Agnico Eagle Mines Reports Record Earnings Amid Rising Gold Prices

Agnico Eagle Mines Ltd. (AEM) achieved record net income in light of surging gold prices, positioning itself as a strong contender for cash returns to shareholders this year.

Headquartered in Toronto, Canada, Agnico Eagle stands as the third-largest gold producer globally, with operations in Canada, Australia, Finland, and Mexico. The company is also engaged in various exploration and development projects.

Since its founding in 1957, Agnico Eagle has prioritized shareholder interests, maintaining a cash dividend every year since 1983.

Agnico Eagle Exceeds Earnings Expectations Again in Q1

On April 24, 2025, Agnico Eagle reported its first-quarter 2025 results, surpassing the Zacks Consensus Estimate by $0.14. The earnings came in at $1.53, well above the expected $1.39.

This marked the 13th consecutive earnings beat for the company.

Payable gold production totaled 873,794 ounces, with all-in sustaining costs (“AISC”) per ounce reported at $1,183. Major contributions came from Canadian Malartic, LaRonde, Macassa, and Nunavut operations.

The company reaffirmed its full-year production and cost guidance.

With gold prices hitting record highs, Agnico Eagle’s adjusted net income followed suit, supported by a strong free cash flow of $594 million.

The company’s cash position increased by $212 million to $1.138 billion, nearing a zero net debt status. At the end of Q1, total outstanding debt was $1.143 billion, and net debt was just $5 million.

Shareholder Focus: Dividends and Share Buybacks

Agnico Eagle continues its long-term commitment to shareholders. With gold prices at historic highs, this focus remains relevant.

Currently, the company is providing a quarterly dividend of $0.40, resulting in a yield of 1.3%. It has also been actively repurchasing shares, having acquired 488,047 shares during the quarter at an average price of $102.44.

Agnico Eagle plans to renew its share buyback program under the same terms this year.

Analysts Maintain Positive Outlook for 2025

Analysts continue to express optimism about Agnico Eagle for the current year. One earnings estimate was raised in the past week, and four adjustments were made following the earnings report.

The Zacks Consensus Estimate now stands at $6.11, a notable increase from $5.30 just 30 days ago. This reflects an earnings growth of 44.4%, compared to last year’s figure of $4.23.

Here is how it appears on the 5-year price and consensus chart.

Image Source: Zacks Investment Research

Shares Approach New Multi-Year Highs

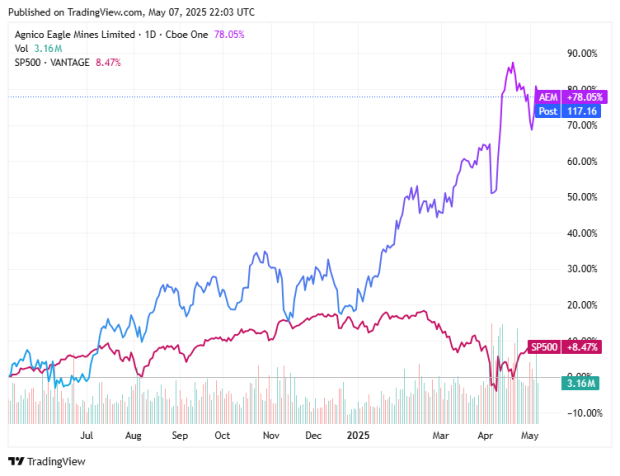

Agnico Eagle shares have performed robustly over the past year, significantly outpacing the S&P 500.

Image Source: Zacks Investment Research

Currently, the shares are attractively priced, with a forward price-to-earnings (P/E) ratio of just 19.5. Additionally, the company has a PEG ratio of 1.0. A PEG below 1.0 typically indicates a combination of growth and value.

For those invested in the gold mining sector, Agnico Eagle remains a strong candidate to consider.