt-Up.

However, it is crucial to recognize a defining characteristic of Melt-Ups—and particularly Mega Melt-Ups: they all culminate in a corresponding meltdown.

Navigating the Melt-Up and Preparing for the Meltdown

The Melt-Up of the 1990s culminated in the crash of 2000, while that of the Roaring Twenties ended with the 1929 crash and led into the Great Depression.

Rest assured, this melt-up will conclude with a crash as well.

However, rather than remaining passive, invest in equipping yourself with the right tools to capitalize on the upside and know precisely when to exit.

This is why we developed Trade360, our comprehensive software suite designed to maximize your experience regardless of market conditions.

We have also implemented two significant upgrades to enhance its utility during the current Mega Melt-Up period.

The first upgrade includes a tool that identifies whether markets are in Melt-Up mode and alerts you to any shifts in this condition.

This capability allows you to avoid uncertainty regarding major peaks, giving you timely notifications when it’s prudent to exit before potential downturns occur.

The second upgrade features an advanced trading strategy tailored for melt-up contexts.

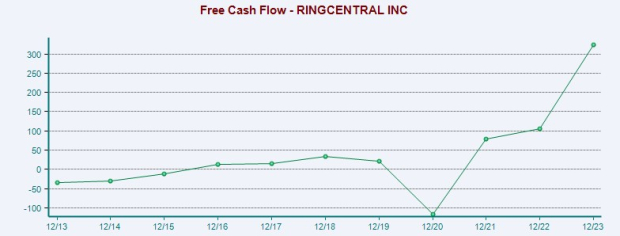

The drawdowns in the Nasdaq-100, previously highlighted, indicate you can expect similar volatility in individual stocks.

Our strategy capitalizes on short-term, pronounced pullbacks within fundamentally sound stocks.

Purchases are executed when prices drop significantly, with sales occurring 21 trading days later.

This simple yet effective strategy boasts an approximately 80% success rate and average returns of around 16%, inclusive of both winning and losing trades.

This strategy remains effective whether operating in a bull or bear market by targeting incredibly rare instances when prices reach irrational extremes.

I elaborated on our Mega Melt-Up thesis and provided a full breakdown of this strategy in a recent complimentary research presentation.

Additionally, I shared insights on 10 stocks to buy and 10 to steer clear of during this melt-up phase—entirely free of charge. Click here to access the replay.

All the best,

Keith Kaplan

CEO, TradeSmith