The Battle of Titans: Humana vs. UnitedHealth Group

Investing in stocks is akin to picking a prized racehorse at the Kentucky Derby. It takes a sharp eye to discern the steed with the most potential for a triumphant gallop. Such keen acumen is currently being put to the test as investors scrutinize the prospects of Humana and its counterpart, UnitedHealth Group.

Market Performance and Historical Context

The stock market, like the unpredictable weather, has demonstrated capricious behavior of late. From the stormy tempests of 2022 to the sunny skies of 2023, valiant stock prices have been on a roller-coaster ride, and Humana and UnitedHealth Group have not been immune to the thrill of the market’s whims.

The Tale of the Tape: Stock Performance

UnitedHealth Group stock has displayed an impressive sprint, notching a 50% gain in the early months of 2021, while Humana’s stock has advanced a more modest 10% over the same period. However, amidst this frenzied race, both stocks have stumbled at times, with UnitedHealth Group taking a tumble in 2023 and the valiant Humana experiencing a setback the year prior.

Outperforming the Giants

Outpacing the S&P 500 index consistently is akin to outmaneuvering heavyweight contenders in a pugilistic bout. The contenders – LLY, JNJ, ABBV, GOOG, TSLA, and MSFT – have all grappled with the formidable index. However, the Trefis High Quality (HQ) Portfolio, like an agile warrior, has managed to emerge victorious each year over the same period, wielding superior returns with steadier, less erratic performance metrics.

The Crystal Ball: Forecasting Future Performances

In a market climate as capricious as the high seas, with oil prices surging and interest rates towering, the trajectory of UNH and HUM over the ensuing year remains a conundrum – will they flail against the S&P or will they soar valiantly? Anticipating a bullish trajectory for both stocks, HUM is currently favored to outshine UNH in the coming three-year stretch.

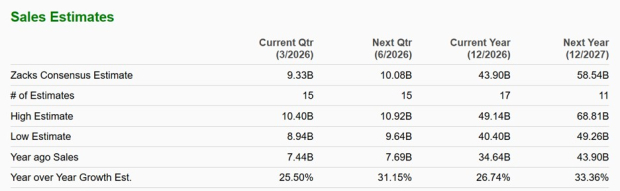

1. Humana’s Revenue Growth Is Better

- Humana has galloped ahead with a robust 13% average annual revenue growth over the last three years, outpacing UnitedHealth’s respectable 10%.

- UnitedHealth’s rise in revenue has been largely propelled by burgeoning demand for its OptumHealth arm, which heralds health care services through local medical groups.

- Meanwhile, Humana’s surge in top-line growth has been fueled by individual Medicare Advantage membership expansion and augmented per-member medical premiums, buoyed further by the strategic Enclara acquisition in 2020.

2. UnitedHealth Is More Profitable

- In terms of profitability, UnitedHealth inches ahead with an ascending operating margin, which stood at 8.8% in 2022, exceeding Humana’s 4.3% margin over the same period.

- UnitedHealth’s operational gem, OptumHealth, has not only contributed to revenue growth but also supported the company in cementing a sound financial position.

3. Cracking the Valuation Nut

- Humana, with superior revenue growth and a more substantial cash cushion, appears to have an edge. Meanwhile, UnitedHealth shines with a more robust financial position, boasting lower debt and a sturdy operating margin.

- Moreover, considering valuation metrics, HUM appears to be the harbinger of richer returns over UNH in the foreseeable future, with its current trading multiples presenting a more appealing picture than UnitedHealth’s.

While the sun seems to shine favorably on HUM for the next three years, it is prudent to gauge the mettle of UnitedHealth Group’s Peers. Comparing companies across industries can provide valuable insights into the formidable playing field. And just as in horse racing, thorough scrutiny is crucial before placing any bets.

| Returns | Jan 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| UNH Return | 0% | 0% | 229% |

| HUM Return | 0% | 0% | 124% |

| S&P 500 Return | 0% | 0% | 113% |

| Trefis Reinforced Value Portfolio | 0% | 0% | 610% |

[1] Month-to-date and year-to-date as of 1/2/2024

[2] Cumulative total returns since the end of 2016

Invest wisely. May the odds be ever in your favor.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.