“`html

Core News Facts

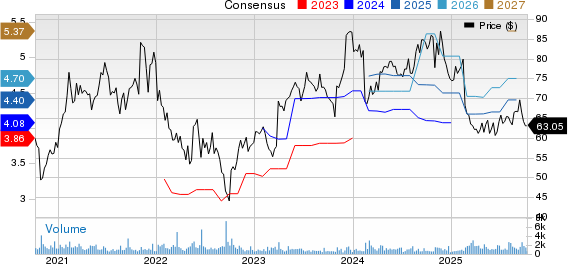

Nvidia (NASDAQ: NVDA) continues to dominate the AI infrastructure market, holding an estimated 70% to 95% market share in AI data center chips. In fiscal 2025, Nvidia’s earnings increased by 147% to $2.94 per share, and revenue surged by 114% to $130.5 billion. AI infrastructure spending is projected to reach $2.8 trillion by 2029, with $490 billion expected to be spent in 2026 alone.

Taiwan Semiconductor Manufacturing (NYSE: TSM), a leader in advanced chip manufacturing, produces around 90% of the world’s most advanced processors. TSMC’s latest 2nm node allows for greater transistor density, keeping it ahead of competitors like Intel, which is reportedly years behind. Meanwhile, Samsung (OTC: SSNL.F), despite being the second-largest semiconductor manufacturer by revenue, is experiencing setbacks with yield rates at around 50% compared to TSMC’s 90% in 3nm chip manufacturing.

Recent contract wins, such as a $16.5 billion deal with Tesla, indicate Samsung’s attempts to catch up in the AI race; however, analysts suggest investing in Nvidia or TSMC is currently more favorable than betting on Samsung’s recovery.

“`