The Remarkable Turnaround of Sprouts Farmers Market Stock

In August 2013, grocery store chain Sprouts Farmers Market (NASDAQ: SFM) made headlines with its initial public offering (IPO). Shares more than doubled on its first day of trading, closing around $40 per share. A Forbes article referred to it as the “Best IPO Debut Since LinkedIn,” marking it as a significant event in the market. To put this into perspective, LinkedIn had been a notable IPO in 2011, making Sprouts one of the most exciting public offerings in several years.

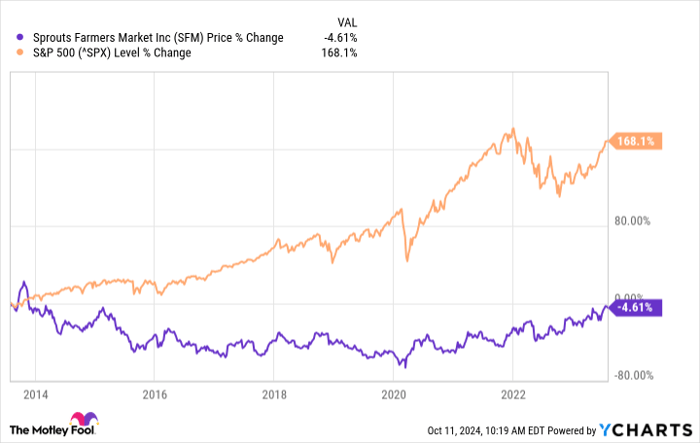

Investors likely felt a rush of excitement after that debut. However, after a decade, Sprouts shares hovered around $38. This indicates that the stock went virtually nowhere for ten years and lagged behind the performance of the S&P 500.

SFM data by YCharts.

Investors who lost patience during this period may have had a valid reason, as stocks that consistently underperform often continue doing so. Yet, they may have overlooked the shift happening with Sprouts. Over the past year, shares surged nearly 200% after a long period of stagnation. Here’s a closer look at the reasons behind this resurgence.

Understanding Sprouts’ Stock Surge

Sprouts Farmers Market operates 415 grocery locations as of the second quarter of 2024, focusing on fresh produce and healthier packaged products. In the first half of 2024, the company’s revenue grew by 10%, with an operating margin of 7%.

These numbers are impressive, yet they are not unusual for Sprouts; the company has consistently experienced double-digit revenue growth since its IPO in 2013. Additionally, its operating margin often outperforms many competitors in the grocery sector.

Although Sprouts has maintained strong business fundamentals over the past decade, the market largely ignored these advancements. As the stock price stagnated while financials improved, the company began buying back shares to take advantage of its lower valuation.

Over time, this strategy resulted in a lower share count and a higher earnings per share (EPS). Historically, companies exhibiting such trends tend to eventually see their stock prices rise, and it appears that investors are finally recognizing the positive developments at Sprouts.

SFM EPS Diluted (TTM) data by YCharts.

But why has this shift occurred now? The stock market can often behave unpredictably, with gaps appearing between a company’s business performance and its stock price. For many years, Sprouts’ solid business growth failed to influence its stock value, but things have changed.

This scenario serves as a reminder that patience can be crucial in investing. As fundamentals strengthen, they eventually translate into stock performance, albeit sometimes after a long wait.

Future Prospects for Sprouts Stock

Looking ahead, Sprouts Farmers Market aims to open over 100 new locations. With slightly over 400 stores currently, this represents an important expansion.

With these new locations, revenue is likely to grow. Additionally, same-store sales growth could provide further revenue boosts. Management forecasts a year-over-year growth of 4% to 5% for this year. If similar growth continues, Sprouts could sustain a double-digit revenue growth rate for several years.

As for profitability, Sprouts currently enjoys a relatively high operating margin, although it may decrease slightly. However, the company has consistently generated positive operating income since going public.

Another positive aspect of Sprouts is that it is now debt-free. Alongside share buybacks, the company has successfully eliminated its financial obligations, positioning it as a safer investment compared to previous years.

While it is unrealistic to expect the stock price to triple again in the near future, ongoing business growth could certainly lead to price appreciation. It is possible that the stock might remain stagnant for a time, as it has in the past. Yet, with strong profits and no debt, investors seem well-positioned to hold onto their shares for the long term.

Should You Consider Investing in Sprouts Farmers Market?

Before making a decision to invest in Sprouts Farmers Market, take note:

The Motley Fool Stock Advisor team recently identified what they believe are the 10 best stocks for investors right now, and Sprouts Farmers Market was not included. These recommendations may hold great promise for future returns.

For instance, consider if Nvidia appeared on this list on April 15, 2005. An investment of $1,000 at that time would now be worth approximately $826,069!*

Stock Advisor offers a comprehensive strategy for investors, including portfolio-building advice, regular updates from analysts, and two new stock picks monthly. Since 2002, this service has provided returns more than quadrupling those of the S&P 500.*

Explore the top 10 stocks »

*Stock Advisor returns as of October 7, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool recommends Sprouts Farmers Market. The Motley Fool has a disclosure policy.

The views expressed here represent those of the author and do not necessarily reflect the views of Nasdaq, Inc.