Meta Platforms’ AI Investments May Drive Future Growth

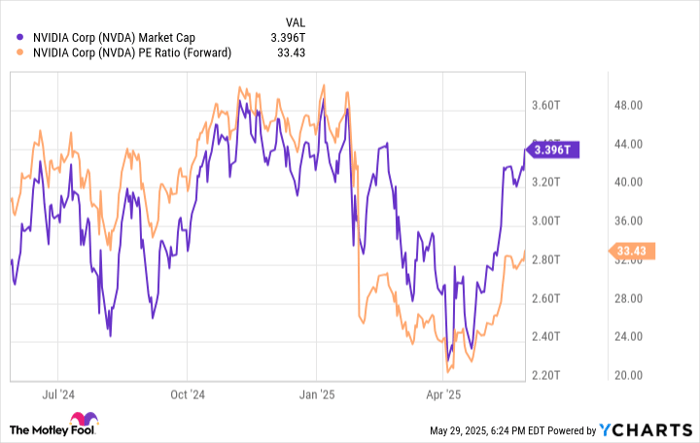

Investors have been tracking artificial intelligence (AI) investments by tech companies over the past two and a half years. While some AI technologies are already in use, others will take time to develop.

A key question remains: What if these AI initiatives succeed? Current valuations often reflect only existing business operations and may not account for the growth potential of AI advancements.

Meta’s Valuation Relies on Legacy Business

Meta Platforms (NASDAQ: META), known for Facebook and Instagram, appears to be valued primarily on its established business. Its trailing price-to-earnings (P/E) ratio is similar to levels seen over the past seven and a half years.

Current market pricing does not reflect the transformative potential of Meta’s AI investments.

AI Efficiency Gains and Advertising Enhancements

AI is expected to boost efficiency significantly. CEO Mark Zuckerberg claims AI will soon code at a level comparable to mid-level software engineers. While this advancement may lead to job losses, it could substantially lower operating costs for Meta.

Additionally, AI improvements are anticipated to enhance advertising effectiveness. Zuckerberg noted that AI already refines audience targeting and ad creation, potentially allowing Meta to charge higher prices for better outcomes.

Opportunities in AI Device Development

Meta is also exploring AI integration into eyewear, collaborating with Ray-Ban on current models. The company aims to develop more advanced AI glasses that enhance daily productivity, tapping into a substantial market, as over a billion people wear glasses globally.

Despite favorable AI trends, Meta is currently priced based on its traditional advertising business. This situation presents an investment opportunity for those who believe in the potential of its AI initiatives.

Advertising Revenue Vulnerabilities

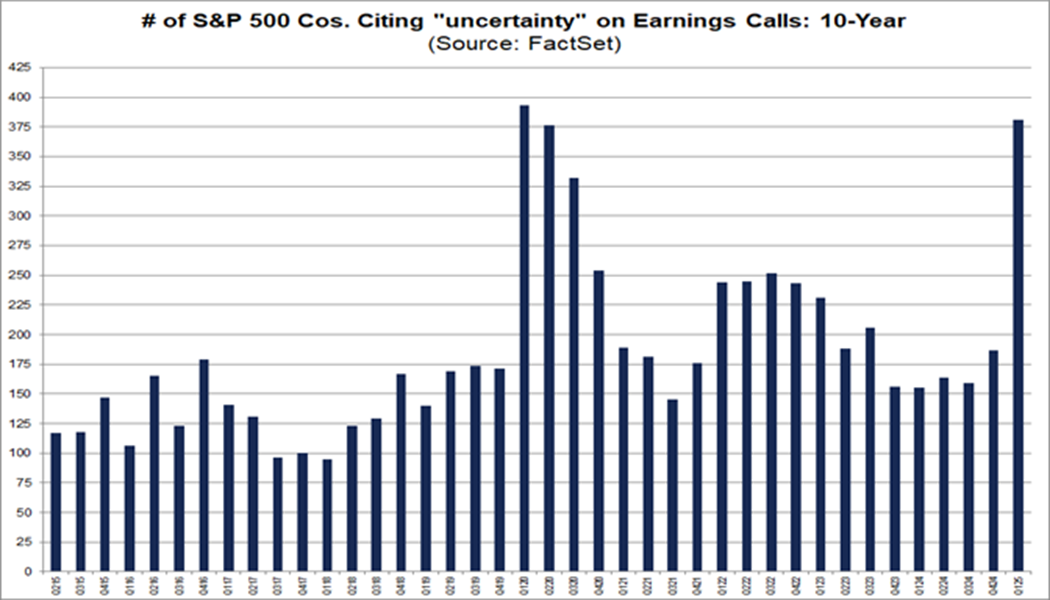

Currently, 98% of Meta’s revenue comes from advertising, making it vulnerable to shifts in the ad market. Economic downturns often lead to reduced ad spending, and current uncertainties due to tariffs add further risk.

Historically, advertising markets rebound strongly after downturns, suggesting that any short-term setbacks could be recovered over a longer investment horizon.

Long-Term Investment Perspective on Meta

Investors willing to hold Meta stock for three to five years could see substantial returns from AI advancements. With the stock priced similarly to previous years, current levels may represent a good entry point.

Final Considerations for Investing in Meta

Before investing in Meta Platforms, it’s essential to evaluate the broader market landscape. Analysts have identified other stocks with strong potential, suggesting caution in allocating funds solely to Meta.

Although Meta has its strengths, investor returns hinge on broader market dynamics and the success of its AI strategies.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.