Agios Pharmaceuticals, Inc. (AGIO) reported a loss of $1.72 per share in the fourth quarter of 2023, wider than the Zacks Consensus Estimate of a loss of $1.64. In the year-ago quarter, the company posted a loss of 67 cents per share.

AGIO reported revenues of $7.1 million, which also missed the Zacks Consensus Estimate of $8 million. In the year-ago quarter, the company recorded revenues of $4.3 million.

Quarter in Detail

In the reported quarter, revenues were generated entirely from product revenues of Agios’ only marketed drug, Pyrukynd (mitapivat), which is approved for treating hemolytic anemia in adults with pyruvate kinase (PK) deficiency.

Pyrukynd revenues in the United States were up 65.1% year over year but declined 4% sequentially. The reported figure missed the model estimate of $7.7 million. The sequential decline in Pyrukynd revenues was due to lower customer inventory levels at the end of the fourth quarter of 2023.

Given the ultra-rare nature of the disease and long lead times associated with initiating patients on therapy, management expects slow and steady growth, with quarter-to-quarter variability in 2024. Research & development expenses totaled $77.5 million, up 10.2% year over year. The increase was due to higher development costs for mitapivat and the upfront payment related to the license agreement with Alnylam Pharmaceuticals.

Selling, general and administrative expenses increased 7.6% year over year to $35.3 million. As of December 31, 2023, cash, cash equivalents, and marketable securities totaled $806.4 million compared with $872.4 million as of September 30, 2023. Management expects this cash balance to fund its operations and meet capital expenditure requirements at least into 2026.

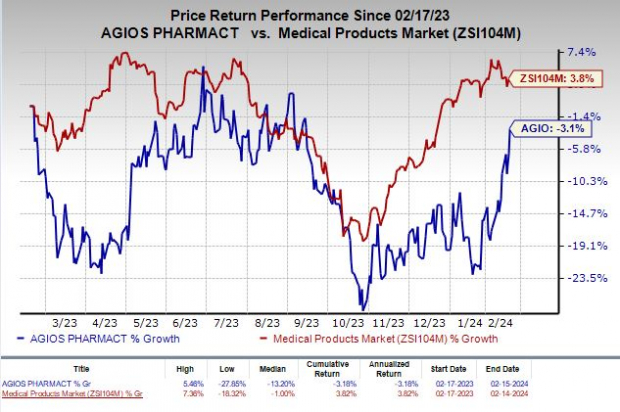

Shares of Agios have lost 3.1% in the past year against the industry’s growth of 3.8%.

Image Source: Zacks Investment Research

Full-Year Results

For 2023, AGIO generated revenues of $26.8 million, up 88.4% year over year. For the same period, the company reported a loss of $6.33 per share compared with a loss of $4.23 in 2022.

Pipeline Updates

AGIO is evaluating mitapivat in the phase III studies — ENERGIZE and ENERGIZE-T — for the treatment of adults with thalassemia. In January 2024, the company announced that the phase III ENERGIZE study achieved its primary and key secondary endpoints.

Data from the ENERGIZE study showed that patients treated with mitapivat demonstrated a statistically significant increase in hemoglobin response, the primary endpoint of the study. Top-line data from the phase III ENERGIZE-T study is expected by mid-2024. Agios plans to submit regulatory filings to the FDA seeking approval for mitapivat by the end of 2024.

Meanwhile, the company plans to complete enrollment in the phase III portion of the RISE UP study investigating mitapivat in sickle cell disease by the end of 2024. Agios is evaluating its PKR activator candidate, AG-946, for lower-risk myelodysplastic syndrome (LR-MDS). Patient dosing in the phase IIb study on AG-946 is expected to begin in mid-2024.

The company has also filed an investigational new drug application with the FDA to begin clinical development of its phenylalanine hydroxylase stabilizer, AG-181, for treating phenylketonuria. In August, Agios and Alnylam announced an exclusive worldwide license agreement.

Zacks Rank & Stocks to Consider

Agios currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the healthcare sector are Exact Sciences Corp. and Puma Biotechnology, Inc., each sporting a Zacks Rank #1 (Strong Buy) at present.

In the past 60 days, estimates for Exact Sciences’ 2024 loss per share have narrowed from $1.22 to $1.15. In the past year, shares of EXAS have lost 3.8%. Exact Sciences’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 44.21%.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 64 cents to 69 cents. In the past year, shares of PBYI have risen 60.1%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.” Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.