Nvidia: A Bright Future as AI Drives Growth in 2025

This past year showcased another outstanding performance for technology stocks. The S&P 500 rose by 23%, while the Nasdaq Composite climbed an impressive 29%, largely powered by advancements in artificial intelligence (AI).

Among the top market performers, the “Magnificent Seven” stocks shined, with Nvidia capturing significant attention as the leading semiconductor stock and the standout performer in the Dow Jones Industrial Average for 2024.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Last year, Nvidia achieved a market capitalization increase of approximately $2.1 trillion, the highest among all companies. This achievement has solidified its position as one of the most valuable firms globally. While some analysts suggest Nvidia’s stock may be due for a correction, Wedbush Securities technology analyst Dan Ives forecasts significant growth ahead for this AI leader, a sentiment shared by many in the field.

Let’s explore the factors working in Nvidia’s favor and why 2025 could set new records for the company.

Nvidia’s 2025 Prospects Look Promising

Over the past two years, Nvidia has positioned itself as the front-runner in the AI arena, mostly due to its advanced graphics processing units (GPUs). These chipsets are essential for creating generative AI applications.

The company’s extensive range of GPUs has differentiated Nvidia from competitors like Advanced Micro Devices, giving it an estimated 90% share of the GPU market.

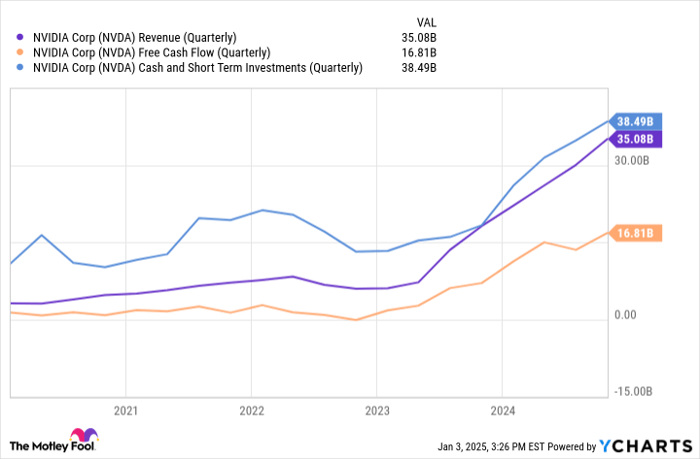

NVDA Revenue (Quarterly) data by YCharts.

Nvidia’s strong market position has led to consistent revenue and profit growth, enabling increased investments in research and development. Notably, Nvidia is introducing Blackwell, its next-generation GPU architecture, which has already sold out for the coming year.

On a broader scale, Ives notes that overall investment in AI infrastructure could exceed $1 trillion soon. Nvidia is set to benefit from this surge, as seen in its investments in European GPU cluster specialist Nebius and the acquisition of AI infrastructure company Run:ai for approximately $700 million.

Image source: Getty Images.

Is Nvidia Stock Worth Buying Now?

Given Nvidia’s rapid stock price increase, it is prudent to evaluate the company’s valuation metrics against the aforementioned growth catalysts.

Data source: YCharts.

At first glance, Nvidia may appear to have a high valuation based on certain multiples. However, considering that its P/E and P/FCF ratios are significantly lower than a year ago, Nvidia’s valuation is quite appealing. In essence, the company’s profits are outpacing its market cap growth, suggesting that the stock price is reasonable.

Moreover, a PEG ratio of 1 indicates that Nvidia is fairly valued at present. Predicting Nvidia’s future earnings remains challenging, but as products like Blackwell are released, the company is expected to see positive results.

I firmly believe Nvidia represents a strong buy opportunity now, and it could potentially be the first company to reach a market cap of $4 trillion by 2025. Anticipation for Nvidia’s performance this year is high, and it presents an attractive investment option for those focused on AI and growth.

Is Investing $1,000 in Nvidia a Good Idea Right Now?

Before making a decision on Nvidia stock, take note of the following:

The Motley Fool Stock Advisor analyst team recently highlighted their selection of the 10 best stocks to buy now… and Nvidia was notably absent from this list. Those ten stocks are anticipated to yield significant returns in the upcoming years.

If you had invested $1,000 in Nvidia when it was featured on April 15, 2005, you would have $885,388!

Stock Advisor provides an accessible path to investment success, offering support for portfolio building, consistent updates from analysts, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nebius Group, and Nvidia. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.