Micron Technology, Inc. (MU) reported a first-quarter fiscal 2026 revenue of $13.64 billion, marking a 56.8% year-over-year increase and surpassing analysts’ expectations of $12.88 billion. The company’s strong performance was driven by high demand for its high-bandwidth memory (HBM) chips, which are currently in short supply due to an AI infrastructure surge. Micron’s non-GAAP net income was $5.48 billion, or $4.78 per share, exceeding projections of $3.94 per share.

For the second quarter of fiscal 2026, Micron anticipates revenues between $18.3 billion and $19.1 billion and earnings per share ranging from $8.22 to $8.62. In contrast, NVIDIA Corporation (NVDA) reported third-quarter fiscal 2026 revenues of $57 billion, a 62% year-over-year increase, and expects to reach about $65 billion in revenue for the fourth quarter. NVIDIA’s performance is attributed to strong demand for its CUDA software platform and Blackwell chips.

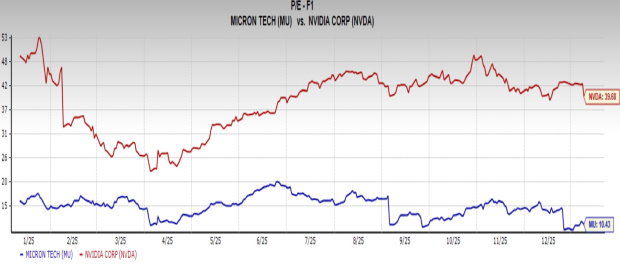

Despite both companies showing robust growth potential in the AI chip market, Micron’s shares are currently near all-time highs, indicating limited room for error, while NVIDIA enjoys a higher price-to-earnings ratio of 39.68 compared to Micron’s 10.43, suggesting stronger market growth expectations for NVIDIA.