Gold Prices Soar: Agnico Eagle Mines Shines Bright in 2023

Gold has experienced a significant surge this year, reaching impressive new highs. In 2023, its performance has outshined the S&P 500 by a notable margin. Consequently, gold mining stocks like Agnico Eagle Mines (AEG) have also thrived in this environment.

Agnico Eagle Mines is a compelling choice for gold investors, featuring a solid balance sheet, strong stock price momentum, impressive earnings growth forecasts, and a reasonable valuation. Furthermore, the stock has a top Zacks Rank, which increases the prospects of a near-term rally.

Image Source: TradingView

Positive Earnings Revisions for AEG

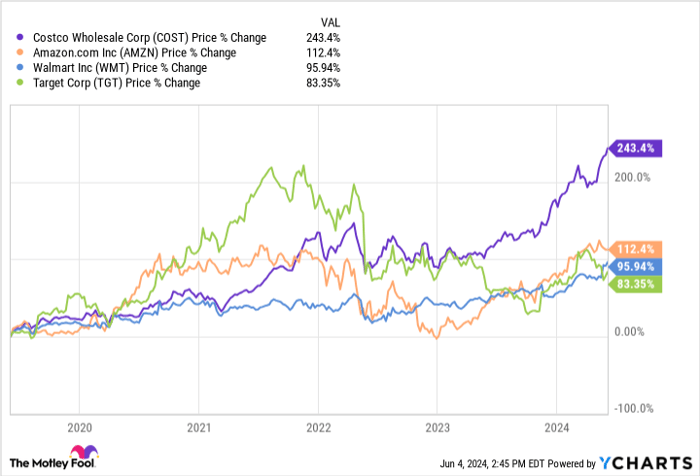

The recent increase in gold prices has led to heightened profit margins for gold mining firms, including Agnico Eagle Mines. Currently, AEG holds a strong Zacks Rank #1 (Strong Buy), a reflection of upward revisions in earnings estimates.

Over the past two months, analysts have almost unanimously raised their earnings forecasts, with FY25 estimates climbing by 23.4% in just 60 days. FY24 estimates have also increased by 9.9%, projecting a significant YoY growth of 79.8% to $4.01 per share. EPS growth is anticipated to reach an impressive 28.2% annually over the next three to five years.

Additionally, the Mining – Gold Industry ranks in the top 4% (9 out of 251) in the Zacks Industry Rank, with a Zacks Earnings ESP indicating a potential upside of 5.82% for the upcoming earnings period.

Image Source: Zacks Investment Research

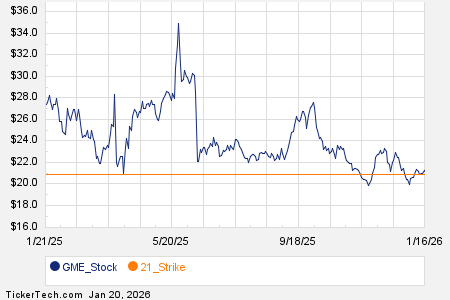

Technical Analysis of AEG Stock

Agnico Eagle Mines stock features an intriguing trading setup. Recently, the stock displayed a bull flag pattern, which investors can use as a reference for potential trades.

If AEG trades above the $88.75 level, it would indicate a technical breakout. Conversely, if it drops below the $86 support level, investors might consider waiting for a better entry point.

Image Source: TradingView

Investment Potential of Agnico Eagle Mines

Currently, Agnico Eagle Mines trades at a one-year forward earnings multiple of 21.6x, which is below the broader market average and significantly lower than its 10-year median of 43x. With earnings poised to grow at an annual rate of 28.2%, AEM offers an attractive PEG ratio of 0.77, indicating it is well-priced.

For investors interested in the gold market, Agnico Eagle Mines presents a strong opportunity. The company has a solid valuation, a top Zacks Rank, and offers a 1.8% dividend yield.

Zacks Identifies Top Semiconductor Stock

Zacks has highlighted a new semiconductor stock that is significantly smaller than NVIDIA, which saw its stock price soar over 800% since our recommendation. While NVIDIA remains strong, our latest pick has considerable growth potential.

With robust earnings growth and a growing customer base, this stock is set to capitalize on the escalating demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Aegon NV (AEG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.