Tom Lee Predicts S&P 500 to Reach 15,000 by 2030

Tom Lee, managing partner at Fundstrat Global Advisors, predicts that the S&P 500 will reach 15,000 by 2030, representing a potential upside of 138% from its current level of 6,297. This projection is driven by increased demand for artificial intelligence, resulting from a projected global labor shortage of 80 million workers by 2030, combined with the economic influence of millennials inheriting an estimated $46 trillion from baby boomers.

Current Valuation and Market Impact

The S&P 500 is currently trading at 22.2 times forward earnings, a valuation that historically correlates with lower returns of about 3% annually. Lee’s optimism suggests that significant growth in technology stocks, especially those related to AI, could propel the index higher.

Top Holdings in Vanguard S&P 500 ETF

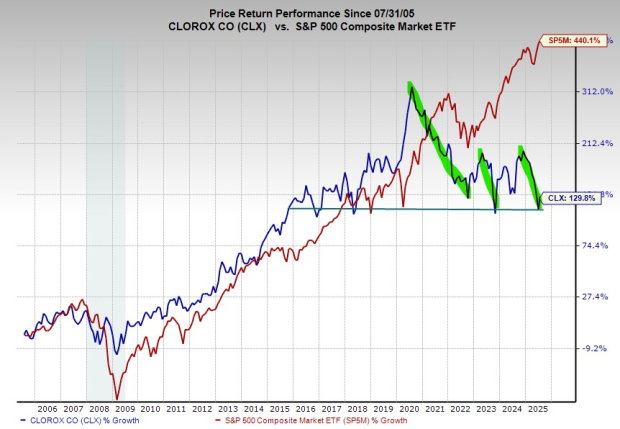

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is the most widely held index fund on Robinhood, dominating the platform among younger, risk-tolerant investors. Its top holdings include Nvidia (7.3%), Microsoft (7%), and Apple (5.8%), which contribute heavily to its performance. Over the past five years, the S&P 500 increased by 95%, averaging a return of 14.3% annually, reinforcing the ETF’s historical resilience as a long-term investment.