“`html

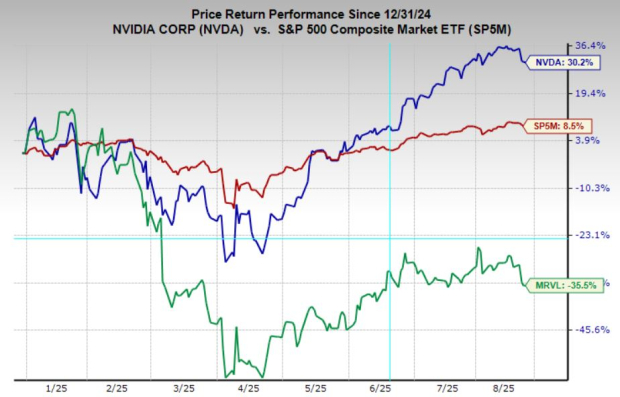

Nvidia (NVDA) is experiencing a 30% increase in stock price year-to-date, significantly outpacing the S&P 500’s 9% rise, while Marvell Technology (MRVL) has fallen approximately 32% despite the semiconductor sector gaining 16%. Both companies are pivotal players in the AI-driven semiconductor sector and are set to release their earnings reports next week.

Marvell is expected to report EPS of $0.67 and revenue of $2.01 billion on August 28, reflecting 123% EPS growth and 58% revenue growth year-over-year. Nvidia’s anticipated EPS is $1.00 on revenues of $46.03 billion, representing a 47.1% increase in EPS and 53.2% in revenue from the previous year, with its earnings report scheduled for August 27.

In terms of valuation, Nvidia trades at approximately 41.1x forward earnings, indicating a premium due to its market leadership, while Marvell trades at about 25x, providing a more attractive valuation against its growth prospects. Both companies present contrasting strengths and investment opportunities within the booming AI ecosystem.

“`